Download Annual Report 2006 - Mühlbauer Group

Download Annual Report 2006 - Mühlbauer Group

Download Annual Report 2006 - Mühlbauer Group

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

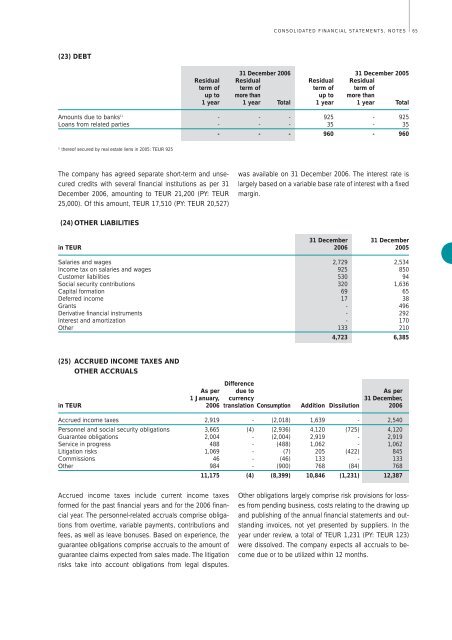

CONSOLIDATED FINANCIAL STATEMENTS, NOTES65(23) DEBT31 December <strong>2006</strong> 31 December 2005Residual Residual Residual Residualterm of term of term of term ofup to more than up to more than1 year 1 year Total 1 year 1 year TotalAmounts due to banks 1) - - - 925 - 925Loans from related parties - - - 35 - 35- - - 960 - 9601)thereof secured by real estate liens in 2005: TEUR 925The company has agreed separate short-term and unsecuredcredits with several financial institutions as per 31December <strong>2006</strong>, amounting to TEUR 21,200 (PY: TEUR25,000). Of this amount, TEUR 17,510 (PY: TEUR 20,527)was available on 31 December <strong>2006</strong>. The interest rate islargely based on a variable base rate of interest with a fixedmargin.(24) OTHER LIABILITIES31 December 31 Decemberin TEUR <strong>2006</strong> 2005Salaries and wages 2,729 2,534Income tax on salaries and wages 925 850Customer liabilities 530 94Social security contributions 320 1,636Capital formation 69 65Deferred income 17 38Grants - 496Derivative financial instruments - 292Interest and amortization - 170Other 133 2104,723 6,385(25) ACCRUED INCOME TAXES ANDOTHER ACCRUALSDifferenceAs per due to As per1 January, currency 31 December,in TEUR <strong>2006</strong> translation Consumption Addition Dissilution <strong>2006</strong>Accrued income taxes 2,919 - (2,018) 1,639 - 2,540Personnel and social security obligations 3,665 (4) (2,936) 4,120 (725) 4,120Guarantee obligations 2,004 - (2,004) 2,919 - 2,919Service in progress 488 - (488) 1,062 - 1,062Litigation risks 1,069 - (7) 205 (422) 845Commissions 46 - (46) 133 - 133Other 984 - (900) 768 (84) 76811,175 (4) (8,399) 10,846 (1,231) 12,387Accrued income taxes include current income taxesformed for the past financial years and for the <strong>2006</strong> financialyear. The personnel-related accruals comprise obligationsfrom overtime, variable payments, contributions andfees, as well as leave bonuses. Based on experience, theguarantee obligations comprise accruals to the amount ofguarantee claims expected from sales made. The litigationrisks take into account obligations from legal disputes.Other obligations largely comprise risk provisions for lossesfrom pending business, costs relating to the drawing upand publishing of the annual financial statements and outstandinginvoices, not yet presented by suppliers. In theyear under review, a total of TEUR 1,231 (PY: TEUR 123)were dissolved. The company expects all accruals to becomedue or to be utilized within 12 months.