STYLE/TYPESMALL CAPGROWTHSMALL CAPVALUESMALL CAPVALUESMALL CAPVALUEMID-CAPGROWTHMID-CAPGROWTHINVESTMENT OBJECTIVES/POLICIESAST Federated Aggressive Growth: seeks capital growth. The Portfolio pursues itsinvestment objective by investing in the stocks of small companies that are traded on nationalsecurity exchanges, NASDAQ stock exchange and the over-the-counter-market. Smallcompanies will be defined as companies with market capitalizations similar to companies in theRussell 2000 Index or the Standard & Poor's Small Cap 600 Index. Up to 25% of thePortfolio's net assets may be invested in foreign securities, which are typically denominated inforeign currencies.AST Goldman Sachs Small-Cap Value: seeks long-term capital appreciation. The Portfoliowill seek its objective through investments primarily in equity securities that are believed to beundervalued in the marketplace. The Portfolio primarily seeks companies that are small-sized,based on the value of their outstanding stock. The Portfolio will have a non-fundamental policyto invest, under normal circumstances, at least 80% of the value of its assets in smallcapitalization companies. The 80% investment requirement applies at the time the Portfolioinvests its assets. The Portfolio generally defines small capitalization companies as companieswith a capitalization of $5 billion or less.AST Gabelli Small-Cap Value: seeks to provide long-term capital growth by investingprimarily in small-capitalization stocks that appear to be undervalued. The Portfolio will havea non-fundamental policy to invest, under normal circumstances, at least 80% of the value of itsassets in small capitalization companies. The 80% investment requirement applies at the timethe Portfolio invests its assets. The Portfolio generally defines small capitalization companiesas those with a capitalization of $1.5 billion or less. Reflecting a value approach to investing,the Portfolio will seek the stocks of companies whose current stock prices do not appear toadequately reflect their underlying value as measured by assets, earnings, cash flow or businessfranchises.AST DeAM Small-Cap Value: seeks maximum growth of investors' capital. The Portfoliopursues its objective, under normal market conditions, by primarily investing at least 80% of itstotal assets in the equity securities of small-sized companies included in the Russell 2000 ®Value Index. The Sub-advisor employs an investment strategy designed to maintain a portfolioof equity securities which approximates the market risk of those stocks included in the Russell2000 ® Value Index, but which attempts to outperform the Russell 2000 ® Value Index.AST Goldman Sachs Mid-Cap Growth (f/k/a AST Janus Mid-Cap Growth): seeks long-termcapital growth. The Portfolio pursues its investment objective, by investing primarily in equitysecurities selected for their growth potential, and normally invests at least 80% of the value ofits assets in medium capitalization companies. For purposes of the Portfolio, medium-sizedcompanies are those whose market capitalizations (measured at the time of investment) fallwithin the range of companies in the Standard & Poor's MidCap 400 Index. The Sub-advisorseeks to identify individual companies with earnings growth potential that may not berecognized by the market at large.AST Neuberger Berman Mid-Cap Growth: seeks capital growth. Under normal marketconditions, the Portfolio primarily invests at least 80% of its net assets in the common stocks ofmid-cap companies. For purposes of the Portfolio, companies with equity marketcapitalizations that fall within the range of the Russell Midcap ® Index, at the time ofinvestment, are considered mid-cap companies. Some of the Portfolio's assets may be investedin the securities of large-cap companies as well as in small-cap companies. The Sub-advisorlooks for fast-growing companies that are in new or rapidly evolving industries.PORTFOLIOADVISOR/SUB-ADVISORFederated InvestmentCounseling/FederatedGlobal InvestmentManagement Corp.Goldman Sachs AssetManagementGAMCOInvestors, Inc.Deutsche AssetManagement, Inc.Goldman Sachs AssetManagementNeuberger BermanManagement Inc.Contract described herein is no longer available for sale.15

