REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

REUTERS GROUP PLC ANNUAL REPORT AND ACCOUNTS 1999

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

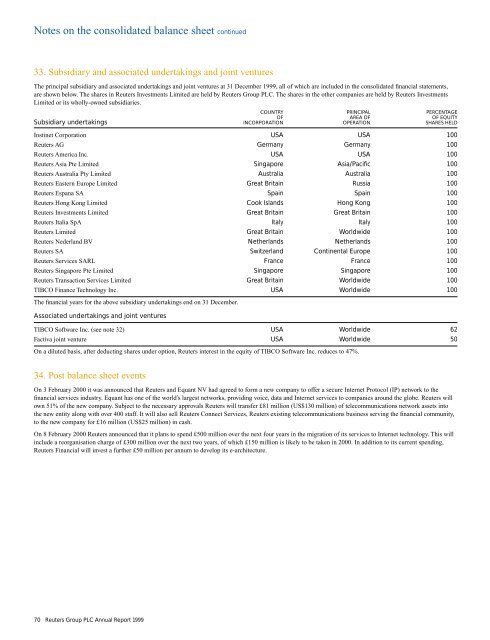

Notes on the consolidated balance sheet continued33. Subsidiary and associated undertakings and joint venturesThe principal subsidiary and associated undertakings and joint ventures at 31 December <strong>1999</strong>, all of which are included in the consolidated financial statements,are shown below. The shares in Reuters Investments Limited are held by Reuters Group <strong>PLC</strong>. The shares in the other companies are held by Reuters InvestmentsLimited or its wholly-owned subsidiaries.COUNTRY PRINCIPAL PERCENTAGEOF AREA OF OF EQUITYSubsidiary undertakings INCORPORATION OPERATION SHARES HELDInstinet Corporation USA USA 100Reuters AG Germany Germany 100Reuters America Inc. USA USA 100Reuters Asia Pte Limited Singapore Asia/Pacific 100Reuters Australia Pty Limited Australia Australia 100Reuters Eastern Europe Limited Great Britain Russia 100Reuters Espana SA Spain Spain 100Reuters Hong Kong Limited Cook Islands Hong Kong 100Reuters Investments Limited Great Britain Great Britain 100Reuters Italia SpA Italy Italy 100Reuters Limited Great Britain Worldwide 100Reuters Nederland BV Netherlands Netherlands 100Reuters SA Switzerland Continental Europe 100Reuters Services SARL France France 100Reuters Singapore Pte Limited Singapore Singapore 100Reuters Transaction Services Limited Great Britain Worldwide 100TIBCO Finance Technology Inc. USA Worldwide 100The financial years for the above subsidiary undertakings end on 31 December.Associated undertakings and joint venturesTIBCO Software Inc. (see note 32) USA Worldwide 62Factiva joint venture USA Worldwide 50On a diluted basis, after deducting shares under option, Reuters interest in the equity of TIBCO Software Inc. reduces to 47%.34. Post balance sheet eventsOn 3 February 2000 it was announced that Reuters and Equant NV had agreed to form a new company to offer a secure Internet Protocol (IP) network to thefinancial services industry. Equant has one of the world’s largest networks, providing voice, data and Internet services to companies around the globe. Reuters willown 51% of the new company. Subject to the necessary approvals Reuters will transfer £81 million (US$130 million) of telecommunications network assets intothe new entity along with over 400 staff. It will also sell Reuters Connect Services, Reuters existing telecommunications business serving the financial community,to the new company for £16 million (US$25 million) in cash.On 8 February 2000 Reuters announced that it plans to spend £500 million over the next four years in the migration of its services to Internet technology. This willinclude a reorganisation charge of £300 million over the next two years, of which £150 million is likely to be taken in 2000. In addition to its current spending,Reuters Financial will invest a further £50 million per annum to develop its e-architecture.70 Reuters Group <strong>PLC</strong> Annual Report <strong>1999</strong>