Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

102<br />

Next Media Limited annual report 06 07<br />

Notes to the Consolidated Financial Statements (<strong>co</strong>ntinued)<br />

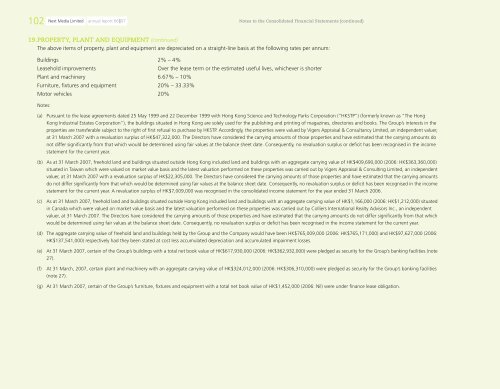

19. PROPERTY, PLANT AND EQUIPMENT (<strong>co</strong>ntinued)<br />

The above items of pr<strong>op</strong>erty, plant and equipment <strong>ar</strong>e depreciated on a straight-line basis at the following rates per annum:<br />

Buildings 2% – 4%<br />

Leasehold improvements Over the lease term or the estimated useful lives, whichever is shorter<br />

Plant and machinery 6.67% – 10%<br />

Furniture, fi xtures and equipment 20% – 33.33%<br />

Motor vehicles 20%<br />

Notes:<br />

(a) Pursuant to the lease agreements dated 25 May 1999 and 22 December 1999 with Hong Kong Science and Technology P<strong>ar</strong>ks Corporation (“HKSTP”) (formerly known as “The Hong<br />

Kong Industrial Estates Corporation”), the buildings situated in Hong Kong <strong>ar</strong>e solely used for the publishing and printing of magazines, directories and books. The Group’s interests in the<br />

pr<strong>op</strong>erties <strong>ar</strong>e transferable subject to the right of fi rst refusal to purchase by HKSTP. Ac<strong>co</strong>rdingly, the pr<strong>op</strong>erties were valued by Vigers Appraisal & Consultancy Limited, an independent valuer,<br />

at 31 M<strong>ar</strong>ch 2007 with a revaluation surplus of HK$47,322,000. The Directors have <strong>co</strong>nsidered the c<strong>ar</strong>rying amounts of those pr<strong>op</strong>erties and have estimated that the c<strong>ar</strong>rying amounts do<br />

not differ signifi cantly from that which would be determined using fair values at the balance sheet date. Consequently, no revaluation surplus or defi cit has been re<strong>co</strong>gnised in the in<strong>co</strong>me<br />

statement for the current ye<strong>ar</strong>.<br />

(b) As at 31 M<strong>ar</strong>ch 2007, freehold land and buildings situated outside Hong Kong included land and buildings with an aggregate c<strong>ar</strong>rying value of HK$409,690,000 (2006: HK$363,360,000)<br />

situated in Taiwan which were valued on m<strong>ar</strong>ket value basis and the latest valuation performed on these pr<strong>op</strong>erties was c<strong>ar</strong>ried out by Vigers Appraisal & Consulting Limited, an independent<br />

valuer, at 31 M<strong>ar</strong>ch 2007 with a revaluation surplus of HK$22,305,000. The Directors have <strong>co</strong>nsidered the c<strong>ar</strong>rying amounts of those pr<strong>op</strong>erties and have estimated that the c<strong>ar</strong>rying amounts<br />

do not differ signifi cantly from that which would be determined using fair values at the balance sheet date. Consequently, no revaluation surplus or defi cit has been re<strong>co</strong>gnised in the in<strong>co</strong>me<br />

statement for the current ye<strong>ar</strong>. A revaluation surplus of HK$7,009,000 was re<strong>co</strong>gnised in the <strong>co</strong>nsolidated in<strong>co</strong>me statement for the ye<strong>ar</strong> ended 31 M<strong>ar</strong>ch 2006.<br />

(c) As at 31 M<strong>ar</strong>ch 2007, freehold land and buildings situated outside Hong Kong included land and buildings with an aggregate c<strong>ar</strong>rying value of HK$1,166,000 (2006: HK$1,212,000) situated<br />

in Canada which were valued on m<strong>ar</strong>ket value basis and the latest valuation performed on these pr<strong>op</strong>erties was c<strong>ar</strong>ried out by Colliers International Realty Advisors Inc., an independent<br />

valuer, at 31 M<strong>ar</strong>ch 2007. The Directors have <strong>co</strong>nsidered the c<strong>ar</strong>rying amounts of those pr<strong>op</strong>erties and have estimated that the c<strong>ar</strong>rying amounts do not differ signifi cantly from that which<br />

would be determined using fair values at the balance sheet date. Consequently, no revaluation surplus or defi cit has been re<strong>co</strong>gnised in the in<strong>co</strong>me statement for the current ye<strong>ar</strong>.<br />

(d) The aggregate c<strong>ar</strong>rying value of freehold land and buildings held by the Group and the Company would have been HK$765,009,000 (2006: HK$765,171,000) and HK$97,627,000 (2006:<br />

HK$137,541,000) respectively had they been stated at <strong>co</strong>st less accumulated depreciation and accumulated impairment losses.<br />

(e) At 31 M<strong>ar</strong>ch 2007, certain of the Group’s buildings with a total net book value of HK$617,930,000 (2006: HK$362,932,000) were pledged as security for the Group’s banking facilities (note<br />

27).<br />

(f) At 31 M<strong>ar</strong>ch, 2007, certain plant and machinery with an aggregate c<strong>ar</strong>rying value of HK$324,012,000 (2006: HK$306,310,000) were pledged as security for the Group’s banking facilities<br />

(note 27).<br />

(g) At 31 M<strong>ar</strong>ch 2007, certain of the Group’s furniture, fi xtures and equipment with a total net book value of HK$1,452,000 (2006: Nil) were under fi nance lease obligation.