Download Annual Report 2006 - Mühlbauer Group

Download Annual Report 2006 - Mühlbauer Group

Download Annual Report 2006 - Mühlbauer Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

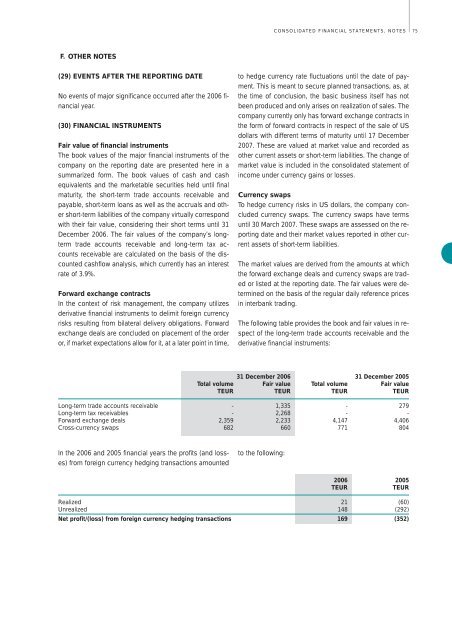

CONSOLIDATED FINANCIAL STATEMENTS, NOTES75F. OTHER NOTES(29) EVENTS AFTER THE REPORTING DATENo events of major significance occurred after the <strong>2006</strong> financialyear.(30) FINANCIAL INSTRUMENTSFair value of financial instrumentsThe book values of the major financial instruments of thecompany on the reporting date are presented here in asummarized form. The book values of cash and cashequivalents and the marketable securities held until finalmaturity, the short-term trade accounts receivable andpayable, short-term loans as well as the accruals and othershort-term liabilities of the company virtually correspondwith their fair value, considering their short terms until 31December <strong>2006</strong>. The fair values of the company’s longtermtrade accounts receivable and long-term tax accountsreceivable are calculated on the basis of the discountedcashflow analysis, which currently has an interestrate of 3.9%.Forward exchange contractsIn the context of risk management, the company utilizesderivative financial instruments to delimit foreign currencyrisks resulting from bilateral delivery obligations. Forwardexchange deals are concluded on placement of the orderor, if market expectations allow for it, at a later point in time,to hedge currency rate fluctuations until the date of payment.This is meant to secure planned transactions, as, atthe time of conclusion, the basic business itself has notbeen produced and only arises on realization of sales. Thecompany currently only has forward exchange contracts inthe form of forward contracts in respect of the sale of USdollars with different terms of maturity until 17 December2007. These are valued at market value and recorded asother current assets or short-term liabilities. The change ofmarket value is included in the consolidated statement ofincome under currency gains or losses.Currency swapsTo hedge currency risks in US dollars, the company concludedcurrency swaps. The currency swaps have termsuntil 30 March 2007. These swaps are assessed on the reportingdate and their market values reported in other currentassets of short-term liabilities.The market values are derived from the amounts at whichthe forward exchange deals and currency swaps are tradedor listed at the reporting date. The fair values were determinedon the basis of the regular daily reference pricesin interbank trading.The following table provides the book and fair values in respectof the long-term trade accounts receivable and thederivative financial instruments:31 December <strong>2006</strong> 31 December 2005Total volume Fair value Total volume Fair valueTEUR TEUR TEUR TEURLong-term trade accounts receivable - 1,335 - 279Long-term tax receivables - 2,268 - -Forward exchange deals 2,359 2,233 4,147 4,406Cross-currency swaps 682 660 771 804In the <strong>2006</strong> and 2005 financial years the profits (and losses)from foreign currency hedging transactions amountedto the following:<strong>2006</strong> 2005TEURTEURRealized 21 (60)Unrealized 148 (292)Net profit/(loss) from foreign currency hedging transactions 169 (352)