Annual report for 2004/05 - Hemas Holdings, Ltd

Annual report for 2004/05 - Hemas Holdings, Ltd

Annual report for 2004/05 - Hemas Holdings, Ltd

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

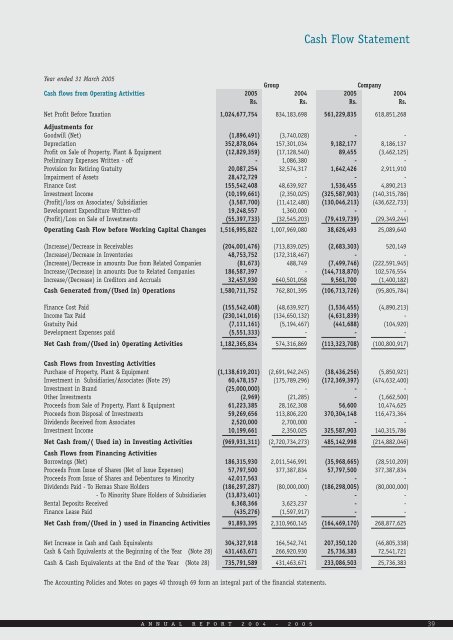

Cash Flow StatementYear ended 31 March 20<strong>05</strong>GroupCompanyCash flows from Operating Activities 20<strong>05</strong> <strong>2004</strong> 20<strong>05</strong> <strong>2004</strong>Rs. Rs. Rs. Rs.Net Profit Be<strong>for</strong>e Taxation 1,024,677,754 834,183,698 561,229,835 618,851,268Adjustments <strong>for</strong>Goodwill (Net) (1,896,491) (3,740,028) - -Depreciation 352,878,064 157,301,034 9,182,177 8,186,137Profit on Sale of Property, Plant & Equipment (12,829,359) (17,128,540) 89,455 (3,462,125)Preliminary Expenses Written - off - 1,086,380 - -Provision <strong>for</strong> Retiring Gratuity 20,087,254 32,574,317 1,642,426 2,911,910Impairment of Assets 28,472,729 - - -Finance Cost 155,542,408 48,639,927 1,536,455 4,890,213Investment Income (10,199,661) (2,350,025) (325,587,903) (140,315,786)(Profit)/loss on Associates/ Subsidiaries (3,587,700) (11,412,480) (130,046,213) (436,622,733)Development Expenditure Written-off 19,248,557 1,360,000 - -(Profit)/Loss on Sale of Investments (55,397,733) (32,545,203) (79,419,739) (29,349,244)Operating Cash Flow be<strong>for</strong>e Working Capital Changes 1,516,995,822 1,007,969,080 38,626,493 25,089,640(Increase)/Decrease in Receivables (204,001,476) (713,839,025) (2,683,303) 520,149(Increase)/Decrease in Inventories 48,753,752 (172,318,467) - -(Increase)/Decrease in amounts Due from Related Companies (81,673) 488,749 (7,499,746) (222,591,945)Increase/(Decrease) in amounts Due to Related Companies 186,587,397 - (144,718,870) 102,576,554Increase/(Decrease) in Creditors and Accruals 32,457,930 640,501,<strong>05</strong>8 9,561,700 (1,400,182)Cash Generated from/(Used in) Operations 1,580,711,752 762,801,395 (106,713,726) (95,8<strong>05</strong>,784)Finance Cost Paid (155,542,408) (48,639,927) (1,536,455) (4,890,213)Income Tax Paid (230,141,016) (134,650,132) (4,631,839) -Gratuity Paid (7,111,161) (5,194,467) (441,688) (104,920)Development Expenses paid (5,551,333) - - -Net Cash from/(Used in) Operating Activities 1,182,365,834 574,316,869 (113,323,708) (100,800,917)Cash Flows from Investing ActivitiesPurchase of Property, Plant & Equipment (1,138,619,201) (2,691,942,245) (38,436,256) (5,850,921)Investment in Subsidiaries/Associates (Note 29) 60,478,157 (175,789,296) (172,369,397) (474,632,400)Investment in Brand (25,000,000) - - -Other Investments (2,969) (21,285) - (1,662,500)Proceeds from Sale of Property, Plant & Equipment 61,223,385 28,162,308 56,600 10,474,625Proceeds from Disposal of Investments 59,269,656 113,806,220 370,304,148 116,473,364Dividends Received from Associates 2,520,000 2,700,000 - -Investment Income 10,199,661 2,350,025 325,587,903 140,315,786Net Cash from/( Used in) in Investing Activities (969,931,311) (2,720,734,273) 485,142,998 (214,882,046)Cash Flows from Financing ActivitiesBorrowings (Net) 186,315,930 2,011,546,991 (35,968,665) (28,510,209)Proceeds From Issue of Shares (Net of Issue Expenses) 57,797,500 377,387,834 57,797,500 377,387,834Proceeds From Issue of Shares and Debentures to Minority 42,017,563 - - -Dividends Paid - To <strong>Hemas</strong> Share Holders (186,297,287) (80,000,000) (186,298,0<strong>05</strong>) (80,000,000)- To Minority Share Holders of Subsidiaries (13,873,401) - - -Rental Deposits Received 6,368,366 3,623,237 - -Finance Lease Paid (435,276) (1,597,917) - -Net Cash from/(Used in ) used in Financing Activities 91,893,395 2,310,960,145 (164,469,170) 268,877,625Net Increase in Cash and Cash Equivalents 304,327,918 164,542,741 207,350,120 (46,8<strong>05</strong>,338)Cash & Cash Equivalents at the Beginning of the Year (Note 28) 431,463,671 266,920,930 25,736,383 72,541,721Cash & Cash Equivalents at the End of the Year (Note 28) 735,791,589 431,463,671 233,086,503 25,736,383The Accounting Policies and Notes on pages 40 through 69 <strong>for</strong>m an integral part of the financial statements.A N N U A L R E P O R T 2 0 0 4 - 2 0 0 5 39