Download Annual Report 2006 - Mühlbauer Group

Download Annual Report 2006 - Mühlbauer Group

Download Annual Report 2006 - Mühlbauer Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

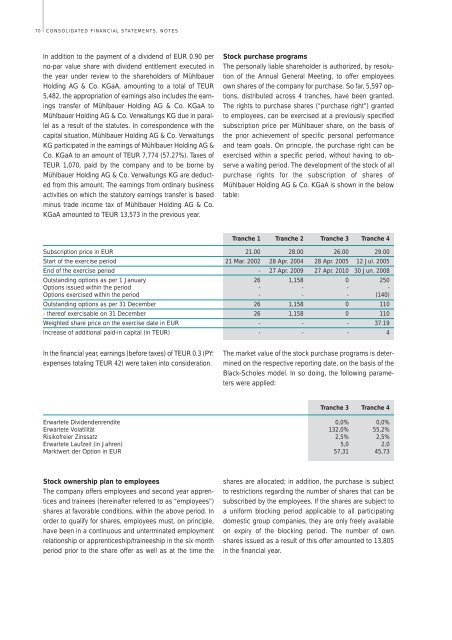

70 CONSOLIDATED FINANCIAL STATEMENTS, NOTESIn addition to the payment of a dividend of EUR 0.90 perno-par value share with dividend entitlement executed inthe year under review to the shareholders of MühlbauerHolding AG & Co. KGaA, amounting to a total of TEUR5,482, the appropriation of earnings also includes the earningstransfer of Mühlbauer Holding AG & Co. KGaA toMühlbauer Holding AG & Co. Verwaltungs KG due in parallelas a result of the statutes. In correspondence with thecapital situation, Mühlbauer Holding AG & Co. VerwaltungsKG participated in the earnings of Mühlbauer Holding AG &Co. KGaA to an amount of TEUR 7,774 (57.27%). Taxes ofTEUR 1,070, paid by the company and to be borne byMühlbauer Holding AG & Co. Verwaltungs KG are deductedfrom this amount. The earnings from ordinary businessactivities on which the statutory earnings transfer is basedminus trade income tax of Mühlbauer Holding AG & Co.KGaA amounted to TEUR 13,573 in the previous year.Stock purchase programsThe personally liable shareholder is authorized, by resolutionof the <strong>Annual</strong> General Meeting, to offer employeesown shares of the company for purchase. So far, 5,597 options,distributed across 4 tranches, have been granted.The rights to purchase shares (“purchase right”) grantedto employees, can be exercised at a previously specifiedsubscription price per Mühlbauer share, on the basis ofthe prior achievement of specific personal performanceand team goals. On principle, the purchase right can beexercised within a specific period, without having to observea waiting period. The development of the stock of allpurchase rights for the subscription of shares ofMühlbauer Holding AG & Co. KGaA is shown in the belowtable:Tranche 1 Tranche 2 Tranche 3 Tranche 4Subscription price in EUR 21.00 28.00 26.00 29.00Start of the exercise period 21 Mar. 2002 28 Apr. 2004 28 Apr. 2005 12 Jul. 2005End of the exercise period - 27 Apr. 2009 27 Apr. 2010 30 Jun. 2008Outstanding options as per 1 January 26 1,158 0 250Options issued within the period - - - -Options exercised within the period - - - (140)Outstanding options as per 31 December 26 1,158 0 110- thereof exercisable on 31 December 26 1,158 0 110Weighted share price on the exercise date in EUR - - - 37.19Increase of additional paid-in capital (in TEUR) - - - 4In the financial year, earnings (before taxes) of TEUR 0.3 (PY:expenses totaling TEUR 42) were taken into consideration.The market value of the stock purchase programs is determinedon the respective reporting date, on the basis of theBlack-Scholes model. In so doing, the following parameterswere applied:Tranche 3 Tranche 4Erwartete Dividendenrendite 0,0% 0,0%Erwartete Volatilität 132,0% 55,2%Risikofreier Zinssatz 2,5% 2,5%Erwartete Laufzeit (in Jahren) 5,0 2,0Marktwert der Option in EUR 57,31 45,73Stock ownership plan to employeesThe company offers employees and second year apprenticesand trainees (hereinafter referred to as “employees”)shares at favorable conditions, within the above period. Inorder to qualify for shares, employees must, on principle,have been in a continuous and unterminated employmentrelationship or apprenticeship/traineeship in the six monthperiod prior to the share offer as well as at the time theshares are allocated; in addition, the purchase is subjectto restrictions regarding the number of shares that can besubscribed by the employees. If the shares are subject toa uniform blocking period applicable to all participatingdomestic group companies, they are only freely availableon expiry of the blocking period. The number of ownshares issued as a result of this offer amounted to 13,805in the financial year.