Banco de Oro Universal Bank provides a - Asianbanks.net

Banco de Oro Universal Bank provides a - Asianbanks.net

Banco de Oro Universal Bank provides a - Asianbanks.net

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

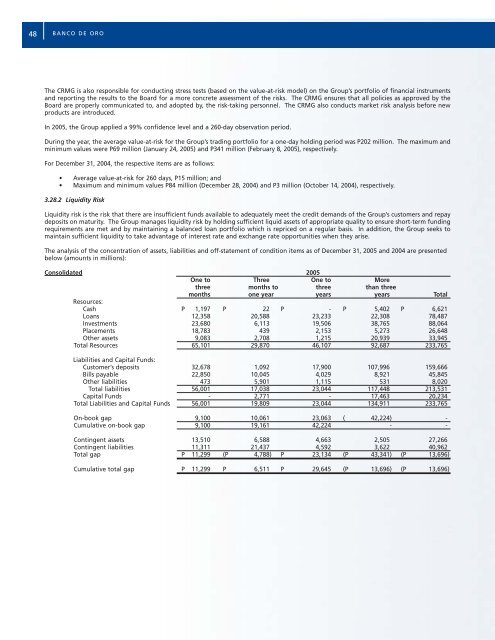

48 BANCO DE OROThe CRMG is also responsible for conducting stress tests (based on the value-at-risk mo<strong>de</strong>l) on the Group’s portfolio of financial instrumentsand reporting the results to the Board for a more concrete assessment of the risks. The CRMG ensures that all policies as approved by theBoard are properly communicated to, and adopted by, the risk-taking personnel. The CRMG also conducts market risk analysis before newproducts are introduced.In 2005, the Group applied a 99% confi<strong>de</strong>nce level and a 260-day observation period.During the year, the average value-at-risk for the Group’s trading portfolio for a one-day holding period was P202 million. The maximum andminimum values were P69 million (January 24, 2005) and P341 million (February 8, 2005), respectively.For December 31, 2004, the respective items are as follows:• Average value-at-risk for 260 days, P15 million; and• Maximum and minimum values P84 million (December 28, 2004) and P3 million (October 14, 2004), respectively.3.28.2 Liquidity RiskLiquidity risk is the risk that there are insufficient funds available to a<strong>de</strong>quately meet the credit <strong>de</strong>mands of the Group’s customers and repay<strong>de</strong>posits on maturity. The Group manages liquidity risk by holding sufficient liquid assets of appropriate quality to ensure short-term fundingrequirements are met and by maintaining a balanced loan portfolio which is repriced on a regular basis. In addition, the Group seeks tomaintain sufficient liquidity to take advantage of interest rate and exchange rate opportunities when they arise.The analysis of the concentration of assets, liabilities and off-statement of condition items as of December 31, 2005 and 2004 are presentedbelow (amounts in millions):Consolidated 2005One to Three One to Morethree months to three than threemonths one year years years TotalResources:Cash P 1,197 P 22 P - P 5,402 P 6,621Loans 12,358 20,588 23,233 22,308 78,487Investments 23,680 6,113 19,506 38,765 88,064Placements 18,783 439 2,153 5,273 26,648Other assets 9,083 2,708 1,215 20,939 33,945Total Resources 65,101 29,870 46,107 92,687 233,765Liabilities and Capital Funds:Customer’s <strong>de</strong>posits 32,678 1,092 17,900 107,996 159,666Bills payable 22,850 10,045 4,029 8,921 45,845Other liabilities 473 5,901 1,115 531 8,020Total liabilities 56,001 17,038 23,044 117,448 213,531Capital Funds - 2,771 - 17,463 20,234Total Liabilities and Capital Funds 56,001 19,809 23,044 134,911 233,765On-book gap 9,100 10,061 23,063 ( 42,224) -Cumulative on-book gap 9,100 19,161 42,224 - -Contingent assets 13,510 6,588 4,663 2,505 27,266Contingent liabilities 11,311 21,437 4,592 3,622 40,962Total gap P 11,299 (P 4,788) P 23,134 (P 43,341) (P 13,696)Cumulative total gap P 11,299 P 6,511 P 29,645 (P 13,696) (P 13,696)