Download Annual Report 2006 - Mühlbauer Group

Download Annual Report 2006 - Mühlbauer Group

Download Annual Report 2006 - Mühlbauer Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

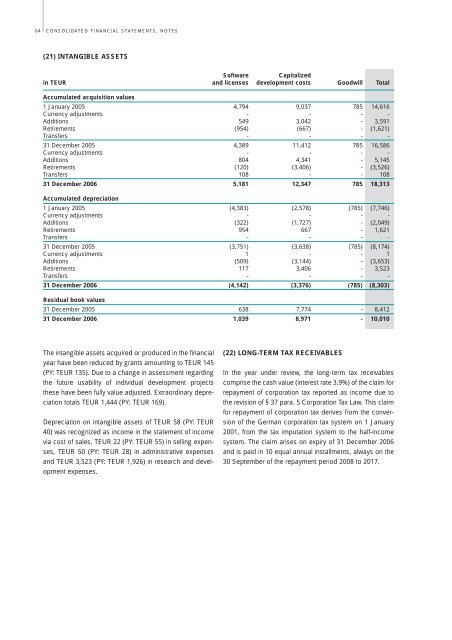

64 CONSOLIDATED FINANCIAL STATEMENTS, NOTES(21) INTANGIBLE ASSETSSoftware Capitalizedin TEUR and licenses development costs Goodwill TotalAccumulated acquisition values1 January 2005 4,794 9,037 785 14,616Currency adjustments - - - -Additions 549 3,042 - 3,591Retirements (954) (667) - (1,621)Transfers - - - -31 December 2005 4,389 11,412 785 16,586Currency adjustments - - - -Additions 804 4,341 - 5,145Retirements (120) (3,406) - (3,526)Transfers 108 - - 10831 December <strong>2006</strong> 5,181 12,347 785 18,313Accumulated depreciation1 January 2005 (4,383) (2,578) (785) (7,746)Currency adjustments - - - -Additions (322) (1,727) - (2,049)Retirements 954 667 - 1,621Transfers - - - -31 December 2005 (3,751) (3,638) (785) (8,174)Currency adjustments 1 - - 1Additions (509) (3,144) - (3,653)Retirements 117 3,406 - 3,523Transfers - - - -31 December <strong>2006</strong> (4,142) (3,376) (785) (8,303)Residual book values31 December 2005 638 7,774 - 8,41231 December <strong>2006</strong> 1,039 8,971 - 10,010The intangible assets acquired or produced in the financialyear have been reduced by grants amounting to TEUR 145(PY: TEUR 135). Due to a change in assessment regardingthe future usability of individual development projectsthese have been fully value adjusted. Extraordinary depreciationtotals TEUR 1,444 (PY: TEUR 169).Depreciation on intangible assets of TEUR 58 (PY: TEUR40) was recognized as income in the statement of incomevia cost of sales, TEUR 22 (PY: TEUR 55) in selling expenses,TEUR 50 (PY: TEUR 28) in administrative expensesand TEUR 3,523 (PY: TEUR 1,926) in research and developmentexpenses.(22) LONG-TERM TAX RECEIVABLESIn the year under review, the long-term tax receivablescomprise the cash value (interest rate 3.9%) of the claim forrepayment of corporation tax reported as income due tothe revision of § 37 para. 5 Corporation Tax Law. This claimfor repayment of corporation tax derives from the conversionof the German corporation tax system on 1 January2001, from the tax imputation system to the half-incomesystem. The claim arises on expiry of 31 December <strong>2006</strong>and is paid in 10 equal annual installments, always on the30 September of the repayment period 2008 to 2017.