REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

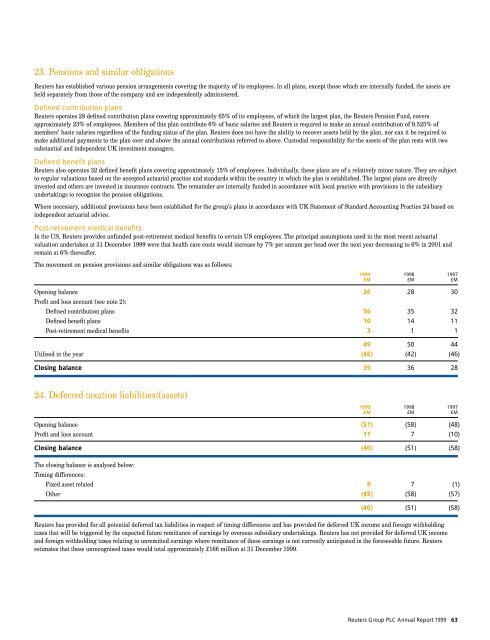

23. Pensions and similar obligationsReuters has established various pension arrangements covering the majority of its employees. In all plans, except those which are internally funded, the assets areheld separately from those of the company and are independently administered.Defined contribution plansReuters operates 28 defined contribution plans covering approximately 65% of its employees, of which the largest plan, the Reuters Pension Fund, coversapproximately 23% of employees. Members of this plan contribute 6% of basic salaries and Reuters is required to make an annual contribution of 9.525% ofmembers’ basic salaries regardless of the funding status of the plan. Reuters does not have the ability to recover assets held by the plan, nor can it be required tomake additional payments to the plan over and above the annual contributions referred to above. Custodial responsibility for the assets of the plan rests with twosubstantial and independent UK investment managers.Defined benefit plansReuters also operates 32 defined benefit plans covering approximately 15% of employees. Individually, these plans are of a relatively minor nature. They are subjectto regular valuations based on the accepted actuarial practice and standards within the country in which the plan is established. The largest plans are directlyinvested and others are invested in insurance contracts. The remainder are internally funded in accordance with local practice with provisions in the subsidiaryundertakings to recognise the pension obligations.Where necessary, additional provisions have been established for the group’s plans in accordance with UK Statement of Standard Accounting Practice 24 based onindependent actuarial advice.Post-retirement medical benefitsIn the US, Reuters provides unfunded post-retirement medical benefits to certain US employees. The principal assumptions used in the most recent actuarialvaluation undertaken at 31 December <strong>1999</strong> were that health care costs would increase by 7% per annum per head over the next year decreasing to 6% in 2001 andremain at 6% thereafter.The movement on pension provisions and similar obligations was as follows:<strong>1999</strong> 1998 1997£M £M £MOpening balance 36 28 30Profit and loss account (see note 2):Defined contribution plans 36 35 32Defined benefit plans 10 14 11Post-retirement medical benefits 3 1 149 50 44Utilised in the year (46) (42) (46)Closing balance 39 36 2824. Deferred taxation liabilities/(assets)<strong>1999</strong> 1998 1997£M £M £MOpening balance (51) (58) (48)Profit and loss account 11 7 (10)Closing balance (40) (51) (58)The closing balance is analysed below:Timing differences:Fixed asset related 5 7 (1)Other (45) (58) (57)(40) (51) (58)Reuters has provided for all potential deferred tax liabilities in respect of timing differences and has provided for deferred UK income and foreign withholdingtaxes that will be triggered by the expected future remittance of earnings by overseas subsidiary undertakings. Reuters has not provided for deferred UK incomeand foreign withholding taxes relating to unremitted earnings where remittance of these earnings is not currently anticipated in the foreseeable future. Reutersestimates that these unrecognised taxes would total approximately £166 million at 31 December <strong>1999</strong>.Reuters Group <strong>PLC</strong> Annual Report <strong>1999</strong> 63