REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

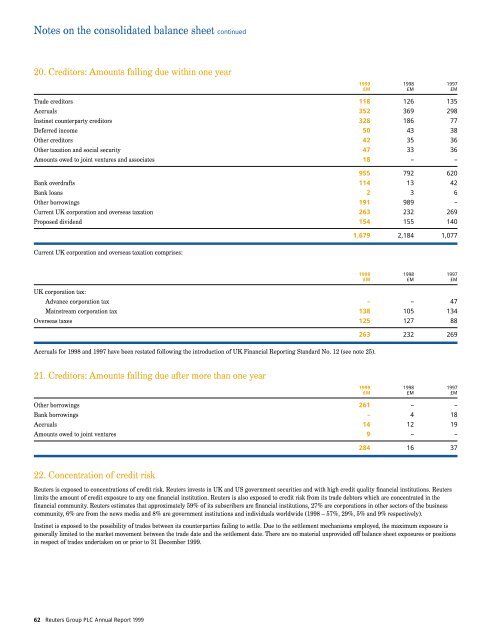

Notes on the consolidated balance sheet continued20. Creditors: Amounts falling due within one year<strong>1999</strong> 1998 1997£M £M £MTrade creditors 118 126 135Accruals 352 369 298Instinet counterparty creditors 328 186 77Deferred income 50 43 38Other creditors 42 35 36Other taxation and social security 47 33 36Amounts owed to joint ventures and associates 18 – –955 792 620Bank overdrafts 114 13 42Bank loans 2 3 6Other borrowings 191 989 –Current UK corporation and overseas taxation 263 232 269Proposed dividend 154 155 1401,679 2,184 1,077Current UK corporation and overseas taxation comprises:<strong>1999</strong> 1998 1997£M £M £MUK corporation tax:Advance corporation tax – – 47Mainstream corporation tax 138 105 134Overseas taxes 125 127 88263 232 269Accruals for 1998 and 1997 have been restated following the introduction of UK Financial Reporting Standard No. 12 (see note 25).21. Creditors: Amounts falling due after more than one year<strong>1999</strong> 1998 1997£M £M £MOther borrowings 261 – –Bank borrowings – 4 18Accruals 14 12 19Amounts owed to joint ventures 9 – –284 16 3722. Concentration of credit riskReuters is exposed to concentrations of credit risk. Reuters invests in UK and US government securities and with high credit quality financial institutions. Reuterslimits the amount of credit exposure to any one financial institution. Reuters is also exposed to credit risk from its trade debtors which are concentrated in thefinancial community. Reuters estimates that approximately 59% of its subscribers are financial institutions, 27% are corporations in other sectors of the businesscommunity, 6% are from the news media and 8% are government institutions and individuals worldwide (1998 – 57%, 29%, 5% and 9% respectively).Instinet is exposed to the possibility of trades between its counterparties failing to settle. Due to the settlement mechanisms employed, the maximum exposure isgenerally limited to the market movement between the trade date and the settlement date. There are no material unprovided off balance sheet exposures or positionsin respect of trades undertaken on or prior to 31 December <strong>1999</strong>.62 Reuters Group <strong>PLC</strong> Annual Report <strong>1999</strong>