Pinewood Studios: Business Case and Economic Impact Assessment

Pinewood Studios: Business Case and Economic Impact Assessment

Pinewood Studios: Business Case and Economic Impact Assessment

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

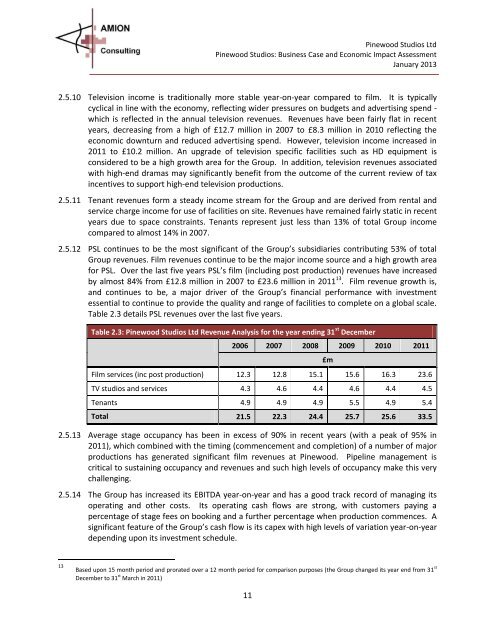

<strong>Pinewood</strong> <strong>Studios</strong> Ltd<strong>Pinewood</strong> <strong>Studios</strong>: <strong>Business</strong> <strong>Case</strong> <strong>and</strong> <strong>Economic</strong> <strong>Impact</strong> <strong>Assessment</strong>January 20132.5.10 Television income is traditionally more stable year-on-year compared to film. It is typicallycyclical in line with the economy, reflecting wider pressures on budgets <strong>and</strong> advertising spend -which is reflected in the annual television revenues. Revenues have been fairly flat in recentyears, decreasing from a high of £12.7 million in 2007 to £8.3 million in 2010 reflecting theeconomic downturn <strong>and</strong> reduced advertising spend. However, television income increased in2011 to £10.2 million. An upgrade of television specific facilities such as HD equipment isconsidered to be a high growth area for the Group. In addition, television revenues associatedwith high-end dramas may significantly benefit from the outcome of the current review of taxincentives to support high-end television productions.2.5.11 Tenant revenues form a steady income stream for the Group <strong>and</strong> are derived from rental <strong>and</strong>service charge income for use of facilities on site. Revenues have remained fairly static in recentyears due to space constraints. Tenants represent just less than 13% of total Group incomecompared to almost 14% in 2007.2.5.12 PSL continues to be the most significant of the Group’s subsidiaries contributing 53% of totalGroup revenues. Film revenues continue to be the major income source <strong>and</strong> a high growth areafor PSL. Over the last five years PSL’s film (including post production) revenues have increasedby almost 84% from £12.8 million in 2007 to £23.6 million in 2011 13 . Film revenue growth is,<strong>and</strong> continues to be, a major driver of the Group’s financial performance with investmentessential to continue to provide the quality <strong>and</strong> range of facilities to complete on a global scale.Table 2.3 details PSL revenues over the last five years.Table 2.3: <strong>Pinewood</strong> <strong>Studios</strong> Ltd Revenue Analysis for the year ending 31 st December2006 2007 2008 2009 2010 2011Film services (inc post production) 12.3 12.8 15.1 15.6 16.3 23.6TV studios <strong>and</strong> services 4.3 4.6 4.4 4.6 4.4 4.5Tenants 4.9 4.9 4.9 5.5 4.9 5.4Total 21.5 22.3 24.4 25.7 25.6 33.52.5.13 Average stage occupancy has been in excess of 90% in recent years (with a peak of 95% in2011), which combined with the timing (commencement <strong>and</strong> completion) of a number of majorproductions has generated significant film revenues at <strong>Pinewood</strong>. Pipeline management iscritical to sustaining occupancy <strong>and</strong> revenues <strong>and</strong> such high levels of occupancy make this verychallenging.2.5.14 The Group has increased its EBITDA year-on-year <strong>and</strong> has a good track record of managing itsoperating <strong>and</strong> other costs. Its operating cash flows are strong, with customers paying apercentage of stage fees on booking <strong>and</strong> a further percentage when production commences. Asignificant feature of the Group’s cash flow is its capex with high levels of variation year-on-yeardepending upon its investment schedule.£m13Based upon 15 month period <strong>and</strong> prorated over a 12 month period for comparison purposes (the Group changed its year end from 31 stDecember to 31 st March in 2011)11