Banco de Oro Universal Bank provides a - Asianbanks.net

Banco de Oro Universal Bank provides a - Asianbanks.net

Banco de Oro Universal Bank provides a - Asianbanks.net

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

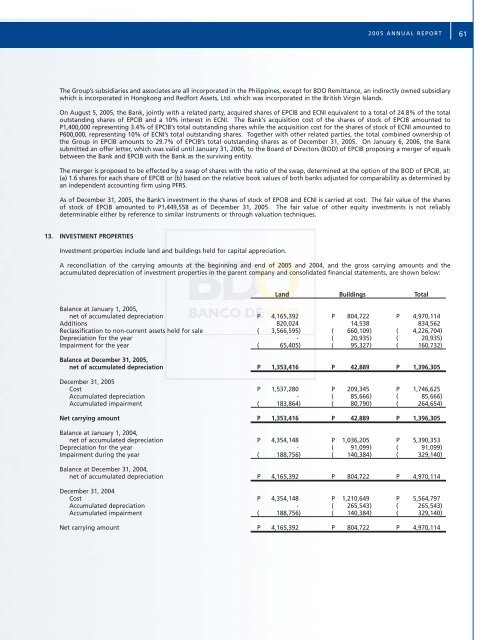

2005 ANNUAL REPORT61The Group’s subsidiaries and associates are all incorporated in the Philippines, except for BDO Remittance, an indirectly owned subsidiarywhich is incorporated in Hongkong and Redfort Assets, Ltd. which was incorporated in the British Virgin Islands.On August 5, 2005, the <strong>Bank</strong>, jointly with a related party, acquired shares of EPCIB and ECNI equivalent to a total of 24.8% of the totaloutstanding shares of EPCIB and a 10% interest in ECNI. The <strong>Bank</strong>’s acquisition cost of the shares of stock of EPCIB amounted toP1,400,000 representing 3.4% of EPCIB’s total outstanding shares while the acquisition cost for the shares of stock of ECNI amounted toP600,000, representing 10% of ECNI’s total outstanding shares. Together with other related parties, the total combined ownership ofthe Group in EPCIB amounts to 29.7% of EPCIB’s total outstanding shares as of December 31, 2005. On January 6, 2006, the <strong>Bank</strong>submitted an offer letter, which was valid until January 31, 2006, to the Board of Directors (BOD) of EPCIB proposing a merger of equalsbetween the <strong>Bank</strong> and EPCIB with the <strong>Bank</strong> as the surviving entity.The merger is proposed to be effected by a swap of shares with the ratio of the swap, <strong>de</strong>termined at the option of the BOD of EPCIB, at:(a) 1.6 shares for each share of EPCIB or (b) based on the relative book values of both banks adjusted for comparability as <strong>de</strong>termined byan in<strong>de</strong>pen<strong>de</strong>nt accounting firm using PFRS.As of December 31, 2005, the <strong>Bank</strong>’s investment in the shares of stock of EPCIB and ECNI is carried at cost. The fair value of the sharesof stock of EPCIB amounted to P1,449,558 as of December 31, 2005. The fair value of other equity investments is not reliably<strong>de</strong>terminable either by reference to similar instruments or through valuation techniques.13. INVESTMENT PROPERTIESInvestment properties inclu<strong>de</strong> land and buildings held for capital appreciation.A reconciliation of the carrying amounts at the beginning and end of 2005 and 2004, and the gross carrying amounts and theaccumulated <strong>de</strong>preciation of investment properties in the parent company and consolidated financial statements, are shown below:Land Buildings TotalBalance at January 1, 2005,<strong>net</strong> of accumulated <strong>de</strong>preciation P 4,165,392 P 804,722 P 4,970,114Additions 820,024 14,538 834,562Reclassification to non-current assets held for sale ( 3,566,595) ( 660,109) ( 4,226,704)Depreciation for the year - ( 20,935) ( 20,935)Impairment for the year ( 65,405) ( 95,327) ( 160,732)Balance at December 31, 2005,<strong>net</strong> of accumulated <strong>de</strong>preciation P 1,353,416 P 42,889 P 1,396,305December 31, 2005Cost P 1,537,280 P 209,345 P 1,746,625Accumulated <strong>de</strong>preciation - ( 85,666) ( 85,666)Accumulated impairment ( 183,864) ( 80,790) ( 264,654)Net carrying amount P 1,353,416 P 42,889 P 1,396,305Balance at January 1, 2004,<strong>net</strong> of accumulated <strong>de</strong>preciation P 4,354,148 P 1,036,205 P 5,390,353Depreciation for the year - ( 91,099) ( 91,099)Impairment during the year ( 188,756) ( 140,384) ( 329,140)Balance at December 31, 2004,<strong>net</strong> of accumulated <strong>de</strong>preciation P 4,165,392 P 804,722 P 4,970,114December 31, 2004Cost P 4,354,148 P 1,210,649 P 5,564,797Accumulated <strong>de</strong>preciation - ( 265,543) ( 265,543)Accumulated impairment ( 188,756) ( 140,384) ( 329,140)Net carrying amount P 4,165,392 P 804,722 P 4,970,114