Annual report for 2004/05 - Hemas Holdings, Ltd

Annual report for 2004/05 - Hemas Holdings, Ltd

Annual report for 2004/05 - Hemas Holdings, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

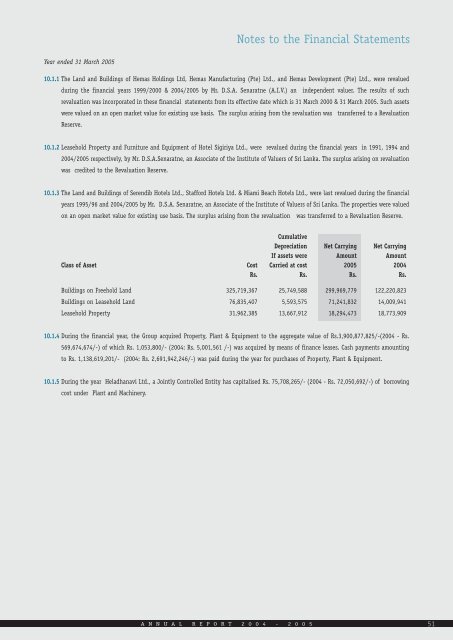

Notes to the Financial StatementsYear ended 31 March 20<strong>05</strong>10.1.1 The Land and Buildings of <strong>Hemas</strong> <strong>Holdings</strong> <strong>Ltd</strong>, <strong>Hemas</strong> Manufacturing (Pte) <strong>Ltd</strong>., and <strong>Hemas</strong> Development (Pte) <strong>Ltd</strong>., were revaluedduring the financial years 1999/2000 & <strong>2004</strong>/20<strong>05</strong> by Mr. D.S.A. Senaratne (A.I.V.) an independent valuer. The results of suchrevaluation was incorporated in these financial statements from its effective date which is 31 March 2000 & 31 March 20<strong>05</strong>. Such assetswere valued on an open market value <strong>for</strong> existing use basis. The surplus arising from the revaluation was transferred to a RevaluationReserve.10.1.2 Leasehold Property and Furniture and Equipment of Hotel Sigiriya <strong>Ltd</strong>., were revalued during the financial years in 1991, 1994 and<strong>2004</strong>/20<strong>05</strong> respectively, by Mr. D.S.A.Senaratne, an Associate of the Institute of Valuers of Sri Lanka. The surplus arising on revaluationwas credited to the Revaluation Reserve.10.1.3 The Land and Buildings of Serendib Hotels <strong>Ltd</strong>., Staf<strong>for</strong>d Hotels <strong>Ltd</strong>. & Miami Beach Hotels <strong>Ltd</strong>., were last revalued during the financialyears 1995/96 and <strong>2004</strong>/20<strong>05</strong> by Mr. D.S.A. Senaratne, an Associate of the Institute of Valuers of Sri Lanka. The properties were valuedon an open market value <strong>for</strong> existing use basis. The surplus arising from the revaluation was transferred to a Revaluation Reserve.CumulativeDepreciation Net Carrying Net CarryingIf assets were Amount AmountClass of Asset Cost Carried at cost 20<strong>05</strong> <strong>2004</strong>Rs. Rs. Rs. Rs.Buildings on Freehold Land 325,719,367 25,749,588 299,969,779 122,220,823Buildings on Leasehold Land 76,835,407 5,593,575 71,241,832 14,009,941Leasehold Property 31,962,385 13,667,912 18,294,473 18,773,90910.1.4 During the financial year, the Group acquired Property, Plant & Equipment to the aggregate value of Rs.3,900,877,825/-(<strong>2004</strong> - Rs.569,674,674/-) of which Rs. 1,<strong>05</strong>3,800/- (<strong>2004</strong>: Rs. 5,001,561 /-) was acquired by means of finance leases. Cash payments amountingto Rs. 1,138,619,201/- (<strong>2004</strong>: Rs. 2,691,942,246/-) was paid during the year <strong>for</strong> purchases of Property, Plant & Equipment.10.1.5 During the year Heladhanavi <strong>Ltd</strong>., a Jointly Controlled Entity has capitalised Rs. 75,708,265/- (<strong>2004</strong> - Rs. 72,<strong>05</strong>0,692/-) of borrowingcost under Plant and Machinery.A N N U A L R E P O R T 2 0 0 4 - 2 0 0 5 51