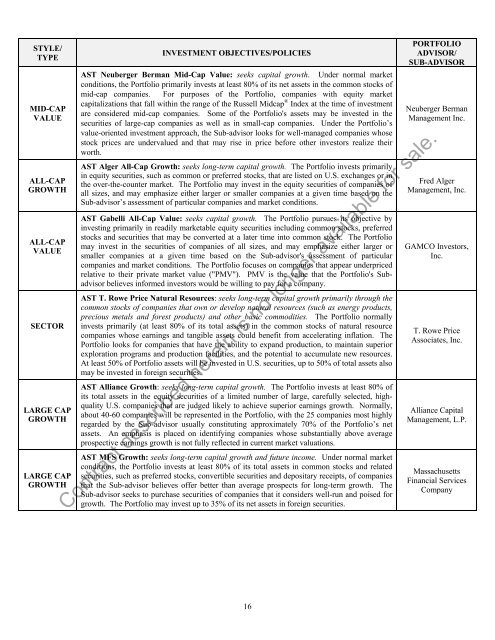

STYLE/TYPEMID-CAPVALUEALL-CAPGROWTHALL-CAPVALUESECTORLARGE CAPGROWTHLARGE CAPGROWTHINVESTMENT OBJECTIVES/POLICIESAST Neuberger Berman Mid-Cap Value: seeks capital growth. Under normal marketconditions, the Portfolio primarily invests at least 80% of its net assets in the common stocks ofmid-cap companies. For purposes of the Portfolio, companies with equity marketcapitalizations that fall within the range of the Russell Midcap ® Index at the time of investmentare considered mid-cap companies. Some of the Portfolio's assets may be invested in thesecurities of large-cap companies as well as in small-cap companies. Under the Portfolio’svalue-oriented investment approach, the Sub-advisor looks for well-managed companies whosestock prices are undervalued and that may rise in price before other investors realize theirworth.AST Alger All-Cap Growth: seeks long-term capital growth. The Portfolio invests primarilyin equity securities, such as common or preferred stocks, that are listed on U.S. exchanges or inthe over-the-counter market. The Portfolio may invest in the equity securities of companies ofall sizes, and may emphasize either larger or smaller companies at a given time based on theSub-advisor’s assessment of particular companies and market conditions.AST Gabelli All-Cap Value: seeks capital growth. The Portfolio pursues its objective byinvesting primarily in readily marketable equity securities including common stocks, preferredstocks and securities that may be converted at a later time into common stock. The Portfoliomay invest in the securities of companies of all sizes, and may emphasize either larger orsmaller companies at a given time based on the Sub-advisor's assessment of particularcompanies and market conditions. The Portfolio focuses on companies that appear underpricedrelative to their private market value ("PMV"). PMV is the value that the Portfolio's Subadvisorbelieves informed investors would be willing to pay for a company.AST T. Rowe Price Natural Resources: seeks long-term capital growth primarily through thecommon stocks of companies that own or develop natural resources (such as energy products,precious metals and forest products) and other basic commodities. The Portfolio normallyinvests primarily (at least 80% of its total assets) in the common stocks of natural resourcecompanies whose earnings and tangible assets could benefit from accelerating inflation. ThePortfolio looks for companies that have the ability to expand production, to maintain superiorexploration programs and production facilities, and the potential to accumulate new resources.At least 50% of Portfolio assets will be invested in U.S. securities, up to 50% of total assets alsomay be invested in foreign securities.AST Alliance Growth: seeks long-term capital growth. The Portfolio invests at least 80% ofits total assets in the equity securities of a limited number of large, carefully selected, highqualityU.S. companies that are judged likely to achieve superior earnings growth. Normally,about 40-60 companies will be represented in the Portfolio, with the 25 companies most highlyregarded by the Sub-advisor usually constituting approximately 70% of the Portfolio’s netassets. An emphasis is placed on identifying companies whose substantially above averageprospective earnings growth is not fully reflected in current market valuations.AST MFS Growth: seeks long-term capital growth and future income. Under normal marketconditions, the Portfolio invests at least 80% of its total assets in common stocks and relatedsecurities, such as preferred stocks, convertible securities and depositary receipts, of companiesthat the Sub-advisor believes offer better than average prospects for long-term growth. TheSub-advisor seeks to purchase securities of companies that it considers well-run and poised forgrowth. The Portfolio may invest up to 35% of its net assets in foreign securities.PORTFOLIOADVISOR/SUB-ADVISORNeuberger BermanManagement Inc.Fred AlgerManagement, Inc.GAMCO Investors,Inc.T. Rowe PriceAssociates, Inc.Alliance CapitalManagement, L.P.MassachusettsFinancial ServicesCompanyContract described herein is no longer available for sale.16

