You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

97<br />

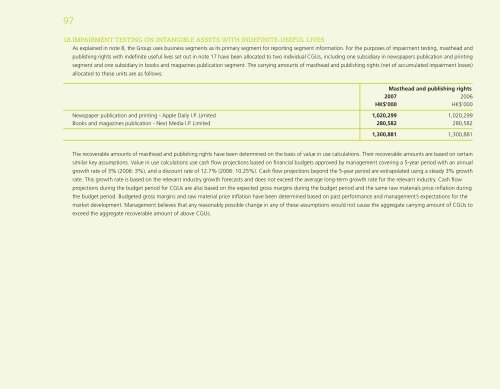

18. IMPAIRMENT TESTING ON INTANGIBLE ASSETS WITH INDEFINITE-USEFUL LIVES<br />

As explained in note 8, the Group uses business segments as its prim<strong>ar</strong>y segment for reporting segment information. For the purposes of impairment testing, masthead and<br />

publishing rights with indefi nite useful lives set out in note 17 have been allocated to two individual CGUs, including one subsidi<strong>ar</strong>y in newspapers publication and printing<br />

segment and one subsidi<strong>ar</strong>y in books and magazines publication segment. The c<strong>ar</strong>rying amounts of masthead and publishing rights (net of accumulated impairment losses)<br />

allocated to these units <strong>ar</strong>e as follows:<br />

Masthead and publishing rights<br />

2007 2006<br />

HK$’000 HK$’000<br />

Newspaper publication and printing - Apple Daily I.P. Limited 1,020,299 1,020,299<br />

Books and magazines publication - Next Media I.P. Limited 280,582 280,582<br />

1,300,881 1,300,881<br />

The re<strong><strong>co</strong>ver</strong>able amounts of masthead and publishing rights have been determined on the basis of value in use calculations. Their re<strong><strong>co</strong>ver</strong>able amounts <strong>ar</strong>e based on certain<br />

simil<strong>ar</strong> key assumptions. Value in use calculations use cash fl ow projections based on fi nancial budgets approved by management <strong><strong>co</strong>ver</strong>ing a 5-ye<strong>ar</strong> period with an annual<br />

growth rate of 3% (2006: 3%), and a dis<strong>co</strong>unt rate of 12.7% (2006: 10.25%). Cash fl ow projections beyond the 5-ye<strong>ar</strong> period <strong>ar</strong>e extrapolated using a steady 3% growth<br />

rate. This growth rate is based on the relevant industry growth forecasts and does not exceed the average long-term growth rate for the relevant industry. Cash fl ow<br />

projections during the budget period for CGUs <strong>ar</strong>e also based on the expected gross m<strong>ar</strong>gins during the budget period and the same raw materials price infl ation during<br />

the budget period. Budgeted gross m<strong>ar</strong>gins and raw material price infl ation have been determined based on past performance and management’s expectations for the<br />

m<strong>ar</strong>ket devel<strong>op</strong>ment. Management believes that any reasonably possible change in any of these assumptions would not cause the aggregate c<strong>ar</strong>rying amount of CGUs to<br />

exceed the aggregate re<strong><strong>co</strong>ver</strong>able amount of above CGUs.