2011 annual report - ALNO

2011 annual report - ALNO

2011 annual report - ALNO

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

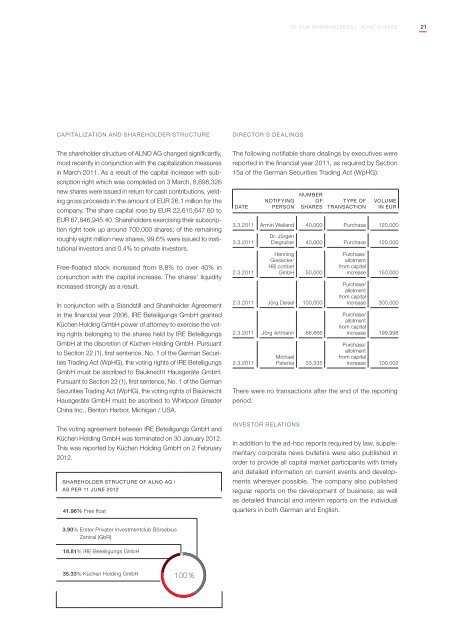

To our shareholders | <strong>ALNO</strong> shares21CAPITALIZATION AND SHAREHOLDER STRUCTUREDirector’s DealingsThe shareholder structure of <strong>ALNO</strong> AG changed significantly,most recently in conjunction with the capitalization measuresin March <strong>2011</strong>. As a result of the capital increase with subscriptionright which was completed on 3 March, 8,698,326new shares were issued in return for cash contributions, yieldinggross proceeds in the amount of EUR 26.1 million for thecompany. The share capital rose by EUR 22,615,647.60 toEUR 67,846,945.40. Shareholders exercising their subscriptionright took up around 700,000 shares; of the remainingroughly eight million new shares, 99.6% were issued to institutionalinvestors and 0.4% to private investors.Free-floated stock increased from 8.8% to over 40% inconjunction with the capital increase. The shares' liquidityincreased strongly as a result.In conjunction with a Standstill and Shareholder Agreementin the financial year 2006, IRE Beteiligungs GmbH grantedKüchen Holding GmbH power of attorney to exercise the votingrights belonging to the shares held by IRE BeteiligungsGmbH at the discretion of Küchen Holding GmbH. Pursuantto Section 22 (1), first sentence, No. 1 of the German SecuritiesTrading Act (WpHG), the voting rights of IRE BeteiligungsGmbH must be ascribed to Bauknecht Hausgeräte GmbH.Pursuant to Section 22 (1), first sentence, No. 1 of the GermanSecurities Trading Act (WpHG), the voting rights of BauknechtHausgeräte GmbH must be ascribed to Whirlpool GreaterChina Inc., Benton Harbor, Michigan / USA.The voting agreement between IRE Beteiligungs GmbH andKüchen Holding GmbH was terminated on 30 January 2012.This was <strong>report</strong>ed by Küchen Holding GmbH on 2 February2012.Shareholder structure of Alno AG |As per 11 June 201241.96% Free floatThe following notifiable share dealings by executives were<strong>report</strong>ed in the financial year <strong>2011</strong>, as required by Section15a of the German Securities Trading Act (WpHG):DateNotifyingpersonNumberofsharesType oftransactionVolumein EUR3.3.<strong>2011</strong> Armin Weiland 40,000 Purchase 120,0003.3.<strong>2011</strong>2.3.<strong>2011</strong>Dr. JürgenDiegruber 40,000 Purchase 120,000HenningGiesecke/HB conbetGmbH 50,0002.3.<strong>2011</strong> Jörg Deisel 100,0002.3.<strong>2011</strong> Jörg Artmann 66,6662.3.<strong>2011</strong>MichaelPaterka 33,335Purchase/allotmentfrom capitalincrease 150,000Purchase/allotmentfrom capitalincrease 300,000Purchase/allotmentfrom capitalincrease 199,998Purchase/allotmentfrom capitalincrease 100,002There were no transactions after the end of the <strong>report</strong>ingperiod.Investor RelationsIn addition to the ad-hoc <strong>report</strong>s required by law, supplementarycorporate news bulletins were also published inorder to provide all capital market participants with timelyand detailed information on current events and developmentswherever possible. The company also publishedregular <strong>report</strong>s on the development of business, as wellas detailed financial and interim <strong>report</strong>s on the individualquarters in both German and English.3.90% Erster Privater Investmentclub BörsebiusZentral (GbR)18.81% IRE Beteiligungs GmbH35.33% Küchen Holding GmbH100 % 100 %