REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

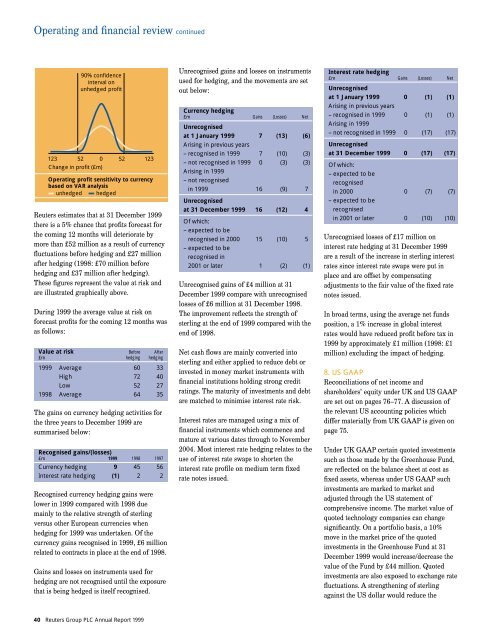

Operating and financial review continued90% confidenceinterval onunhedged profit123 52 0 52 123Change in profit (£m)Operating profit sensitivity to currencybased on VAR analysisunhedged hedgedReuters estimates that at 31 December <strong>1999</strong>there is a 5% chance that profits forecast forthe coming 12 months will deteriorate bymore than £52 million as a result of currencyfluctuations before hedging and £27 millionafter hedging (1998: £70 million beforehedging and £37 million after hedging).These figures represent the value at risk andare illustrated graphically above.During <strong>1999</strong> the average value at risk onforecast profits for the coming 12 months wasas follows:Value at risk Before After£m hedging hedging<strong>1999</strong> Average 60 33High 72 40Low 52 271998 Average 64 35The gains on currency hedging activities forthe three years to December <strong>1999</strong> aresummarised below:Recognised gains/(losses)£m <strong>1999</strong> 1998 1997Currency hedging 9 45 56Interest rate hedging (1) 2 2Recognised currency hedging gains werelower in <strong>1999</strong> compared with 1998 duemainly to the relative strength of sterlingversus other European currencies whenhedging for <strong>1999</strong> was undertaken. Of thecurrency gains recognised in <strong>1999</strong>, £6 millionrelated to contracts in place at the end of 1998.Gains and losses on instruments used forhedging are not recognised until the exposurethat is being hedged is itself recognised.Unrecognised gains and losses on instrumentsused for hedging, and the movements are setout below:Currency hedging£m Gains (Losses) NetUnrecognisedat 1 January <strong>1999</strong> 7 (13) (6)Arising in previous years– recognised in <strong>1999</strong> 7 (10) (3)– not recognised in <strong>1999</strong> 0 (3) (3)Arising in <strong>1999</strong>– not recognisedin <strong>1999</strong> 16 (9) 7Unrecognisedat 31 December <strong>1999</strong> 16 (12) 4Of which:– expected to berecognised in 2000 15 (10) 5– expected to berecognised in2001 or later 1 (2) (1)Unrecognised gains of £4 million at 31December <strong>1999</strong> compare with unrecognisedlosses of £6 million at 31 December 1998.The improvement reflects the strength ofsterling at the end of <strong>1999</strong> compared with theend of 1998.Net cash flows are mainly converted intosterling and either applied to reduce debt orinvested in money market instruments withfinancial institutions holding strong creditratings. The maturity of investments and debtare matched to minimise interest rate risk.Interest rates are managed using a mix offinancial instruments which commence andmature at various dates through to November2004. Most interest rate hedging relates to theuse of interest rate swaps to shorten theinterest rate profile on medium term fixedrate notes issued.Interest rate hedging£m Gains (Losses) NetUnrecognisedat 1 January <strong>1999</strong> 0 (1) (1)Arising in previous years– recognised in <strong>1999</strong> 0 (1) (1)Arising in <strong>1999</strong>– not recognised in <strong>1999</strong> 0 (17) (17)Unrecognisedat 31 December <strong>1999</strong> 0 (17) (17)Of which:– expected to berecognisedin 2000 0 (7) (7)– expected to berecognisedin 2001 or later 0 (10) (10)Unrecognised losses of £17 million oninterest rate hedging at 31 December <strong>1999</strong>are a result of the increase in sterling interestrates since interest rate swaps were put inplace and are offset by compensatingadjustments to the fair value of the fixed ratenotes issued.In broad terms, using the average net fundsposition, a 1% increase in global interestrates would have reduced profit before tax in<strong>1999</strong> by approximately £1 million (1998: £1million) excluding the impact of hedging.8. US GAAPReconciliations of net income andshareholders’ equity under UK and US GAAPare set out on pages 76–77. A discussion ofthe relevant US accounting policies whichdiffer materially from UK GAAP is given onpage 75.Under UK GAAP certain quoted investmentssuch as those made by the Greenhouse Fund,are reflected on the balance sheet at cost asfixed assets, whereas under US GAAP suchinvestments are marked to market andadjusted through the US statement ofcomprehensive income. The market value ofquoted technology companies can changesignificantly. On a portfolio basis, a 10%move in the market price of the quotedinvestments in the Greenhouse Fund at 31December <strong>1999</strong> would increase/decrease thevalue of the Fund by £44 million. Quotedinvestments are also exposed to exchange ratefluctuations. A strengthening of sterlingagainst the US dollar would reduce the40 Reuters Group <strong>PLC</strong> Annual Report <strong>1999</strong>