STYLE/TYPESTRATEGICORTACTICALALLOCA-TIONSTRATEGICORTACTICALALLOCA-TIONSTRATEGICORTACTICALALLOCA-TIONMID-CAPEQUITYSECTORINVESTMENT OBJECTIVES/POLICIESRydex Variable Trust – Nova: seeks to provide investment results that match the performanceof a specific benchmark on a daily basis. The Portfolio's current benchmark is 150% of theperformance of the S&P 500 ® Index (the "underlying index"). If the Portfolio meets itsobjective, the value of the Portfolio's shares will tend to increase on a daily basis by 150% ofthe value of any increase in the underlying index. When the value of the underlying indexdeclines, the value of the Portfolio's shares should also decrease on a daily basis by 150% of thevalue of any decrease in the underlying index (e.g., if the underlying index goes down by 5%,the value of the Portfolio's shares should go down by 7.5% on that day). Unlike a traditionalindex fund, as its primary investment strategy, the Portfolio invests to a significant extent inleveraged instruments, such as swap agreements, futures contracts and options on securities,futures contracts, and stock indices, as well as equity securities.Rydex Variable Trust – Ursa: seeks to provide investment results that will inversely correlateto the performance of the S&P 500 ® Index (the "underlying index"). If the Portfolio meets itsobjective, the value of the Portfolio's shares will tend to increase during times when the value ofthe underlying index is decreasing. When the value of the underlying index is increasing,however, the value of the Portfolio's shares should decrease on a daily basis by an inverselyproportionate amount (e.g., if the underlying index goes up by 5%, the value of the Portfolio'sshares should go down by 5% on that day). Unlike a traditional index fund, the Portfolio'sbenchmark is to perform exactly opposite the underlying index, and the Ursa Fund will not ownthe securities included in the underlying index. Instead, as its primary investment strategy, thePortfolio invests to a significant extent in short sales of securities or futures contracts and inoptions on securities, futures contracts, and stock indices.Rydex Variable Trust – OTC: seeks to provide investment results that correspond to abenchmark for over-the-counter securities. The Portfolio's current benchmark is the NASDAQ100 Index ® (the "underlying index"). If the Portfolio meets its objective, the value of thePortfolio's shares should increase on a daily basis by the amount of any increase in the value ofthe underlying index. However, when the value of the underlying index declines, the value ofthe Portfolio's shares should also decrease on a daily basis by the amount of the decrease invalue of the underlying index. The Portfolio invests principally in securities of companiesincluded in the underlying index. It also may invest in other instruments whose performance isexpected to correspond to that of the underlying index, and may engage in futures and optionstransactions and enter into swap agreements.INVESCO Variable Investment Funds – Dynamics: seek long-term capital growth. ThePortfolio invests at least 65% of its assets in common stocks of mid-sized companies.INVESCO defines mid-sized companies as companies that are included in the Russell MidcapGrowth Index at the time of purchase, or if not included in that Index, have marketcapitalizations of between $2.5 billion and $15 billion at the time of purchase. The core of thePortfolio’s investments are in securities of established companies that are leaders in attractivegrowth markets with a history of strong returns. The remainder of the Portfolio is invested insecurities of companies that show accelerating growth, driven by product cycles, favorableindustry or sector conditions, and other factors that INVESCO believes will lead to rapid salesor earnings growth.INVESCO Variable Investment Funds – Technology: seeks capital growth. The Portfolionormally invests 80% of its net assets in the equity securities and equity-related instruments ofcompanies engaged in technology-related industries. These include, but are not limited to,various applied technologies, hardware, software, semiconductors, telecommunicationsequipment and services and service-related companies in information technology. Many ofthese products and services are subject to rapid obsolescence, which may lower market value ofthe securities of the companies in this sector. At any given time, 20% of the Portfolio's assets isnot required to be invested in the sector.PORTFOLIOADVISOR/SUB-ADVISORRydex GlobalAdvisors(f/k/a PADCOAdvisors II, Inc.)Rydex GlobalAdvisors(f/k/a PADCOAdvisors II, Inc.)Rydex GlobalAdvisors(f/k/a PADCOAdvisors II, Inc.)INVESCO FundsGroup, Inc.Contract described herein is no longer available for sale.INVESCO FundsGroup, Inc.21

