2011 annual report - ALNO

2011 annual report - ALNO

2011 annual report - ALNO

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

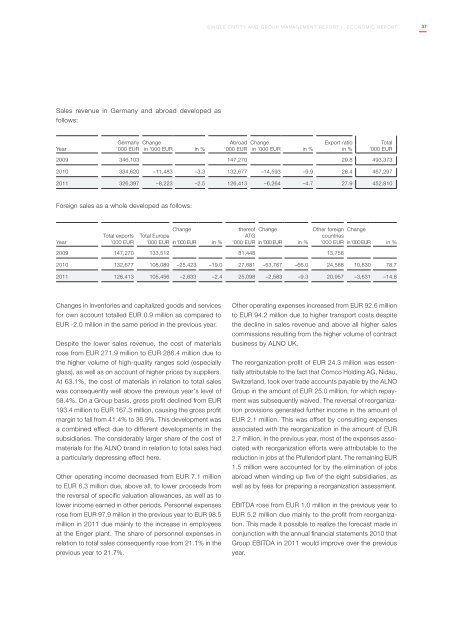

SINGLE-ENTITY AND GROUP MANAGEMENT REPORT | Economic <strong>report</strong>37Sales revenue in Germany and abroad developed asfollows:YearGermany Change Abroad Change Export ratio Total'000 EUR in '000 EUR in % '000 EUR in '000 EUR in % in % '000 EUR2009 346,103 147,270 29.8 493,3732010 334,620 –11,483 –3.3 132,677 –14,593 –9.9 28.4 467,297<strong>2011</strong> 326,397 –8,223 –2.5 126,413 –6,264 –4.7 27.9 452,810Foreign sales as a whole developed as follows:YearChangethereof ChangeOther foreign ChangeTotal exports Total EuropeATGcountries'000 EUR '000 EUR in '000 EUR in % '000 EUR in '000 EUR in % '000 EUR in '000 EUR in %2009 147,270 133,512 81,448 13,7582010 132,677 108,089 –25,423 –19.0 27,681 –53,767 –66.0 24,588 10,830 78.7<strong>2011</strong> 126,413 105,456 –2,633 –2.4 25,098 –2,583 –9.3 20,957 –3,631 –14.8Changes in inventories and capitalized goods and servicesfor own account totalled EUR 0.9 million as compared toEUR -2.0 million in the same period in the previous year.Despite the lower sales revenue, the cost of materialsrose from EUR 271.9 million to EUR 286.4 million due tothe higher volume of high-quality ranges sold (especiallyglass), as well as on account of higher prices by suppliers.At 63.1%, the cost of materials in relation to total saleswas consequently well above the previous year's level of58.4%. On a Group basis, gross profit declined from EUR193.4 million to EUR 167.3 million, causing the gross profitmargin to fall from 41.4% to 36.9%. This development wasa combined effect due to different developments in thesubsidiaries. The considerably larger share of the cost ofmaterials for the <strong>ALNO</strong> brand in relation to total sales hada particularly depressing effect here.Other operating income decreased from EUR 7.1 millionto EUR 6.3 million due, above all, to lower proceeds fromthe reversal of specific valuation allowances, as well as tolower income earned in other periods. Personnel expensesrose from EUR 97.9 million in the previous year to EUR 98.5million in <strong>2011</strong> due mainly to the increase in employeesat the Enger plant. The share of personnel expenses inrelation to total sales consequently rose from 21.1% in theprevious year to 21.7%.Other operating expenses increased from EUR 92.6 millionto EUR 94.2 million due to higher transport costs despitethe decline in sales revenue and above all higher salescommissions resulting from the higher volume of contractbusiness by <strong>ALNO</strong> UK.The reorganization profit of EUR 24.3 million was essentiallyattributable to the fact that Comco Holding AG, Nidau,Switzerland, took over trade accounts payable by the <strong>ALNO</strong>Group in the amount of EUR 25.0 million, for which repaymentwas subsequently waived. The reversal of reorganizationprovisions generated further income in the amount ofEUR 2.1 million. This was offset by consulting expensesassociated with the reorganization in the amount of EUR2.7 million. In the previous year, most of the expenses associatedwith reorganization efforts were attributable to thereduction in jobs at the Pfullendorf plant. The remaining EUR1.5 million were accounted for by the elimination of jobsabroad when winding up five of the eight subsidiaries, aswell as by fees for preparing a reorganization assessment.EBITDA rose from EUR 1.0 million in the previous year toEUR 5.2 million due mainly to the profit from reorganization.This made it possible to realize the forecast made inconjunction with the <strong>annual</strong> financial statements 2010 thatGroup EBITDA in <strong>2011</strong> would improve over the previousyear.