REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

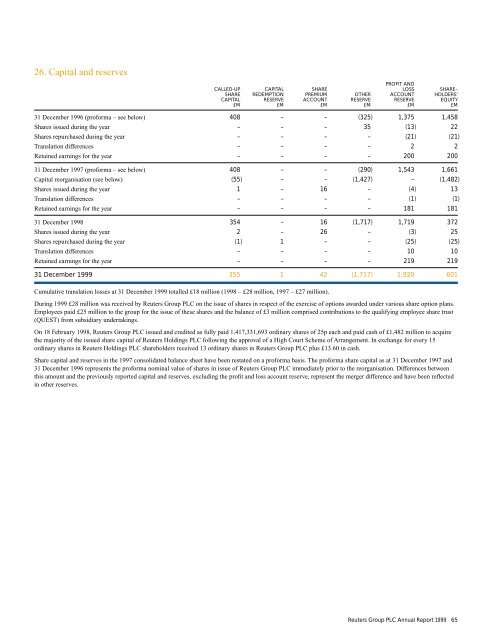

26. Capital and reservesPROFIT <strong>AND</strong>CALLED-UP CAPITAL SHARE LOSS SHARE–SHARE REDEMPTION PREMIUM OTHER ACCOUNT HOLDERS’CAPITAL RESERVE ACCOUNT RESERVE RESERVE EQUITY£M £M £M £M £M £M31 December 1996 (proforma – see below) 408 – – (325) 1,375 1,458Shares issued during the year – – – 35 (13) 22Shares repurchased during the year – – – – (21) (21)Translation differences – – – – 2 2Retained earnings for the year – – – – 200 20031 December 1997 (proforma – see below) 408 – – (290) 1,543 1,661Capital reorganisation (see below) (55) – – (1,427) – (1,482)Shares issued during the year 1 – 16 – (4) 13Translation differences – – – – (1) (1)Retained earnings for the year – – – – 181 18131 December 1998 354 – 16 (1,717) 1,719 372Shares issued during the year 2 – 26 – (3) 25Shares repurchased during the year (1) 1 – – (25) (25)Translation differences – – – – 10 10Retained earnings for the year – – – – 219 21931 December <strong>1999</strong> 355 1 42 (1,717) 1,920 601Cumulative translation losses at 31 December <strong>1999</strong> totalled £18 million (1998 – £28 million, 1997 – £27 million).During <strong>1999</strong> £28 million was received by Reuters Group <strong>PLC</strong> on the issue of shares in respect of the exercise of options awarded under various share option plans.Employees paid £25 million to the group for the issue of these shares and the balance of £3 million comprised contributions to the qualifying employee share trust(QUEST) from subsidiary undertakings.On 18 February 1998, Reuters Group <strong>PLC</strong> issued and credited as fully paid 1,417,331,693 ordinary shares of 25p each and paid cash of £1,482 million to acquirethe majority of the issued share capital of Reuters Holdings <strong>PLC</strong> following the approval of a High Court Scheme of Arrangement. In exchange for every 15ordinary shares in Reuters Holdings <strong>PLC</strong> shareholders received 13 ordinary shares in Reuters Group <strong>PLC</strong> plus £13.60 in cash.Share capital and reserves in the 1997 consolidated balance sheet have been restated on a proforma basis. The proforma share capital as at 31 December 1997 and31 December 1996 represents the proforma nominal value of shares in issue of Reuters Group <strong>PLC</strong> immediately prior to the reorganisation. Differences betweenthis amount and the previously reported capital and reserves, excluding the profit and loss account reserve, represent the merger difference and have been reflectedin other reserves.Reuters Group <strong>PLC</strong> Annual Report <strong>1999</strong> 65