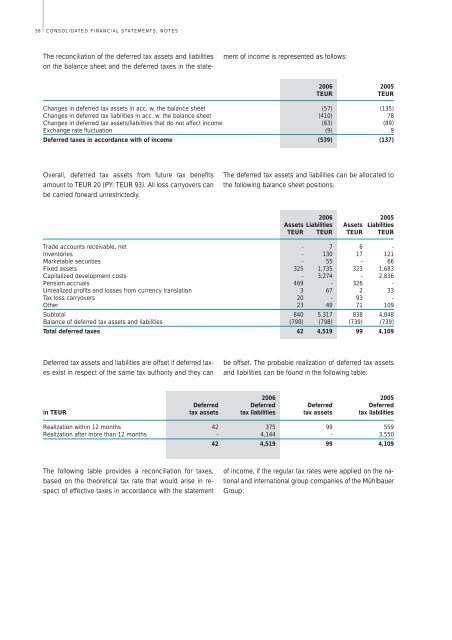

58 CONSOLIDATED FINANCIAL STATEMENTS, NOTESThe reconciliation of the deferred tax assets and liabilitieson the balance sheet and the deferred taxes in the statementof income is represented as follows:<strong>2006</strong> 2005TEURTEURChanges in deferred tax assets in acc. w. the balance sheet (57) (135)Changes in deferred tax liabilities in acc. w. the balance sheet (410) 78Changes in deferred tax assets/liabilities that do not affect income (63) (89)Exchange rate fluctuation (9) 9Deferred taxes in accordance with of income (539) (137)Overall, deferred tax assets from future tax benefitsamount to TEUR 20 (PY: TEUR 93). All loss carryovers canbe carried forward unrestrictedly.The deferred tax assets and liabilities can be allocated tothe following balance sheet positions:<strong>2006</strong> 2005Assets Liabilities Assets LiabilitiesTEUR TEUR TEUR TEURTrade accounts receivable, net - 7 6 -Inventories - 130 17 121Marketable securities - 55 - 66Fixed assets 325 1,735 323 1,683Capitalized development costs - 3,274 - 2,836Pension accruals 469 - 326 -Unrealized profits and losses from currency translation 3 67 2 33Tax loss carryovers 20 - 93 -Other 23 49 71 109Subtotal 840 5,317 838 4,848Balance of deferred tax assets and liabilities (798) (798) (739) (739)Total deferred taxes 42 4,519 99 4,109Deferred tax assets and liabilities are offset if deferred taxesexist in respect of the same tax authority and they canbe offset. The probable realization of deferred tax assetsand liabilities can be found in the following table:<strong>2006</strong> 2005Deferred Deferred Deferred Deferredin TEUR tax assets tax liabilities tax assets tax liabilitiesRealization within 12 months 42 375 99 559Realization after more than 12 months - 4,144 - 3,55042 4,519 99 4,109The following table provides a reconciliation for taxes,based on the theoretical tax rate that would arise in respectof effective taxes in accordance with the statementof income, if the regular tax rates were applied on the nationaland international group companies of the Mühlbauer<strong>Group</strong>:

CONSOLIDATED FINANCIAL STATEMENTS, NOTES59<strong>2006</strong> 2005Income before income taxes TEUR 38,013 34,668Rate of income tax including trade tax % 36.7 36.7Expected income tax expenditure with uniform tax burden TEUR (13,962) (12,721)Reconciliation:Deviating national tax burden TEUR (36) 158Deviating international tax burden TEUR 314 335Tax share for:Tax-free earnings TEUR 874 31Non-tax deductible expenditure TEUR (333) (102)Actual taxes relating to other periods TEUR 21 12Tax imputation credits from previous years TEUR - 218Other tax deviations TEUR (58) -Income tax expenditure before extraordinary gains *) andtax reduction on earnings related to the personally liable shareholder TEUR (13,180) (12,069)Effective tax rate before extraordinary gains *) % 34.7 34.8Extraordinary gains *) TEUR 2,268 -Income tax expenditure before tax reduction on earningsrelated to the personally liable shareholder TEUR (10,912) (12,069)Effective tax rate % 28.7 34.8Tax savings on earnings related to the personally liable shareholder TEUR 627 421Income tax expenditure shown TEUR (10,285) (11,648)Tax rate in accordance with the statement of income % 27.1 33.6*)Earnings from the capitalization of a claim for payment of a corporation tax creditThe tax savings on earnings related to the personally liableshareholder arises due to the fact that the corporation taxand the solidarity surcharge on the earnings of the personallyliable shareholder need not be posted by the company.These taxes are directly attributable to the personally liableshareholder and are individually taxed by him, irrespectiveof the tax rates applicable to the company. Thepercentage of tax expenditure before tax reduction onearnings related to the personally liable shareholder(28.7%; PY: 34.8%,) thus corresponds with the effective taxrate that is to be applied on the earnings attributable to theshareholders of the limited partnership.(12) EARNINGS PER SHAREBasic earnings per share are determined by reducing theearnings before taxes (EBT), applicable to the shareholdersof the limited partnership in correspondence with theirshare in the total capital, of currently 42.73%, by the shareof taxes applicable to them in accordance with the effectivetax rate (see also note (11)) and by subsequently dividingthe resultant share of net earnings for the year applicableto the shareholders of the limited partnership bythe weighted average of shares that were outstanding inthe year under review.<strong>2006</strong> 2005Income before income taxes TEUR 38,013 34,668Portion of share capital in total capital % 42.73 42.73Portion of income before income taxes applicable to theshareholders of the limited partnership TEUR 16,243 14,814Effective tax rate % 28.7 34.8Effective tax amount TEUR 4,653 5,155Portion of net earnings for the year applicable to theshareholders of the limited partnership TEUR 11,590 9,659Weighted average of common shares No. 6,279,200 6,279,200Repurchased shares (weighted) No. (192,761) (207,093)Weighted average of shares outstanding No. 6,086,439 6,072,107Dilution effects from subscription rights of employees and executives No. 201 352Weighted average of shares outstanding (fully diluted) No. 6,086,640 6,072,459Basic earnings per share EUR 1.90 1.59Diluted earnings per share EUR 1.90 1.59Diluted earnings per share are calculated by dividing theshare of net earnings for the year applicable to the shareholdersof the limited partnership through the weighted averageof shares that were outstanding in the year under reviewplus the number of shares that would have been issuedhad outstanding exercise rights been executed.Basic and diluted earnings per share adjusted by extraordinarygains from the capitalization of a claim for paymentof a corporation tax credit totals EUR 1.74.