STYLE/TYPESECTORSECTORSECTORSECTORSECTORSECTORSECTORINVESTMENT OBJECTIVES/POLICIESProFund VP Healthcare: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Dow Jones U.S. Healthcare Sector Index. TheDown Jones U.S. healthcare Sector Index measures the performance of the healthcare economicsector of the U.S. equity market. Component companies include health care providers,biotechnology companies, medical supplies, advanced medical devices and pharmaceuticals.ProFund VP Industrial: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Dow Jones U.S. Industrial Sector Index. The DowJones U.S. Industrial Sector Index measures the performance of the industrial economic sectorof the U.S. equity market. Component companies include building materials, heavyconstruction, factory equipment, heavy machinery, industrial services, pollution control,containers and packaging, industrial diversified, air freight, marine transportation, railroads,trucking, land-transportation equipment, shipbuilding, transportation services, advancedindustrial equipment, electric components and equipment, and aerospace.ProFund VP Internet: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Dow Jones U.S. Internet Index. The Dow JonesComposite Internet Index measures the performance of stocks in the U.S. equity markets thatgenerate the majority of their revenues from the Internet. The Index is composed of two subgroups:Internet Commerce – companies that derive the majority of their revenues fromproviding goods and/or services through an open network, such as a web site; and InternetServices – companies that derive the majority of their revenues from providing access to theInternet or providing services to people using the Internet.ProFund VP Pharmaceuticals: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Dow Jones U.S. Pharmaceuticals Sector Index. TheDow Jones U.S. Pharmaceuticals Index measures the performance of the pharmaceuticalsindustry of the U.S. equity market. Component companies include the makers of prescriptionand over-the-counter drugs, such as aspirin, cold remedies, birth control pills, and vaccines, aswell as companies engaged in contract drug research..ProFund VP Precious Metals: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Philadelphia Stock Exchange Gold & Silver SectorIndex. The Philadelphia Stock Exchange Gold and Silver Sector Index measures theperformance of the gold and silver mining industry of the global equity market. Componentcompanies include companies involved in the mining and production of gold, silver, and otherprecious metals, precious stones and pearls. The Index does not include producers ofcommemorative medals and coins that are made of these metals.ProFund VP Real Estate: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Dow Jones U.S. Real Estate Index. The Dow JonesU.S. Real Estate Index measures the performance of the real estate industry of the U.S. equitymarket. Component companies include those that invest directly or indirectly throughdevelopment, management or ownership of shopping malls, apartment buildings, housingdevelopments and, real estate investment trusts ("REITs") that invest in apartments, office andretail properties. REITs are passive investment vehicles that invest primarily in incomeproducingreal estate or real estate related loans or interests.ProFund VP Semiconductor: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Dow Jones U.S. Semiconductor Index. The DowJones U.S. Semiconductor Index measures the performance of the semiconductor industry ofthe U.S. equity market. Component companies are engaged in the production ofsemiconductors and other integrated chips, as well as other related products such as circuitboards and motherboards.PORTFOLIOADVISOR/SUB-ADVISORProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCContract described herein is no longer available for sale.ProFund AdvisorsLLC25