- Page 1 and 2: Effective January 1, 2008, American

- Page 4 and 5: HOW DO I PURCHASE THIS ANNUITY?We s

- Page 6 and 7: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 8 and 9: SUMMARY OF CONTRACT FEES AND CHARGE

- Page 10 and 11: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 12 and 13: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 14 and 15: Effective close of business June 28

- Page 18 and 19: STYLE/TYPELARGE CAPGROWTHLARGE CAPG

- Page 20 and 21: STYLE/TYPEBALANCEDBALANCEDASSETALLO

- Page 22 and 23: STYLE/TYPESTRATEGICORTACTICALALLOCA

- Page 24 and 25: STYLE/TYPELARGE CAPEQUITYLARGE CAPE

- Page 26 and 27: STYLE/TYPESECTORSECTORSECTORSECTORS

- Page 28 and 29: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 30 and 31: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 32 and 33: eneficiaries even if the market dec

- Page 34 and 35: • Annuitant: The Annuitant is the

- Page 36 and 37: Credits Applied to Purchase Payment

- Page 38 and 39: ARE THERE RESTRICTIONS OR CHARGES O

- Page 40 and 41: Allocations during prolonged market

- Page 42 and 43: To the extent permitted by law, we

- Page 44 and 45: Certain provisions of this benefit

- Page 46 and 47: When we determine if a CDSC applies

- Page 48 and 49: You may also annuitize your contrac

- Page 50 and 51: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 52 and 53: Beneficiary to pay taxes on your An

- Page 54 and 55: AMERICAN SKANDIA’S ANNUITY REWARD

- Page 56 and 57: When do you determine the Death Ben

- Page 58 and 59: WHAT HAPPENS TO MY UNITS WHEN THERE

- Page 60 and 61: • Then, from any "income on the c

- Page 62 and 63: The IRS has released Treasury regul

- Page 64 and 65: Prudential Financial is a New Jerse

- Page 66 and 67:

Service Fees Payable to American Sk

- Page 68 and 69:

INCORPORATION OF CERTAIN DOCUMENTS

- Page 70 and 71:

APPENDIX A - FINANCIAL INFORMATION

- Page 72 and 73:

MANAGEMENT’S DISCUSSION AND ANALY

- Page 74 and 75:

The Company’s income tax (benefit

- Page 76 and 77:

31, 2001. The estimated present val

- Page 78 and 79:

interest rate risk from contracts t

- Page 80 and 81:

AUDITED CONSOLIDATED FINANCIAL STAT

- Page 82 and 83:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 84 and 85:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 86 and 87:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 88 and 89:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 90 and 91:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 92 and 93:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 94 and 95:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 96 and 97:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 98 and 99:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 100 and 101:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 102 and 103:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 104 and 105:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 106 and 107:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 108 and 109:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 110 and 111:

Year Ended December 31,Sub-account

- Page 112 and 113:

Year Ended December 31,Sub-account

- Page 114 and 115:

Year Ended December 31,Sub-account

- Page 116 and 117:

Year Ended December 31,Sub-account

- Page 118 and 119:

Year Ended December 31,Sub-account

- Page 120 and 121:

Year Ended December 31,Sub-account

- Page 122 and 123:

Year Ended December 31,Sub-account

- Page 124 and 125:

17. Effective May 3, 1999, American

- Page 126 and 127:

Examples of Guaranteed Minimum Deat

- Page 128 and 129:

coverage under the Rider, we will r

- Page 130 and 131:

PLEASE SEND ME A STATEMENT OF ADDIT

- Page 132 and 133:

Variable Annuity Issued by:Variable

- Page 134 and 135:

NOTESContract described herein is n

- Page 136 and 137:

American Skandia's Privacy PolicyAt