Banco de Oro Universal Bank provides a - Asianbanks.net

Banco de Oro Universal Bank provides a - Asianbanks.net

Banco de Oro Universal Bank provides a - Asianbanks.net

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

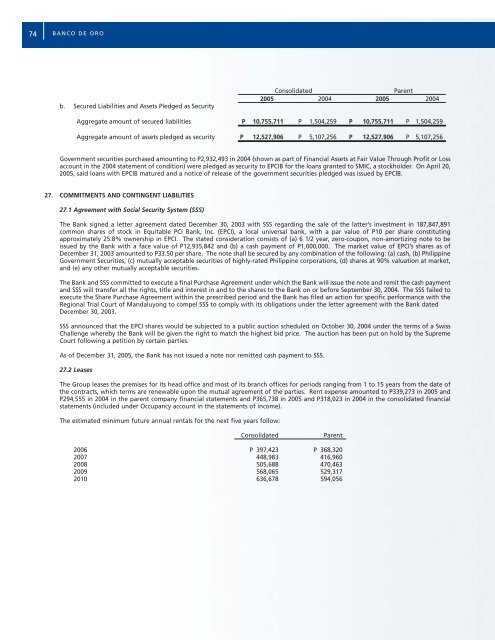

74 BANCO DE OROb. Secured Liabilities and Assets Pledged as SecurityConsolidatedParent2005 2004 2005 2004Aggregate amount of secured liabilities P 10,755,711 P 1,504,259 P 10,755,711 P 1,504,259Aggregate amount of assets pledged as security P 12,527,906 P 5,107,256 P 12,527,906 P 5,107,256Government securities purchased amounting to P2,932,493 in 2004 (shown as part of Financial Assets at Fair Value Through Profit or Lossaccount in the 2004 statement of condition) were pledged as security to EPCIB for the loans granted to SMIC, a stockhol<strong>de</strong>r. On April 20,2005, said loans with EPCIB matured and a notice of release of the government securities pledged was issued by EPCIB.27. COMMITMENTS AND CONTINGENT LIABILITIES27.1 Agreement with Social Security System (SSS)The <strong>Bank</strong> signed a letter agreement dated December 30, 2003 with SSS regarding the sale of the latter’s investment in 187,847,891common shares of stock in Equitable PCI <strong>Bank</strong>, Inc. (EPCI), a local universal bank, with a par value of P10 per share constitutingapproximately 25.8% ownership in EPCI. The stated consi<strong>de</strong>ration consists of (a) 6 1/2 year, zero-coupon, non-amortizing note to beissued by the <strong>Bank</strong> with a face value of P12,935,842 and (b) a cash payment of P1,000,000. The market value of EPCI’s shares as ofDecember 31, 2003 amounted to P33.50 per share. The note shall be secured by any combination of the following: (a) cash, (b) PhilippineGovernment Securities, (c) mutually acceptable securities of highly-rated Philippine corporations, (d) shares at 90% valuation at market,and (e) any other mutually acceptable securities.The <strong>Bank</strong> and SSS committed to execute a final Purchase Agreement un<strong>de</strong>r which the <strong>Bank</strong> will issue the note and remit the cash paymentand SSS will transfer all the rights, title and interest in and to the shares to the <strong>Bank</strong> on or before September 30, 2004. The SSS failed toexecute the Share Purchase Agreement within the prescribed period and the <strong>Bank</strong> has filed an action for specific performance with theRegional Trial Court of Mandaluyong to compel SSS to comply with its obligations un<strong>de</strong>r the letter agreement with the <strong>Bank</strong> datedDecember 30, 2003.SSS announced that the EPCI shares would be subjected to a public auction scheduled on October 30, 2004 un<strong>de</strong>r the terms of a SwissChallenge whereby the <strong>Bank</strong> will be given the right to match the highest bid price. The auction has been put on hold by the SupremeCourt following a petition by certain parties.As of December 31, 2005, the <strong>Bank</strong> has not issued a note nor remitted cash payment to SSS.27.2 LeasesThe Group leases the premises for its head office and most of its branch offices for periods ranging from 1 to 15 years from the date ofthe contracts, which terms are renewable upon the mutual agreement of the parties. Rent expense amounted to P339,273 in 2005 andP294,555 in 2004 in the parent company financial statements and P365,738 in 2005 and P318,023 in 2004 in the consolidated financialstatements (inclu<strong>de</strong>d un<strong>de</strong>r Occupancy account in the statements of income).The estimated minimum future annual rentals for the next five years follow:ConsolidatedParent2006 P 397,423 P 368,3202007 448,983 416,9602008 505,688 470,4632009 568,065 529,3172010 636,678 594,056