2005 Annual Report / Crédit Agricole (Suisse) SA

2005 Annual Report / Crédit Agricole (Suisse) SA

2005 Annual Report / Crédit Agricole (Suisse) SA

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

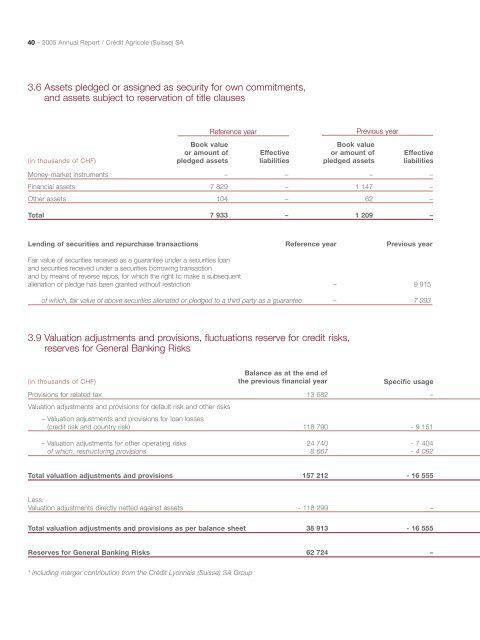

40 – <strong>2005</strong> <strong>Annual</strong> <strong>Report</strong> / Crédit <strong>Agricole</strong> (<strong>Suisse</strong>) <strong>SA</strong>3.6 Assets pledged or assigned as security for own commitments,and assets subject to reservation of title clausesReference yearPrevious year(in thousands of CHF)Book valueor amount ofpledged assetsEffectiveliabilitiesBook valueor amount ofpledged assetsEffectiveliabilitiesMoney-market instruments – – – –Financial assets 7 829 – 1 147 –Other assets 104 – 62 –Total 7 933 – 1 209 –Lending of securities and repurchase transactions Reference year Previous yearFair value of securities received as a guarantee under a securities loanand securities received under a securities borrowing transactionand by means of reverse repos, for which the right to make a subsequentalienation or pledge has been granted without restriction – 9 915of which, fair value of above securities alienated or pledged to a third party as a guarantee – 7 0933.9 Valuation adjustments and provisions, fluctuations reserve for credit risks,reserves for General Banking Risks(in thousands of CHF)Balance as at the end ofthe previous financial yearSpecific usageProvisions for related tax 13 682 –Valuation adjustments and provisions for default risk and other risks– Valuation adjustments and provisions for loan losses(credit risk and country risk) 118 790 - 9 151– Valuation adjustments for other operating risks 24 740 - 7 404of which, restructuring provisions 8 667 - 4 092Total valuation adjustments and provisions 157 212 - 16 555Less:Valuation adjustments directly netted against assets - 118 299 –Total valuation adjustments and provisions as per balance sheet 38 913 - 16 555Reserves for General Banking Risks 62 724 –* including merger contribution from the Crédit Lyonnais (<strong>Suisse</strong>) <strong>SA</strong> Group