2011 annual report - ALNO

2011 annual report - ALNO

2011 annual report - ALNO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

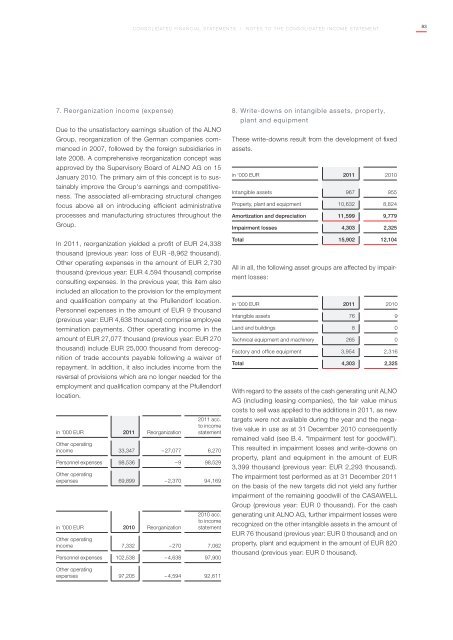

Consolidated financial statements | Notes to the consolidated income statement837. Reorganization income (expense)Due to the unsatisfactory earnings situation of the <strong>ALNO</strong>Group, reorganization of the German companies commencedin 2007, followed by the foreign subsidiaries inlate 2008. A comprehensive reorganization concept wasapproved by the Supervisory Board of <strong>ALNO</strong> AG on 15January 2010. The primary aim of this concept is to sustainablyimprove the Group's earnings and competitiveness.The associated all-embracing structural changesfocus above all on introducing efficient administrativeprocesses and manufacturing structures throughout theGroup.In <strong>2011</strong>, reorganization yielded a profit of EUR 24,338thousand (previous year: loss of EUR -8,962 thousand).Other operating expenses in the amount of EUR 2,730thousand (previous year: EUR 4,594 thousand) compriseconsulting expenses. In the previous year, this item alsoincluded an allocation to the provision for the employmentand qualification company at the Pfullendorf location.Personnel expenses in the amount of EUR 9 thousand(previous year: EUR 4,638 thousand) comprise employeetermination payments. Other operating income in theamount of EUR 27,077 thousand (previous year: EUR 270thousand) include EUR 25,000 thousand from derecognitionof trade accounts payable following a waiver ofrepayment. In addition, it also includes income from thereversal of provisions which are no longer needed for theemployment and qualification company at the Pfullendorflocation.in '000 EUR <strong>2011</strong> Reorganization<strong>2011</strong> acc.to incomestatementOther operatingincome 33,347 – 27,077 6,270Personnel expenses 98,536 – 9 98,529Other operatingexpenses 69,899 – 2,370 94,169in '000 EUR 2010 Reorganization2010 acc.to incomestatementOther operatingincome 7,332 – 270 7,062Personnel expenses 102,538 – 4,638 97,9008. Write-downs on intangible assets, property,plant and equipmentThese write-downs result from the development of fixedassets.in '000 EUR <strong>2011</strong> 2010Intangible assets 967 955Property, plant and equipment 10,632 8,824Amortization and depreciation 11,599 9,779Impairment losses 4,303 2,325Total 15,902 12,104All in all, the following asset groups are affected by impairmentlosses:in '000 EUR <strong>2011</strong> 2010Intangible assets 76 9Land and buildings 8 0Technical equipment and machinery 265 0Factory and office equipment 3,954 2,316Total 4,303 2,325With regard to the assets of the cash generating unit <strong>ALNO</strong>AG (including leasing companies), the fair value minuscosts to sell was applied to the additions in <strong>2011</strong>, as newtargets were not available during the year and the negativevalue in use as at 31 December 2010 consequentlyremained valid (see B.4. "Impairment test for goodwill").This resulted in impairment losses and write-downs onproperty, plant and equipment in the amount of EUR3,399 thousand (previous year: EUR 2,293 thousand).The impairment test performed as at 31 December <strong>2011</strong>on the basis of the new targets did not yield any furtherimpairment of the remaining goodwill of the CASAWELLGroup (previous year: EUR 0 thousand). For the cashgenerating unit <strong>ALNO</strong> AG, further impairment losses wererecognized on the other intangible assets in the amount ofEUR 76 thousand (previous year: EUR 0 thousand) and onproperty, plant and equipment in the amount of EUR 820thousand (previous year: EUR 0 thousand).Other operatingexpenses 97,205 – 4,594 92,611