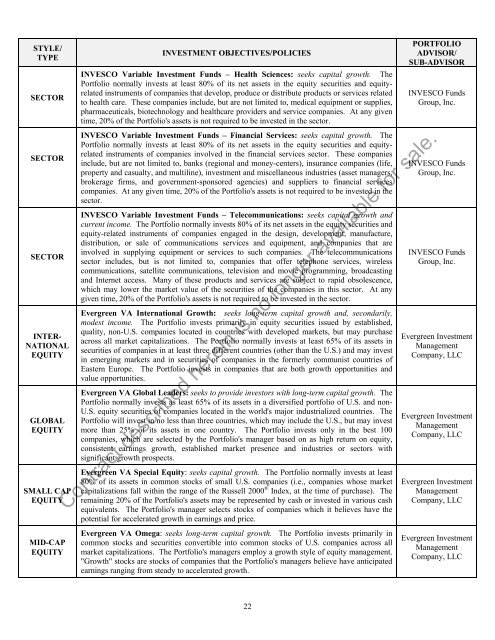

STYLE/TYPESECTORSECTORSECTORINTER-NATIONALEQUITYGLOBALEQUITYSMALL CAPEQUITYMID-CAPEQUITYINVESTMENT OBJECTIVES/POLICIESINVESCO Variable Investment Funds – Health Sciences: seeks capital growth. ThePortfolio normally invests at least 80% of its net assets in the equity securities and equityrelatedinstruments of companies that develop, produce or distribute products or services relatedto health care. These companies include, but are not limited to, medical equipment or supplies,pharmaceuticals, biotechnology and healthcare providers and service companies. At any giventime, 20% of the Portfolio's assets is not required to be invested in the sector.INVESCO Variable Investment Funds – Financial Services: seeks capital growth. ThePortfolio normally invests at least 80% of its net assets in the equity securities and equityrelatedinstruments of companies involved in the financial services sector. These companiesinclude, but are not limited to, banks (regional and money-centers), insurance companies (life,property and casualty, and multiline), investment and miscellaneous industries (asset managers,brokerage firms, and government-sponsored agencies) and suppliers to financial servicescompanies. At any given time, 20% of the Portfolio's assets is not required to be invested in thesector.INVESCO Variable Investment Funds – Telecommunications: seeks capital growth andcurrent income. The Portfolio normally invests 80% of its net assets in the equity securities andequity-related instruments of companies engaged in the design, development, manufacture,distribution, or sale of communications services and equipment, and companies that areinvolved in supplying equipment or services to such companies. The telecommunicationssector includes, but is not limited to, companies that offer telephone services, wirelesscommunications, satellite communications, television and movie programming, broadcastingand Internet access. Many of these products and services are subject to rapid obsolescence,which may lower the market value of the securities of the companies in this sector. At anygiven time, 20% of the Portfolio's assets is not required to be invested in the sector.Evergreen VA International Growth: seeks long-term capital growth and, secondarily,modest income. The Portfolio invests primarily in equity securities issued by established,quality, non-U.S. companies located in countries with developed markets, but may purchaseacross all market capitalizations. The Portfolio normally invests at least 65% of its assets insecurities of companies in at least three different countries (other than the U.S.) and may investin emerging markets and in securities of companies in the formerly communist countries ofEastern Europe. The Portfolio invests in companies that are both growth opportunities andvalue opportunities.Evergreen VA Global Leaders: seeks to provide investors with long-term capital growth. ThePortfolio normally invests as least 65% of its assets in a diversified portfolio of U.S. and non-U.S. equity securities of companies located in the world's major industrialized countries. ThePortfolio will invest in no less than three countries, which may include the U.S., but may investmore than 25% of its assets in one country. The Portfolio invests only in the best 100companies, which are selected by the Portfolio's manager based on as high return on equity,consistent earnings growth, established market presence and industries or sectors withsignificant growth prospects.Evergreen VA Special Equity: seeks capital growth. The Portfolio normally invests at least80% of its assets in common stocks of small U.S. companies (i.e., companies whose marketcapitalizations fall within the range of the Russell 2000 ® Index, at the time of purchase). Theremaining 20% of the Portfolio's assets may be represented by cash or invested in various cashequivalents. The Portfolio's manager selects stocks of companies which it believes have thepotential for accelerated growth in earnings and price.PORTFOLIOADVISOR/SUB-ADVISORINVESCO FundsGroup, Inc.INVESCO FundsGroup, Inc.INVESCO FundsGroup, Inc.Evergreen InvestmentManagementCompany, LLCEvergreen InvestmentManagementCompany, LLCEvergreen InvestmentManagementCompany, LLCContract described herein is no longer available for sale.Evergreen VA Omega: seeks long-term capital growth. The Portfolio invests primarily incommon stocks and securities convertible into common stocks of U.S. companies across allmarket capitalizations. The Portfolio's managers employ a growth style of equity management."Growth" stocks are stocks of companies that the Portfolio's managers believe have anticipatedearnings ranging from steady to accelerated growth.Evergreen InvestmentManagementCompany, LLC22