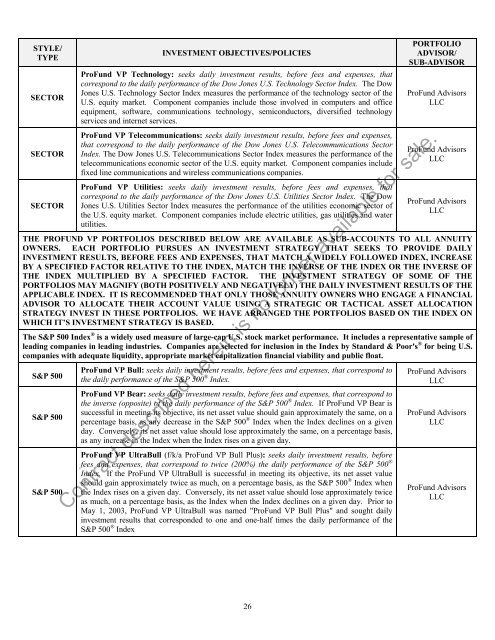

STYLE/TYPESECTORSECTORSECTORINVESTMENT OBJECTIVES/POLICIESProFund VP Technology: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Dow Jones U.S. Technology Sector Index. The DowJones U.S. Technology Sector Index measures the performance of the technology sector of theU.S. equity market. Component companies include those involved in computers and officeequipment, software, communications technology, semiconductors, diversified technologyservices and internet services.ProFund VP Telecommunications: seeks daily investment results, before fees and expenses,that correspond to the daily performance of the Dow Jones U.S. Telecommunications SectorIndex. The Dow Jones U.S. Telecommunications Sector Index measures the performance of thetelecommunications economic sector of the U.S. equity market. Component companies includefixed line communications and wireless communications companies.ProFund VP Utilities: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Dow Jones U.S. Utilities Sector Index. The DowJones U.S. Utilities Sector Index measures the performance of the utilities economic sector ofthe U.S. equity market. Component companies include electric utilities, gas utilities and waterutilities.PORTFOLIOADVISOR/SUB-ADVISORProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCTHE PROFUND VP PORTFOLIOS DESCRIBED BELOW ARE AVAILABLE AS SUB-ACCOUNTS TO ALL ANNUITYOWNERS. EACH PORTFOLIO PURSUES AN INVESTMENT STRATEGY THAT SEEKS TO PROVIDE DAILYINVESTMENT RESULTS, BEFORE FEES AND EXPENSES, THAT MATCH A WIDELY FOLLOWED INDEX, INCREASEBY A SPECIFIED FACTOR RELATIVE TO THE INDEX, MATCH THE INVERSE OF THE INDEX OR THE INVERSE OFTHE INDEX MULTIPLIED BY A SPECIFIED FACTOR. THE INVESTMENT STRATEGY OF SOME OF THEPORTFOLIOS MAY MAGNIFY (BOTH POSITIVELY AND NEGATIVELY) THE DAILY INVESTMENT RESULTS OF THEAPPLICABLE INDEX. IT IS RECOMMENDED THAT ONLY THOSE ANNUITY OWNERS WHO ENGAGE A FINANCIALADVISOR TO ALLOCATE THEIR ACCOUNT VALUE USING A STRATEGIC OR TACTICAL ASSET ALLOCATIONSTRATEGY INVEST IN THESE PORTFOLIOS. WE HAVE ARRANGED THE PORTFOLIOS BASED ON THE INDEX ONWHICH IT’S INVESTMENT STRATEGY IS BASED.The S&P 500 Index ® is a widely used measure of large-cap U.S. stock market performance. It includes a representative sample ofleading companies in leading industries. Companies are selected for inclusion in the Index by Standard & Poor's ® for being U.S.companies with adequate liquidity, appropriate market capitalization financial viability and public float.S&P 500S&P 500S&P 500ProFund VP Bull: seeks daily investment results, before fees and expenses, that correspond tothe daily performance of the S&P 500 ® Index.ProFund VP Bear: seeks daily investment results, before fees and expenses, that correspond tothe inverse (opposite) of the daily performance of the S&P 500 ® Index. If ProFund VP Bear issuccessful in meeting its objective, its net asset value should gain approximately the same, on apercentage basis, as any decrease in the S&P 500 ® Index when the Index declines on a givenday. Conversely, its net asset value should lose approximately the same, on a percentage basis,as any increase in the Index when the Index rises on a given day.ProFund VP UltraBull (f/k/a ProFund VP Bull Plus): seeks daily investment results, beforefees and expenses, that correspond to twice (200%) the daily performance of the S&P 500 ®Index. If the ProFund VP UltraBull is successful in meeting its objective, its net asset valueshould gain approximately twice as much, on a percentage basis, as the S&P 500 ® Index whenthe Index rises on a given day. Conversely, its net asset value should lose approximately twiceas much, on a percentage basis, as the Index when the Index declines on a given day. Prior toMay 1, 2003, ProFund VP UltraBull was named "ProFund VP Bull Plus" and sought dailyinvestment results that corresponded to one and one-half times the daily performance of theS&P 500 ® IndexProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCContract described herein is no longer available for sale.26

