Annual report for 2004/05 - Hemas Holdings, Ltd

Annual report for 2004/05 - Hemas Holdings, Ltd

Annual report for 2004/05 - Hemas Holdings, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

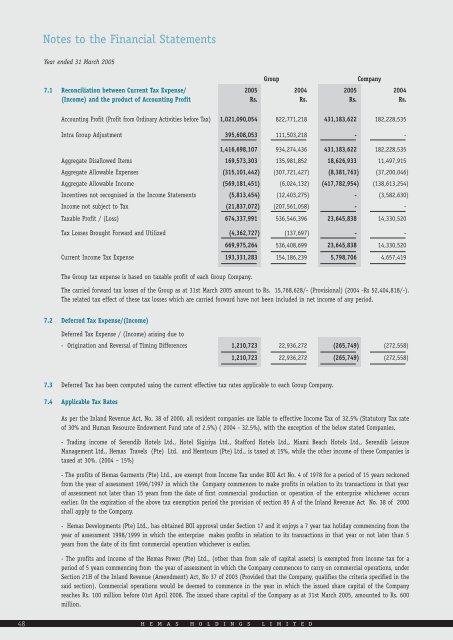

Notes to the Financial StatementsYear ended 31 March 20<strong>05</strong>GroupCompany7.1 Reconciliation between Current Tax Expense/ 20<strong>05</strong> <strong>2004</strong> 20<strong>05</strong> <strong>2004</strong>(Income) and the product of Accounting Profit Rs. Rs. Rs. Rs.Accounting Profit (Profit from Ordinary Activities be<strong>for</strong>e Tax) 1,021,090,<strong>05</strong>4 822,771,218 431,183,622 182,228,535Intra Group Adjustment 395,608,<strong>05</strong>3 111,503,218 - -1,416,698,107 934,274,436 431,183,622 182,228,535Aggregate Disallowed Items 169,573,303 135,981,852 18,626,933 11,497,915Aggregate Allowable Expenses (315,101,442) (307,721,427) (8,381,763) (37,200,046)Aggregate Allowable Income (569,181,451) (6,024,132) (417,782,954) (138,613,254)Incentives not recognised in the Income Statements (5,813,454) (12,403,275) - (3,582,630)Income not subject to Tax (21,837,072) (207,561,<strong>05</strong>8) - -Taxable Profit / (Loss) 674,337,991 536,546,396 23,645,838 14,330,520Tax Losses Brought Forward and Utilized (4,362,727) (137,697) - -669,975,264 536,408,699 23,645,838 14,330,520Current Income Tax Expense 193,331,283 154,186,239 5,798,706 4,657,419The Group tax expense is based on taxable profit of each Group Company.The carried <strong>for</strong>ward tax losses of the Group as at 31st March 20<strong>05</strong> amount to Rs. 15,768,628/- (Provisional) (<strong>2004</strong> -Rs 52,404,818/-).The related tax effect of these tax losses which are carried <strong>for</strong>ward have not been included in net income of any period.7.2 Deferred Tax Expense/(Income)Deferred Tax Expense / (Income) arising due to- Origination and Reversal of Timing Differences 1,210,723 22,936,272 (265,749) (272,558)1,210,723 22,936,272 (265,749) (272,558)7.3 Deferred Tax has been computed using the current effective tax rates applicable to each Group Company.7.4 Applicable Tax RatesAs per the Inland Revenue Act, No. 38 of 2000, all resident companies are liable to effective Income Tax of 32.5% (Statutory Tax rateof 30% and Human Resource Endowment Fund rate of 2.5%) ( <strong>2004</strong> - 32.5%), with the exception of the below stated Companies.- Trading income of Serendib Hotels <strong>Ltd</strong>., Hotel Sigiriya <strong>Ltd</strong>., Staf<strong>for</strong>d Hotels <strong>Ltd</strong>., Miami Beach Hotels <strong>Ltd</strong>., Serendib LeisureManagement <strong>Ltd</strong>., <strong>Hemas</strong> Travels (Pte) <strong>Ltd</strong>. and Hemtours (Pte) <strong>Ltd</strong>., is taxed at 15%, while the other income of these Companies istaxed at 30%. (<strong>2004</strong> – 15%)- The profits of <strong>Hemas</strong> Garments (Pte) <strong>Ltd</strong>., are exempt from Income Tax under BOI Act No. 4 of 1978 <strong>for</strong> a period of 15 years reckonedfrom the year of assessment 1996/1997 in which the Company commences to make profits in relation to its transactions in that yearof assessment not later than 15 years from the date of first commercial production or operation of the enterprise whichever occursearlier. On the expiration of the above tax exemption period the provision of section 85 A of the Inland Revenue Act No. 38 of 2000shall apply to the Company.- <strong>Hemas</strong> Developments (Pte) <strong>Ltd</strong>., has obtained BOI approval under Section 17 and it enjoys a 7 year tax holiday commencing from theyear of assessment 1998/1999 in which the enterprise makes profits in relation to its transactions in that year or not later than 5years from the date of its first commercial operation whichever is earlier.- The profits and income of the <strong>Hemas</strong> Power (Pte) <strong>Ltd</strong>., (other than from sale of capital assets) is exempted from income tax <strong>for</strong> aperiod of 5 years commencing from the year of assessment in which the Company commences to carry on commercial operations, underSection 21H of the Inland Revenue (Amendment) Act, No 37 of 2003 (Provided that the Company, qualifies the criteria specified in thesaid section). Commercial operations would be deemed to commence in the year in which the issued share capital of the Companyreaches Rs. 100 million be<strong>for</strong>e 01st April 2008. The issued share capital of the Company as at 31st March 20<strong>05</strong>, amounted to Rs. 600million.48H E M A S H O L D I N G S L I M I T E D