2012 Annual Report - Stone Energy Corporation

2012 Annual Report - Stone Energy Corporation

2012 Annual Report - Stone Energy Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

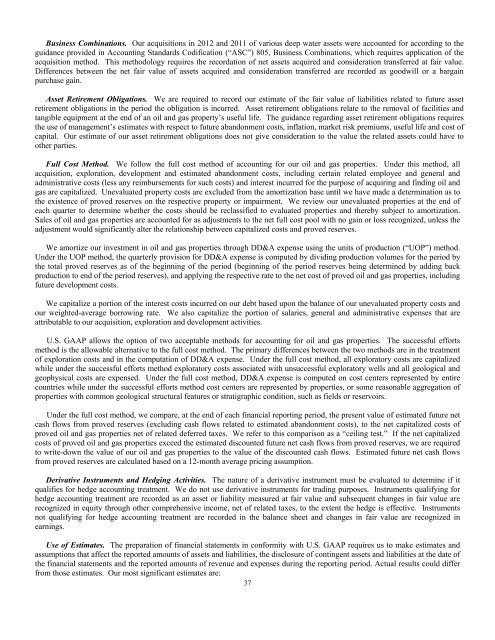

Business Combinations. Our acquisitions in <strong>2012</strong> and 2011 of various deep water assets were accounted for according to theguidance provided in Accounting Standards Codification (“ASC”) 805, Business Combinations, which requires application of theacquisition method. This methodology requires the recordation of net assets acquired and consideration transferred at fair value.Differences between the net fair value of assets acquired and consideration transferred are recorded as goodwill or a bargainpurchase gain.Asset Retirement Obligations. We are required to record our estimate of the fair value of liabilities related to future assetretirement obligations in the period the obligation is incurred. Asset retirement obligations relate to the removal of facilities andtangible equipment at the end of an oil and gas property’s useful life. The guidance regarding asset retirement obligations requiresthe use of management’s estimates with respect to future abandonment costs, inflation, market risk premiums, useful life and cost ofcapital. Our estimate of our asset retirement obligations does not give consideration to the value the related assets could have toother parties.Full Cost Method. We follow the full cost method of accounting for our oil and gas properties. Under this method, allacquisition, exploration, development and estimated abandonment costs, including certain related employee and general andadministrative costs (less any reimbursements for such costs) and interest incurred for the purpose of acquiring and finding oil andgas are capitalized. Unevaluated property costs are excluded from the amortization base until we have made a determination as tothe existence of proved reserves on the respective property or impairment. We review our unevaluated properties at the end ofeach quarter to determine whether the costs should be reclassified to evaluated properties and thereby subject to amortization.Sales of oil and gas properties are accounted for as adjustments to the net full cost pool with no gain or loss recognized, unless theadjustment would significantly alter the relationship between capitalized costs and proved reserves.We amortize our investment in oil and gas properties through DD&A expense using the units of production (“UOP”) method.Under the UOP method, the quarterly provision for DD&A expense is computed by dividing production volumes for the period bythe total proved reserves as of the beginning of the period (beginning of the period reserves being determined by adding backproduction to end of the period reserves), and applying the respective rate to the net cost of proved oil and gas properties, includingfuture development costs.We capitalize a portion of the interest costs incurred on our debt based upon the balance of our unevaluated property costs andour weighted-average borrowing rate. We also capitalize the portion of salaries, general and administrative expenses that areattributable to our acquisition, exploration and development activities.U.S. GAAP allows the option of two acceptable methods for accounting for oil and gas properties. The successful effortsmethod is the allowable alternative to the full cost method. The primary differences between the two methods are in the treatmentof exploration costs and in the computation of DD&A expense. Under the full cost method, all exploratory costs are capitalizedwhile under the successful efforts method exploratory costs associated with unsuccessful exploratory wells and all geological andgeophysical costs are expensed. Under the full cost method, DD&A expense is computed on cost centers represented by entirecountries while under the successful efforts method cost centers are represented by properties, or some reasonable aggregation ofproperties with common geological structural features or stratigraphic condition, such as fields or reservoirs.Under the full cost method, we compare, at the end of each financial reporting period, the present value of estimated future netcash flows from proved reserves (excluding cash flows related to estimated abandonment costs), to the net capitalized costs ofproved oil and gas properties net of related deferred taxes. We refer to this comparison as a “ceiling test.” If the net capitalizedcosts of proved oil and gas properties exceed the estimated discounted future net cash flows from proved reserves, we are requiredto write-down the value of our oil and gas properties to the value of the discounted cash flows. Estimated future net cash flowsfrom proved reserves are calculated based on a 12-month average pricing assumption.Derivative Instruments and Hedging Activities. The nature of a derivative instrument must be evaluated to determine if itqualifies for hedge accounting treatment. We do not use derivative instruments for trading purposes. Instruments qualifying forhedge accounting treatment are recorded as an asset or liability measured at fair value and subsequent changes in fair value arerecognized in equity through other comprehensive income, net of related taxes, to the extent the hedge is effective. Instrumentsnot qualifying for hedge accounting treatment are recorded in the balance sheet and changes in fair value are recognized inearnings.Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires us to make estimates andassumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date ofthe financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differfrom those estimates. Our most significant estimates are:37