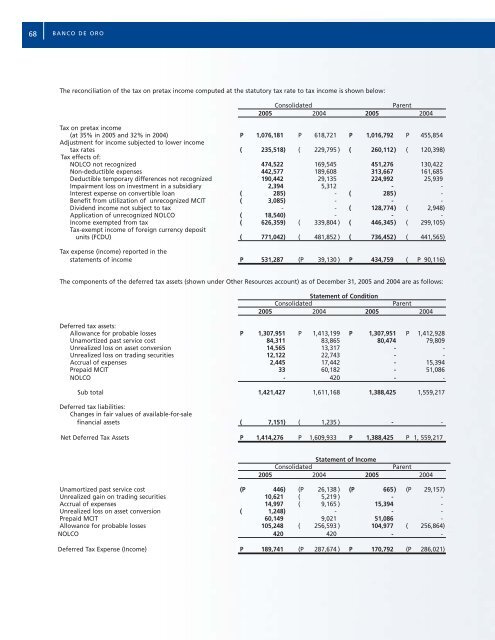

68 BANCO DE OROThe reconciliation of the tax on pretax income computed at the statutory tax rate to tax income is shown below:ConsolidatedParent2005 2004 2005 2004Tax on pretax income(at 35% in 2005 and 32% in 2004) P 1,076,181 P 618,721 P 1,016,792 P 455,854Adjustment for income subjected to lower incometax rates ( 235,518) ( 229,795 ) ( 260,112) ( 120,398)Tax effects of:NOLCO not recognized 474,522 169,545 451,276 130,422Non-<strong>de</strong>ductible expenses 442,577 189,608 313,667 161,685Deductible temporary differences not recognized 190,442 29,135 224,992 25,939Impairment loss on investment in a subsidiary 2,394 5,312 - -Interest expense on convertible loan ( 285) - ( 285) -Benefit from utilization of unrecognized MCIT ( 3,085) - - -Divi<strong>de</strong>nd income not subject to tax - - ( 128,774) ( 2,948)Application of unrecognized NOLCO ( 18,540) - - -Income exempted from tax ( 626,359) ( 339,804 ) ( 446,345) ( 299,105)Tax-exempt income of foreign currency <strong>de</strong>positunits (FCDU) ( 771,042) ( 481,852 ) ( 736,452) ( 441,565)Tax expense (income) reported in thestatements of income P 531,287 (P 39,130 ) P 434,759 ( P 90,116)The components of the <strong>de</strong>ferred tax assets (shown un<strong>de</strong>r Other Resources account) as of December 31, 2005 and 2004 are as follows:Statement of ConditionConsolidatedParent2005 2004 2005 2004Deferred tax assets:Allowance for probable losses P 1,307,951 P 1,413,199 P 1,307,951 P 1,412,928Unamortized past service cost 84,311 83,865 80,474 79,809Unrealized loss on asset conversion 14,565 13,317 - -Unrealized loss on trading securities 12,122 22,743 - -Accrual of expenses 2,445 17,442 - 15,394Prepaid MCIT 33 60,182 - 51,086NOLCO - 420 - -Sub total 1,421,427 1,611,168 1,388,425 1,559,217Deferred tax liabilities:Changes in fair values of available-for-salefinancial assets ( 7,151) ( 1,235 ) - -Net Deferred Tax Assets P 1,414,276 P 1,609,933 P 1,388,425 P 1, 559,217Statement of IncomeConsolidatedParent2005 2004 2005 2004Unamortized past service cost (P 446) (P 26,138 ) (P 665) (P 29,157)Unrealized gain on trading securities 10,621 ( 5,219 ) - -Accrual of expenses 14,997 ( 9,165 ) 15,394 -Unrealized loss on asset conversion ( 1,248) - - -Prepaid MCIT 60,149 9,021 51,086 -Allowance for probable losses 105,248 ( 256,593 ) 104,977 ( 256,864)NOLCO 420 420 - -Deferred Tax Expense (Income) P 189,741 (P 287,674 ) P 170,792 (P 286,021)

2005 ANNUAL REPORT69ConsolidatedStatements of Changes in Capital Funds2005 2004Changes in fair values of available-for-sale financial assets P 5,916 P 1,225Deferred Tax Income P 5,916 P 1,225The Group has a NOLCO of P2,246,592 and P2,877,997 in the parent company and consolidated financial statements, respectively, as ofDecember 31, 2005 that can be claimed as <strong>de</strong>duction against taxable income for the next three consecutive years after the NOLCO wasincurred.The breakdown of NOLCO with the corresponding validity periods follow:Year Consolidated Parent Valid Until2005 P 1,384,876 P 1,289,362 20082004 859,635 407,569 20072003 633,486 549,661 2006In the parent company and consolidated financial statements, the <strong>de</strong>ferred tax asset arising from the 2002 NOLCO amounting toP558,964 and P563,816, respectively, expired in 2005.As of December 31, 2005, the Group has MCIT totaling P77,812 and P84,361 in the parent company and consolidated financial statements,respectively, that can be applied against regular corporate income tax for the next three consecutive years after the MCIT was incurred.The breakdown of MCIT with the corresponding validity periods follow:Year Consolidated Parent Valid Until2005 P 29,111 P 29,111 20082004 31,760 28,433 20072003 23,490 20,268 2006In the parent company and consolidated financial statements, the <strong>de</strong>ferred tax asset arising from the 2002 MCIT amounting to P2,385expired in 2005.21.2 Relevant Tax RegulationsAmong the significant provisions of the National Internal Revenue Co<strong>de</strong> (NIRC) that apply to the Group are the following:a. The regular corporate income tax of 32% (35% starting November 1, 2005) is imposed on taxable income <strong>net</strong> of applicable <strong>de</strong>ductions;b. Fringe benefits tax (same rate as the 32% corporate income tax) is imposed on the grossed-up value of the benefits given by employersto their managerial and supervisory employees (this is a final tax to be paid by the employer);c. MCIT of 2% based on gross income, as <strong>de</strong>fined un<strong>de</strong>r the Tax Co<strong>de</strong>, is required to be paid at the end of the year starting on the fourthyear from the date of registration with the Bureau of Internal Revenue (BIR) whenever the RCIT is lower than the MCIT;d. NOLCO can be claimed as <strong>de</strong>duction against taxable income within three years after NOLCO is incurred;e. The amount of interest expense allowed as income tax <strong>de</strong>duction is reduced by an amount equal to 38% of the interest incomesubjected to final tax;f. FCDU transactions with non-resi<strong>de</strong>nts of the Philippines and other offshore banking units (offshore income) are tax-exempt;g. Foreign currency transactions with foreign currency <strong>de</strong>posit units, local commercial banks, and branches of foreign banks are subjectto 10% withholding tax; and,h. Withholding tax of 7.5% is imposed on interest earned by resi<strong>de</strong>nts un<strong>de</strong>r the expan<strong>de</strong>d foreign currency <strong>de</strong>posit system.21.3 New Tax RegulationsOn May 24, 2005, Republic Act (RA) No. 9337 (“RA 9337”), amending certain sections of the National Internal Revenue Co<strong>de</strong> of 1997 wassigned into law and became effective beginning November 1, 2005. The following are the major changes brought about by RA No. 9337that are relevant to the Group:a. RCIT rate is increased from 32% to 35% starting November 1, 2005 until December 31, 2008 and will be reduced to 30% beginningJanuary 1, 2009;