Banco de Oro Universal Bank provides a - Asianbanks.net

Banco de Oro Universal Bank provides a - Asianbanks.net

Banco de Oro Universal Bank provides a - Asianbanks.net

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

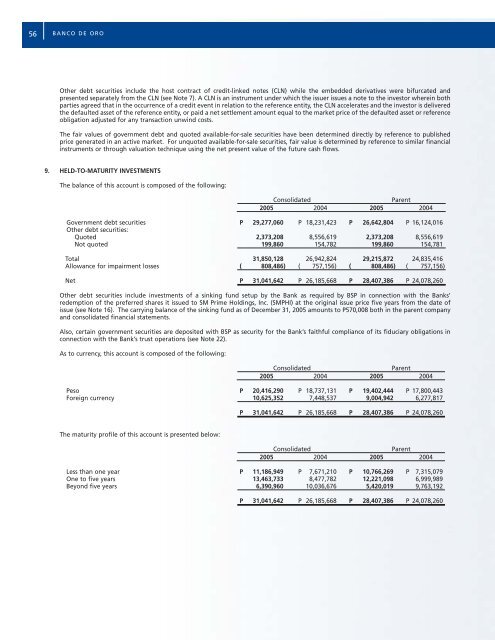

56 BANCO DE OROOther <strong>de</strong>bt securities inclu<strong>de</strong> the host contract of credit-linked notes (CLN) while the embed<strong>de</strong>d <strong>de</strong>rivatives were bifurcated andpresented separately from the CLN (see Note 7). A CLN is an instrument un<strong>de</strong>r which the issuer issues a note to the investor wherein bothparties agreed that in the occurrence of a credit event in relation to the reference entity, the CLN accelerates and the investor is <strong>de</strong>liveredthe <strong>de</strong>faulted asset of the reference entity, or paid a <strong>net</strong> settlement amount equal to the market price of the <strong>de</strong>faulted asset or referenceobligation adjusted for any transaction unwind costs.The fair values of government <strong>de</strong>bt and quoted available-for-sale securities have been <strong>de</strong>termined directly by reference to publishedprice generated in an active market. For unquoted available-for-sale securities, fair value is <strong>de</strong>termined by reference to similar financialinstruments or through valuation technique using the <strong>net</strong> present value of the future cash flows.9. HELD-TO-MATURITY INVESTMENTSThe balance of this account is composed of the following:ConsolidatedParent2005 2004 2005 2004Government <strong>de</strong>bt securities P 29,277,060 P 18,231,423 P 26,642,804 P 16,124,016Other <strong>de</strong>bt securities:Quoted 2,373,208 8,556,619 2,373,208 8,556,619Not quoted 199,860 154,782 199,860 154,781Total 31,850,128 26,942,824 29,215,872 24,835,416Allowance for impairment losses ( 808,486) ( 757,156) ( 808,486) ( 757,156)Net P 31,041,642 P 26,185,668 P 28,407,386 P 24,078,260Other <strong>de</strong>bt securities inclu<strong>de</strong> investments of a sinking fund setup by the <strong>Bank</strong> as required by BSP in connection with the <strong>Bank</strong>s’re<strong>de</strong>mption of the preferred shares it issued to SM Prime Holdings, Inc. (SMPHI) at the original issue price five years from the date ofissue (see Note 16). The carrying balance of the sinking fund as of December 31, 2005 amounts to P570,008 both in the parent companyand consolidated financial statements.Also, certain government securities are <strong>de</strong>posited with BSP as security for the <strong>Bank</strong>’s faithful compliance of its fiduciary obligations inconnection with the <strong>Bank</strong>’s trust operations (see Note 22).As to currency, this account is composed of the following:ConsolidatedParent2005 2004 2005 2004Peso P 20,416,290 P 18,737,131 P 19,402,444 P 17,800,443Foreign currency 10,625,352 7,448,537 9,004,942 6,277,817P 31,041,642 P 26,185,668 P 28,407,386 P 24,078,260The maturity profile of this account is presented below:ConsolidatedParent2005 2004 2005 2004Less than one year P 11,186,949 P 7,671,210 P 10,766,269 P 7,315,079One to five years 13,463,733 8,477,782 12,221,098 6,999,989Beyond five years 6,390,960 10,036,676 5,420,019 9,763,192P 31,041,642 P 26,185,668 P 28,407,386 P 24,078,260