9months 2010 Investors' Presentation - Palm Hills Developments

9months 2010 Investors' Presentation - Palm Hills Developments

9months 2010 Investors' Presentation - Palm Hills Developments

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

COMPETITIVE ADVANTAGES<br />

Growth drivers<br />

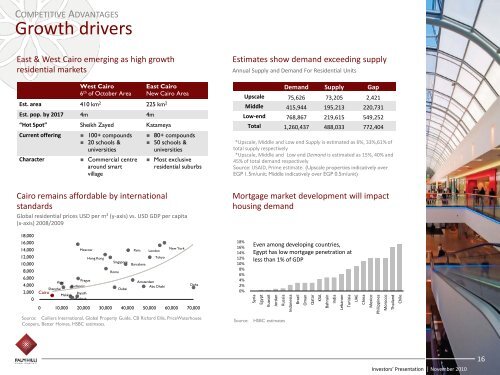

East & West Cairo emerging as high growth<br />

residential markets<br />

Est. area<br />

Est. pop. by 2017<br />

“Hot Spot”<br />

Current offering<br />

Character<br />

18,000<br />

16,000<br />

14,000<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

0<br />

Moscow<br />

Prague<br />

Kiev<br />

Budapest<br />

Shanghai<br />

Cairo<br />

Riyadh<br />

Makkah<br />

Madinah<br />

West Cairo<br />

6 th of October Area<br />

410 km2 4m<br />

Sheikh Zayed<br />

� 100+ compounds<br />

� 20 schools &<br />

universities<br />

� Commercial centre<br />

around smart<br />

village<br />

Hong Kong<br />

Singapore<br />

Rome<br />

Dubai<br />

Paris<br />

Barcelona<br />

East Cairo<br />

New Cairo Area<br />

225 km2 4m<br />

Katameya<br />

Cairo remains affordable by international<br />

standards<br />

� 80+ compounds<br />

� 50 schools &<br />

universities<br />

� Most exclusive<br />

residential suburbs<br />

Global residential prices USD per m² (y-axis) vs. USD GDP per capita<br />

(x-axis) 2008/2009<br />

London<br />

Tokyo<br />

Amsterdam<br />

Abu Dhabi<br />

New York<br />

0 10,000 20,000 30,000 40,000 50,000 60,000 70,000<br />

Source: Colliers International, Global Property Guide, CB Richard Ellis, PriceWaterhouse<br />

Coopers, Better Homes, HSBC estimates.<br />

Doha<br />

Estimates show demand exceeding supply<br />

Annual Supply and Demand For Residential Units<br />

18%<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Even among developing countries,<br />

Egypt has low mortgage penetration at<br />

less than 1% of GDP<br />

Syria<br />

Egypt<br />

Kuwait<br />

Jordan<br />

Russia<br />

Source: HSBC estimates<br />

Demand Supply Gap<br />

Upscale 75,626 73,205 2,421<br />

Middle 415,944 195,213 220,731<br />

Low-end 768,867 219,615 549,252<br />

Total 1,260,437 488,033 772,404<br />

•*Upscale, Middle and Low end Supply is estimated as 6%, 33%,61% of<br />

total supply respectively<br />

•*Upscale, Middle and Low end Demand is estimated as 15%, 40% and<br />

45% of total demand respectively<br />

Source: USAID, Prime estimate. (Upscale properties indicatively over<br />

EGP 1.5m/unit; Middle indicatively over EGP 0.5m/unit)<br />

Mortgage market development will impact<br />

housing demand<br />

Indonesia<br />

Brazil<br />

Oman<br />

Qatar<br />

KSA<br />

Bahrain<br />

India<br />

Lebanon<br />

Tunisia<br />

UAE<br />

China<br />

Mexico<br />

Philippines<br />

Morocco<br />

Thailand<br />

Chile<br />

Investors’ <strong>Presentation</strong> | November <strong>2010</strong><br />

16