- Page 1 and 2: Effective January 1, 2008, American

- Page 4 and 5: HOW DO I PURCHASE THIS ANNUITY?We s

- Page 6 and 7: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 8 and 9: SUMMARY OF CONTRACT FEES AND CHARGE

- Page 10 and 11: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 12 and 13: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 14 and 15: Effective close of business June 28

- Page 16 and 17: STYLE/TYPESMALL CAPGROWTHSMALL CAPV

- Page 18 and 19: STYLE/TYPELARGE CAPGROWTHLARGE CAPG

- Page 20 and 21: STYLE/TYPEBALANCEDBALANCEDASSETALLO

- Page 22 and 23: STYLE/TYPESTRATEGICORTACTICALALLOCA

- Page 24 and 25: STYLE/TYPELARGE CAPEQUITYLARGE CAPE

- Page 28 and 29: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 30 and 31: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 32 and 33: eneficiaries even if the market dec

- Page 34 and 35: • Annuitant: The Annuitant is the

- Page 36 and 37: Credits Applied to Purchase Payment

- Page 38 and 39: ARE THERE RESTRICTIONS OR CHARGES O

- Page 40 and 41: Allocations during prolonged market

- Page 42 and 43: To the extent permitted by law, we

- Page 44 and 45: Certain provisions of this benefit

- Page 46 and 47: When we determine if a CDSC applies

- Page 48 and 49: You may also annuitize your contrac

- Page 50 and 51: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 52 and 53: Beneficiary to pay taxes on your An

- Page 54 and 55: AMERICAN SKANDIA’S ANNUITY REWARD

- Page 56 and 57: When do you determine the Death Ben

- Page 58 and 59: WHAT HAPPENS TO MY UNITS WHEN THERE

- Page 60 and 61: • Then, from any "income on the c

- Page 62 and 63: The IRS has released Treasury regul

- Page 64 and 65: Prudential Financial is a New Jerse

- Page 66 and 67: Service Fees Payable to American Sk

- Page 68 and 69: INCORPORATION OF CERTAIN DOCUMENTS

- Page 70 and 71: APPENDIX A - FINANCIAL INFORMATION

- Page 72 and 73: MANAGEMENT’S DISCUSSION AND ANALY

- Page 74 and 75: The Company’s income tax (benefit

- Page 76 and 77:

31, 2001. The estimated present val

- Page 78 and 79:

interest rate risk from contracts t

- Page 80 and 81:

AUDITED CONSOLIDATED FINANCIAL STAT

- Page 82 and 83:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 84 and 85:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 86 and 87:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 88 and 89:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 90 and 91:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 92 and 93:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 94 and 95:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 96 and 97:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 98 and 99:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 100 and 101:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 102 and 103:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 104 and 105:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 106 and 107:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 108 and 109:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 110 and 111:

Year Ended December 31,Sub-account

- Page 112 and 113:

Year Ended December 31,Sub-account

- Page 114 and 115:

Year Ended December 31,Sub-account

- Page 116 and 117:

Year Ended December 31,Sub-account

- Page 118 and 119:

Year Ended December 31,Sub-account

- Page 120 and 121:

Year Ended December 31,Sub-account

- Page 122 and 123:

Year Ended December 31,Sub-account

- Page 124 and 125:

17. Effective May 3, 1999, American

- Page 126 and 127:

Examples of Guaranteed Minimum Deat

- Page 128 and 129:

coverage under the Rider, we will r

- Page 130 and 131:

PLEASE SEND ME A STATEMENT OF ADDIT

- Page 132 and 133:

Variable Annuity Issued by:Variable

- Page 134 and 135:

NOTESContract described herein is n

- Page 136 and 137:

American Skandia's Privacy PolicyAt