REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

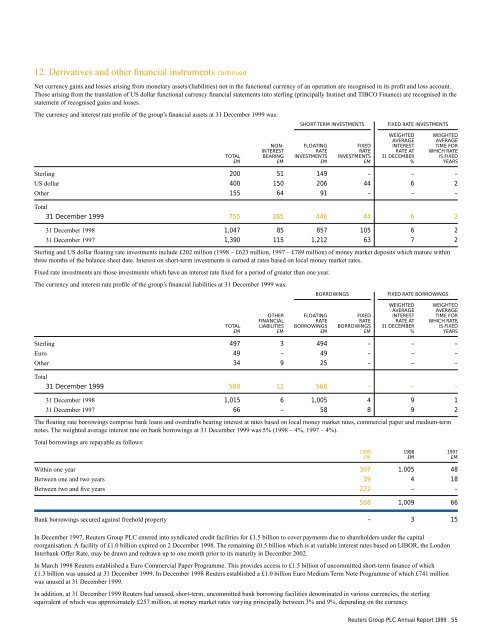

12. Derivatives and other financial instruments continuedNet currency gains and losses arising from monetary assets/(liabilities) not in the functional currency of an operation are recognised in its profit and loss account.Those arising from the translation of US dollar functional currency financial statements into sterling (principally Instinet and TIBCO Finance) are recognised in thestatement of recognised gains and losses.The currency and interest rate profile of the group’s financial assets at 31 December <strong>1999</strong> was:SHORT-TERM INVESTMENTSFIXED RATE INVESTMENTSWEIGHTED WEIGHTEDAVERAGE AVERAGENON- FLOATING FIXED INTEREST TIME FORINTEREST RATE RATE RATE AT WHICH RATETOTAL BEARING INVESTMENTS INVESTMENTS 31 DECEMBER IS FIXED£M £M £M £M % YEARSSterling 200 51 149 – – –US dollar 400 150 206 44 6 2Other 155 64 91 – – –Total31 December <strong>1999</strong> 755 265 446 44 6 231 December 1998 1,047 85 857 105 6 231 December 1997 1,390 115 1,212 63 7 2Sterling and US dollar floating rate investments include £202 million (1998 – £623 million, 1997 – £789 million) of money market deposits which mature withinthree months of the balance sheet date. Interest on short-term investments is earned at rates based on local money market rates.Fixed rate investments are those investments which have an interest rate fixed for a period of greater than one year.The currency and interest rate profile of the group’s financial liabilities at 31 December <strong>1999</strong> was:BORROWINGSFIXED RATE BORROWINGSWEIGHTED WEIGHTEDAVERAGE AVERAGEOTHER FLOATING FIXED INTEREST TIME FORFINANCIAL RATE RATE RATE AT WHICH RATETOTAL LIABILITIES BORROWINGS BORROWINGS 31 DECEMBER IS FIXED£M £M £M £M % YEARSSterling 497 3 494 – – –Euro 49 – 49 – – –Other 34 9 25 – – –Total31 December <strong>1999</strong> 580 12 568 – – –31 December 1998 1,015 6 1,005 4 9 131 December 1997 66 – 58 8 9 2The floating rate borrowings comprise bank loans and overdrafts bearing interest at rates based on local money market rates, commercial paper and medium-termnotes. The weighted average interest rate on bank borrowings at 31 December <strong>1999</strong> was 5% (1998 – 4%, 1997 – 4%).Total borrowings are repayable as follows:<strong>1999</strong> 1998 1997£M £M £MWithin one year 307 1,005 48Between one and two years 39 4 18Between two and five years 222 – –568 1,009 66Bank borrowings secured against freehold property – 3 15In December 1997, Reuters Group <strong>PLC</strong> entered into syndicated credit facilities for £1.5 billion to cover payments due to shareholders under the capitalreorganisation. A facility of £1.0 billion expired on 2 December 1998. The remaining £0.5 billion which is at variable interest rates based on LIBOR, the LondonInterbank Offer Rate, may be drawn and redrawn up to one month prior to its maturity in December 2002.In March 1998 Reuters established a Euro Commercial Paper Programme. This provides access to £1.5 billion of uncommitted short-term finance of which£1.3 billion was unused at 31 December <strong>1999</strong>. In December 1998 Reuters established a £1.0 billion Euro Medium Term Note Programme of which £741 millionwas unused at 31 December <strong>1999</strong>.In addition, at 31 December <strong>1999</strong> Reuters had unused, short-term, uncommitted bank borrowing facilities denominated in various currencies, the sterlingequivalent of which was approximately £257 million, at money market rates varying principally between 3% and 9%, depending on the currency.Reuters Group <strong>PLC</strong> Annual Report <strong>1999</strong> 55