German - ADM

German - ADM

German - ADM

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

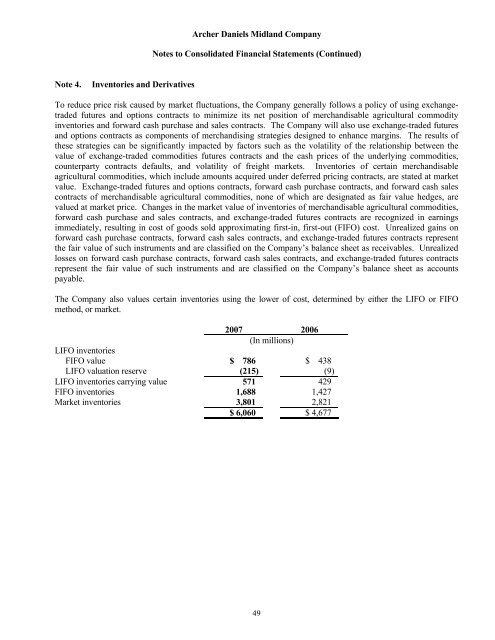

Archer Daniels Midland CompanyNotes to Consolidated Financial Statements (Continued)Note 4.Inventories and DerivativesTo reduce price risk caused by market fluctuations, the Company generally follows a policy of using exchangetradedfutures and options contracts to minimize its net position of merchandisable agricultural commodityinventories and forward cash purchase and sales contracts. The Company will also use exchange-traded futuresand options contracts as components of merchandising strategies designed to enhance margins. The results ofthese strategies can be significantly impacted by factors such as the volatility of the relationship between thevalue of exchange-traded commodities futures contracts and the cash prices of the underlying commodities,counterparty contracts defaults, and volatility of freight markets. Inventories of certain merchandisableagricultural commodities, which include amounts acquired under deferred pricing contracts, are stated at marketvalue. Exchange-traded futures and options contracts, forward cash purchase contracts, and forward cash salescontracts of merchandisable agricultural commodities, none of which are designated as fair value hedges, arevalued at market price. Changes in the market value of inventories of merchandisable agricultural commodities,forward cash purchase and sales contracts, and exchange-traded futures contracts are recognized in earningsimmediately, resulting in cost of goods sold approximating first-in, first-out (FIFO) cost. Unrealized gains onforward cash purchase contracts, forward cash sales contracts, and exchange-traded futures contracts representthe fair value of such instruments and are classified on the Company’s balance sheet as receivables. Unrealizedlosses on forward cash purchase contracts, forward cash sales contracts, and exchange-traded futures contractsrepresent the fair value of such instruments and are classified on the Company’s balance sheet as accountspayable.The Company also values certain inventories using the lower of cost, determined by either the LIFO or FIFOmethod, or market.2007 2006(In millions)LIFO inventoriesFIFO value $ 786 $ 438LIFO valuation reserve (215) (9)LIFO inventories carrying value 571 429FIFO inventories 1,688 1,427Market inventories 3,801 2,821$ 6,060 $ 4,67749