German - ADM

German - ADM

German - ADM

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

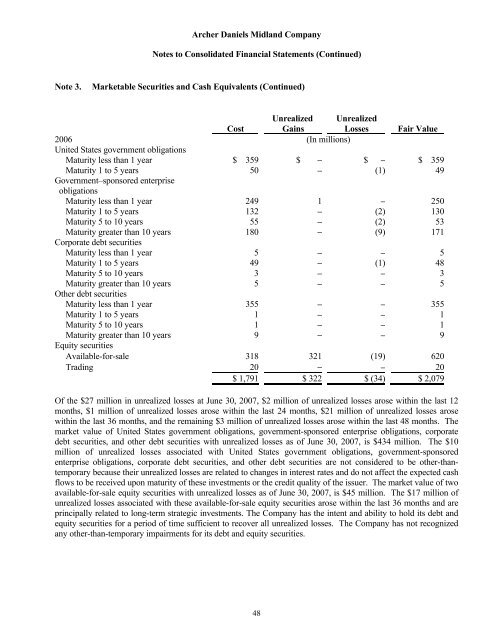

Archer Daniels Midland CompanyNotes to Consolidated Financial Statements (Continued)Note 3.Marketable Securities and Cash Equivalents (Continued)Unrealized UnrealizedCost Gains Losses Fair Value2006 (In millions)United States government obligationsMaturity less than 1 year $ 359 $ – $ – $ 359Maturity 1 to 5 years 50 – (1) 49Government–sponsored enterpriseobligationsMaturity less than 1 year 249 1 – 250Maturity 1 to 5 years 132 – (2) 130Maturity 5 to 10 years 55 – (2) 53Maturity greater than 10 years 180 – (9) 171Corporate debt securitiesMaturity less than 1 year 5 – – 5Maturity 1 to 5 years 49 – (1) 48Maturity 5 to 10 years 3 – – 3Maturity greater than 10 years 5 – – 5Other debt securitiesMaturity less than 1 year 355 – – 355Maturity 1 to 5 years 1 – – 1Maturity 5 to 10 years 1 – – 1Maturity greater than 10 years 9 – – 9Equity securitiesAvailable-for-sale 318 321 (19) 620Trading 20 – – 20$ 1,791 $ 322 $ (34) $ 2,079Of the $27 million in unrealized losses at June 30, 2007, $2 million of unrealized losses arose within the last 12months, $1 million of unrealized losses arose within the last 24 months, $21 million of unrealized losses arosewithin the last 36 months, and the remaining $3 million of unrealized losses arose within the last 48 months. Themarket value of United States government obligations, government-sponsored enterprise obligations, corporatedebt securities, and other debt securities with unrealized losses as of June 30, 2007, is $434 million. The $10million of unrealized losses associated with United States government obligations, government-sponsoredenterprise obligations, corporate debt securities, and other debt securities are not considered to be other-thantemporarybecause their unrealized losses are related to changes in interest rates and do not affect the expected cashflows to be received upon maturity of these investments or the credit quality of the issuer. The market value of twoavailable-for-sale equity securities with unrealized losses as of June 30, 2007, is $45 million. The $17 million ofunrealized losses associated with these available-for-sale equity securities arose within the last 36 months and areprincipally related to long-term strategic investments. The Company has the intent and ability to hold its debt andequity securities for a period of time sufficient to recover all unrealized losses. The Company has not recognizedany other-than-temporary impairments for its debt and equity securities.48