Banco de Oro Universal Bank provides a - Asianbanks.net

Banco de Oro Universal Bank provides a - Asianbanks.net

Banco de Oro Universal Bank provides a - Asianbanks.net

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

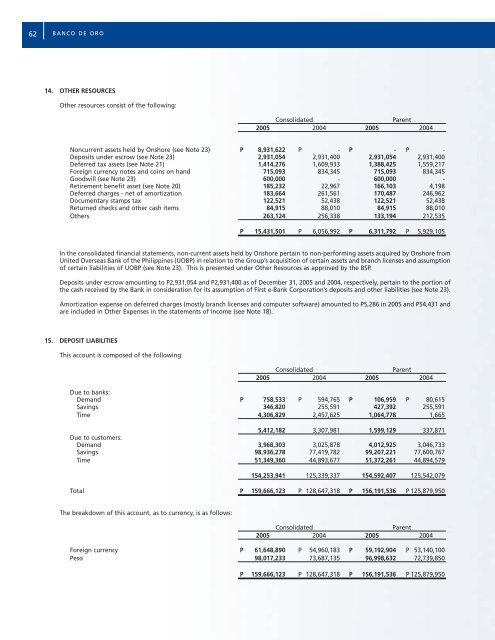

62 BANCO DE ORO14. OTHER RESOURCESOther resources consist of the following:ConsolidatedParent2005 2004 2005 2004Noncurrent assets held by Onshore (see Note 23) P 8,931,622 P - P - P -Deposits un<strong>de</strong>r escrow (see Note 23) 2,931,054 2,931,400 2,931,054 2,931,400Deferred tax assets (see Note 21) 1,414,276 1,609,933 1,388,425 1,559,217Foreign currency notes and coins on hand 715,093 834,345 715,093 834,345Goodwill (see Note 23) 600,000 - 600,000 -Retirement benefit asset (see Note 20) 185,232 22,967 166,103 4,198Deferred charges - <strong>net</strong> of amortization 183,664 261,561 170,487 246,962Documentary stamps tax 122,521 52,438 122,521 52,438Returned checks and other cash items 84,915 88,010 84,915 88,010Others 263,124 256,338 133,194 212,535P 15,431,501 P 6,056,992 P 6,311,792 P 5,929,105In the consolidated financial statements, non-current assets held by Onshore pertain to non-performing assets acquired by Onshore fromUnited Overseas <strong>Bank</strong> of the Philippines (UOBP) in relation to the Group’s acquisition of certain assets and branch licenses and assumptionof certain liabilities of UOBP (see Note 23). This is presented un<strong>de</strong>r Other Resources as approved by the BSP.Deposits un<strong>de</strong>r escrow amounting to P2,931,054 and P2,931,400 as of December 31, 2005 and 2004, respectively, pertain to the portion ofthe cash received by the <strong>Bank</strong> in consi<strong>de</strong>ration for its assumption of First e-<strong>Bank</strong> Corporation’s <strong>de</strong>posits and other liabilities (see Note 23).Amortization expense on <strong>de</strong>ferred charges (mostly branch licenses and computer software) amounted to P5,286 in 2005 and P54,431 andare inclu<strong>de</strong>d in Other Expenses in the statements of income (see Note 18).15. DEPOSIT LIABILITIESThis account is composed of the following:ConsolidatedParent2005 2004 2005 2004Due to banks:Demand P 758,533 P 594,765 P 106,959 P 80,615Savings 346,820 255,591 427,392 255,591Time 4,306,829 2,457,625 1,064,778 1,6655,412,182 3,307,981 1,599,129 337,871Due to customers:Demand 3,968,303 3,025,878 4,012,925 3,046,733Savings 98,936,278 77,419,782 99,207,221 77,600,767Time 51,349,360 44,893,677 51,372,261 44,894,579154,253,941 125,339,337 154,592,407 125,542,079Total P 159,666,123 P 128,647,318 P 156,191,536 P 125,879,950The breakdown of this account, as to currency, is as follows:ConsolidatedParent2005 2004 2005 2004Foreign currency P 61,648,890 P 54,960,183 P 59,192,904 P 53,140,100Peso 98,017,233 73,687,135 96,998,632 72,739,850P 159,666,123 P 128,647,318 P 156,191,536 P 125,879,950