German - ADM

German - ADM

German - ADM

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

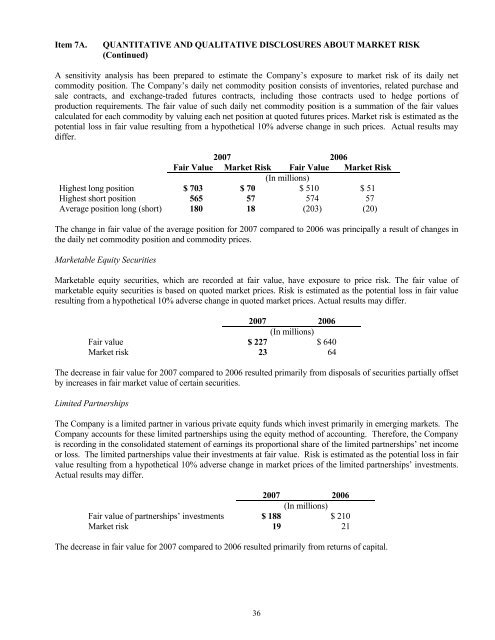

Item 7A.QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK(Continued)A sensitivity analysis has been prepared to estimate the Company’s exposure to market risk of its daily netcommodity position. The Company’s daily net commodity position consists of inventories, related purchase andsale contracts, and exchange-traded futures contracts, including those contracts used to hedge portions ofproduction requirements. The fair value of such daily net commodity position is a summation of the fair valuescalculated for each commodity by valuing each net position at quoted futures prices. Market risk is estimated as thepotential loss in fair value resulting from a hypothetical 10% adverse change in such prices. Actual results maydiffer.2007 2006Fair Value Market Risk Fair Value Market Risk(In millions)Highest long position $ 703 $ 70 $ 510 $ 51Highest short position 565 57 574 57Average position long (short) 180 18 (203) (20)The change in fair value of the average position for 2007 compared to 2006 was principally a result of changes inthe daily net commodity position and commodity prices.Marketable Equity SecuritiesMarketable equity securities, which are recorded at fair value, have exposure to price risk. The fair value ofmarketable equity securities is based on quoted market prices. Risk is estimated as the potential loss in fair valueresulting from a hypothetical 10% adverse change in quoted market prices. Actual results may differ.2007 2006(In millions)Fair value $ 227 $ 640Market risk 23 64The decrease in fair value for 2007 compared to 2006 resulted primarily from disposals of securities partially offsetby increases in fair market value of certain securities.Limited PartnershipsThe Company is a limited partner in various private equity funds which invest primarily in emerging markets. TheCompany accounts for these limited partnerships using the equity method of accounting. Therefore, the Companyis recording in the consolidated statement of earnings its proportional share of the limited partnerships’ net incomeor loss. The limited partnerships value their investments at fair value. Risk is estimated as the potential loss in fairvalue resulting from a hypothetical 10% adverse change in market prices of the limited partnerships’ investments.Actual results may differ.2007 2006(In millions)Fair value of partnerships’ investments $ 188 $ 210Market risk 19 21The decrease in fair value for 2007 compared to 2006 resulted primarily from returns of capital.36