2012 Annual Report - Stone Energy Corporation

2012 Annual Report - Stone Energy Corporation

2012 Annual Report - Stone Energy Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

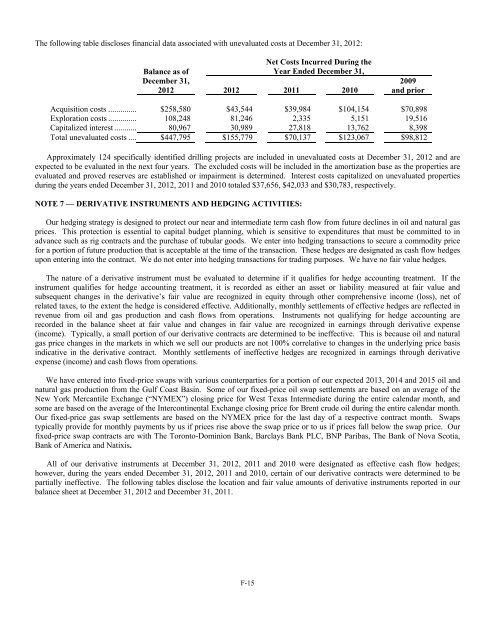

The following table discloses financial data associated with unevaluated costs at December 31, <strong>2012</strong>:Balance as ofDecember 31,<strong>2012</strong>Net Costs Incurred During theYear Ended December 31,<strong>2012</strong> 2011 20102009and priorAcquisition costs .............. $258,580 $43,544 $39,984 $104,154 $70,898Exploration costs .............. 108,248 81,246 2,335 5,151 19,516Capitalized interest ........... 80,967 30,989 27,818 13,762 8,398Total unevaluated costs .... $447,795 $155,779 $70,137 $123,067 $98,812Approximately 124 specifically identified drilling projects are included in unevaluated costs at December 31, <strong>2012</strong> and areexpected to be evaluated in the next four years. The excluded costs will be included in the amortization base as the properties areevaluated and proved reserves are established or impairment is determined. Interest costs capitalized on unevaluated propertiesduring the years ended December 31, <strong>2012</strong>, 2011 and 2010 totaled $37,656, $42,033 and $30,783, respectively.NOTE 7 — DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES:Our hedging strategy is designed to protect our near and intermediate term cash flow from future declines in oil and natural gasprices. This protection is essential to capital budget planning, which is sensitive to expenditures that must be committed to inadvance such as rig contracts and the purchase of tubular goods. We enter into hedging transactions to secure a commodity pricefor a portion of future production that is acceptable at the time of the transaction. These hedges are designated as cash flow hedgesupon entering into the contract. We do not enter into hedging transactions for trading purposes. We have no fair value hedges.The nature of a derivative instrument must be evaluated to determine if it qualifies for hedge accounting treatment. If theinstrument qualifies for hedge accounting treatment, it is recorded as either an asset or liability measured at fair value andsubsequent changes in the derivative’s fair value are recognized in equity through other comprehensive income (loss), net ofrelated taxes, to the extent the hedge is considered effective. Additionally, monthly settlements of effective hedges are reflected inrevenue from oil and gas production and cash flows from operations. Instruments not qualifying for hedge accounting arerecorded in the balance sheet at fair value and changes in fair value are recognized in earnings through derivative expense(income). Typically, a small portion of our derivative contracts are determined to be ineffective. This is because oil and naturalgas price changes in the markets in which we sell our products are not 100% correlative to changes in the underlying price basisindicative in the derivative contract. Monthly settlements of ineffective hedges are recognized in earnings through derivativeexpense (income) and cash flows from operations.We have entered into fixed-price swaps with various counterparties for a portion of our expected 2013, 2014 and 2015 oil andnatural gas production from the Gulf Coast Basin. Some of our fixed-price oil swap settlements are based on an average of theNew York Mercantile Exchange (“NYMEX”) closing price for West Texas Intermediate during the entire calendar month, andsome are based on the average of the Intercontinental Exchange closing price for Brent crude oil during the entire calendar month.Our fixed-price gas swap settlements are based on the NYMEX price for the last day of a respective contract month. Swapstypically provide for monthly payments by us if prices rise above the swap price or to us if prices fall below the swap price. Ourfixed-price swap contracts are with The Toronto-Dominion Bank, Barclays Bank PLC, BNP Paribas, The Bank of Nova Scotia,Bank of America and Natixis.All of our derivative instruments at December 31, <strong>2012</strong>, 2011 and 2010 were designated as effective cash flow hedges;however, during the years ended December 31, <strong>2012</strong>, 2011 and 2010, certain of our derivative contracts were determined to bepartially ineffective. The following tables disclose the location and fair value amounts of derivative instruments reported in ourbalance sheet at December 31, <strong>2012</strong> and December 31, 2011.F-15