REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

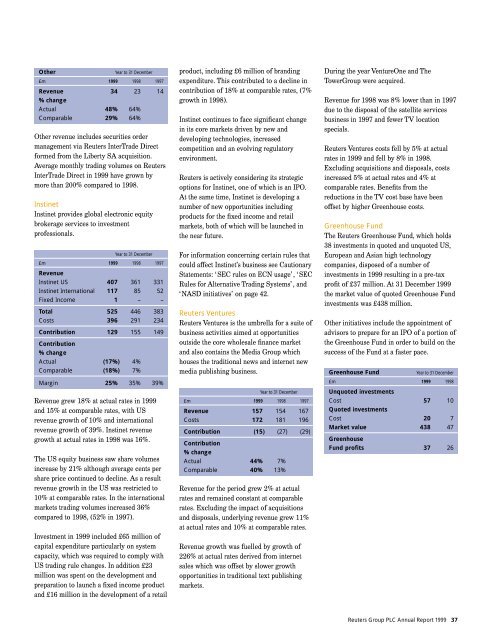

OtherYear to 31 December£m <strong>1999</strong> 1998 1997Revenue 34 23 14% changeActual 48% 64%Comparable 29% 64%Other revenue includes securities ordermanagement via Reuters InterTrade Directformed from the Liberty SA acquisition.Average monthly trading volumes on ReutersInterTrade Direct in <strong>1999</strong> have grown bymore than 200% compared to 1998.InstinetInstinet provides global electronic equitybrokerage services to investmentprofessionals.Year to 31 December£m <strong>1999</strong> 1998 1997RevenueInstinet US 407 361 331Instinet International 117 85 52Fixed Income 1 – –Total 525 446 383Costs 396 291 234Contribution 129 155 149Contribution% changeActual (17%) 4%Comparable (18%) 7%Margin 25% 35% 39%Revenue grew 18% at actual rates in <strong>1999</strong>and 15% at comparable rates, with USrevenue growth of 10% and internationalrevenue growth of 39%. Instinet revenuegrowth at actual rates in 1998 was 16%.The US equity business saw share volumesincrease by 21% although average cents pershare price continued to decline. As a resultrevenue growth in the US was restricted to10% at comparable rates. In the internationalmarkets trading volumes increased 36%compared to 1998, (52% in 1997).Investment in <strong>1999</strong> included £65 million ofcapital expenditure particularly on systemcapacity, which was required to comply withUS trading rule changes. In addition £23million was spent on the development andpreparation to launch a fixed income productand £16 million in the development of a retailproduct, including £6 million of brandingexpenditure. This contributed to a decline incontribution of 18% at comparable rates, (7%growth in 1998).Instinet continues to face significant changein its core markets driven by new anddeveloping technologies, increasedcompetition and an evolving regulatoryenvironment.Reuters is actively considering its strategicoptions for Instinet, one of which is an IPO.At the same time, Instinet is developing anumber of new opportunities includingproducts for the fixed income and retailmarkets, both of which will be launched inthe near future.For information concerning certain rules thatcould affect Instinet’s business see CautionaryStatements: ‘SEC rules on ECN usage’, ‘SECRules for Alternative Trading Systems’, and‘NASD initiatives’ on page 42.Reuters VenturesReuters Ventures is the umbrella for a suite ofbusiness activities aimed at opportunitiesoutside the core wholesale finance marketand also contains the Media Group whichhouses the traditional news and internet newmedia publishing business.Year to 31 December£m <strong>1999</strong> 1998 1997Revenue 157 154 167Costs 172 181 196Contribution (15) (27) (29)Contribution% changeActual 44% 7%Comparable 40% 13%Revenue for the period grew 2% at actualrates and remained constant at comparablerates. Excluding the impact of acquisitionsand disposals, underlying revenue grew 11%at actual rates and 10% at comparable rates.Revenue growth was fuelled by growth of226% at actual rates derived from internetsales which was offset by slower growthopportunities in traditional text publishingmarkets.During the year VentureOne and TheTowerGroup were acquired.Revenue for 1998 was 8% lower than in 1997due to the disposal of the satellite servicesbusiness in 1997 and fewer TV locationspecials.Reuters Ventures costs fell by 5% at actualrates in <strong>1999</strong> and fell by 8% in 1998.Excluding acquisitions and disposals, costsincreased 5% at actual rates and 4% atcomparable rates. Benefits from thereductions in the TV cost base have beenoffset by higher Greenhouse costs.Greenhouse FundThe Reuters Greenhouse Fund, which holds38 investments in quoted and unquoted US,European and Asian high technologycompanies, disposed of a number ofinvestments in <strong>1999</strong> resulting in a pre-taxprofit of £37 million. At 31 December <strong>1999</strong>the market value of quoted Greenhouse Fundinvestments was £438 million.Other initiatives include the appointment ofadvisors to prepare for an IPO of a portion ofthe Greenhouse Fund in order to build on thesuccess of the Fund at a faster pace.Greenhouse FundYear to 31 December£m <strong>1999</strong> 1998Unquoted investmentsCost 57 10Quoted investmentsCost 20 7Market value 438 47GreenhouseFund profits 37 26Reuters Group <strong>PLC</strong> Annual Report <strong>1999</strong> 37