2011 annual report - ALNO

2011 annual report - ALNO

2011 annual report - ALNO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

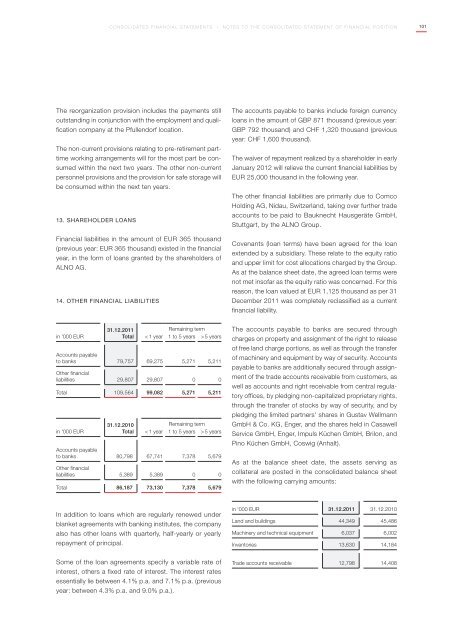

Consolidated financial statements | Notes to the consolidated statement of financial position101The reorganization provision includes the payments stilloutstanding in conjunction with the employment and qualificationcompany at the Pfullendorf location.The non-current provisions relating to pre-retirement parttimeworking arrangements will for the most part be consumedwithin the next two years. The other non-currentpersonnel provisions and the provision for safe storage willbe consumed within the next ten years.13. Shareholder loansFinancial liabilities in the amount of EUR 365 thousand(previous year: EUR 365 thousand) existed in the financialyear, in the form of loans granted by the shareholders of<strong>ALNO</strong> AG.14. Other financial liabilitiesThe accounts payable to banks include foreign currencyloans in the amount of GBP 871 thousand (previous year:GBP 792 thousand) and CHF 1,320 thousand (previousyear: CHF 1,600 thousand).The waiver of repayment realized by a shareholder in earlyJanuary 2012 will relieve the current financial liabilities byEUR 25,000 thousand in the following year.The other financial liabilities are primarily due to ComcoHolding AG, Nidau, Switzerland, taking over further tradeaccounts to be paid to Bauknecht Hausgeräte GmbH,Stuttgart, by the <strong>ALNO</strong> Group.Covenants (loan terms) have been agreed for the loanextended by a subsidiary. These relate to the equity ratioand upper limit for cost allocations charged by the Group.As at the balance sheet date, the agreed loan terms werenot met insofar as the equity ratio was concerned. For thisreason, the loan valued at EUR 1,125 thousand as per 31December <strong>2011</strong> was completely reclassified as a currentfinancial liability.in '000 EUR31.12.<strong>2011</strong>TotalRemaining term< 1 year 1 to 5 years > 5 yearsAccounts payableto banks 79,757 69,275 5,271 5,211Other financialliabilities 29,807 29,807 0 0Total 109,564 99,082 5,271 5,211in '000 EUR31.12.2010TotalRemaining term< 1 year 1 to 5 years > 5 yearsAccounts payableto banks 80,798 67,741 7,378 5,679Other financialliabilities 5,389 5,389 0 0Total 86,187 73,130 7,378 5,679The accounts payable to banks are secured throughcharges on property and assignment of the right to releaseof free land charge portions, as well as through the transferof machinery and equipment by way of security. Accountspayable to banks are additionally secured through assignmentof the trade accounts receivable from customers, aswell as accounts and right receivable from central regulatoryoffices, by pledging non-capitalized proprietary rights,through the transfer of stocks by way of security, and bypledging the limited partners' shares in Gustav WellmannGmbH & Co. KG, Enger, and the shares held in CasawellService GmbH, Enger, Impuls Küchen GmbH, Brilon, andPino Küchen GmbH, Coswig (Anhalt).As at the balance sheet date, the assets serving ascollateral are posted in the consolidated balance sheetwith the following carrying amounts:In addition to loans which are regularly renewed underblanket agreements with banking institutes, the companyalso has other loans with quarterly, half-yearly or yearlyrepayment of principal.in '000 EUR 31.12.<strong>2011</strong> 31.12.2010Land and buildings 44,349 45,486Machinery and technical equipment 6,037 6,002Inventories 13,630 14,184Some of the loan agreements specify a variable rate ofinterest, others a fixed rate of interest. The interest ratesessentially lie between 4.1% p.a. and 7.1% p.a. (previousyear: between 4.3% p.a. and 9.0% p.a.).Trade accounts receivable 12,798 14,408