- Page 1 and 2: Effective January 1, 2008, American

- Page 4 and 5: HOW DO I PURCHASE THIS ANNUITY?We s

- Page 6 and 7: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 8 and 9: SUMMARY OF CONTRACT FEES AND CHARGE

- Page 10 and 11: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 12 and 13: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 14 and 15: Effective close of business June 28

- Page 16 and 17: STYLE/TYPESMALL CAPGROWTHSMALL CAPV

- Page 18 and 19: STYLE/TYPELARGE CAPGROWTHLARGE CAPG

- Page 20 and 21: STYLE/TYPEBALANCEDBALANCEDASSETALLO

- Page 24 and 25: STYLE/TYPELARGE CAPEQUITYLARGE CAPE

- Page 26 and 27: STYLE/TYPESECTORSECTORSECTORSECTORS

- Page 28 and 29: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 30 and 31: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 32 and 33: eneficiaries even if the market dec

- Page 34 and 35: • Annuitant: The Annuitant is the

- Page 36 and 37: Credits Applied to Purchase Payment

- Page 38 and 39: ARE THERE RESTRICTIONS OR CHARGES O

- Page 40 and 41: Allocations during prolonged market

- Page 42 and 43: To the extent permitted by law, we

- Page 44 and 45: Certain provisions of this benefit

- Page 46 and 47: When we determine if a CDSC applies

- Page 48 and 49: You may also annuitize your contrac

- Page 50 and 51: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 52 and 53: Beneficiary to pay taxes on your An

- Page 54 and 55: AMERICAN SKANDIA’S ANNUITY REWARD

- Page 56 and 57: When do you determine the Death Ben

- Page 58 and 59: WHAT HAPPENS TO MY UNITS WHEN THERE

- Page 60 and 61: • Then, from any "income on the c

- Page 62 and 63: The IRS has released Treasury regul

- Page 64 and 65: Prudential Financial is a New Jerse

- Page 66 and 67: Service Fees Payable to American Sk

- Page 68 and 69: INCORPORATION OF CERTAIN DOCUMENTS

- Page 70 and 71: APPENDIX A - FINANCIAL INFORMATION

- Page 72 and 73:

MANAGEMENT’S DISCUSSION AND ANALY

- Page 74 and 75:

The Company’s income tax (benefit

- Page 76 and 77:

31, 2001. The estimated present val

- Page 78 and 79:

interest rate risk from contracts t

- Page 80 and 81:

AUDITED CONSOLIDATED FINANCIAL STAT

- Page 82 and 83:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 84 and 85:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 86 and 87:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 88 and 89:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 90 and 91:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 92 and 93:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 94 and 95:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 96 and 97:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 98 and 99:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 100 and 101:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 102 and 103:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 104 and 105:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 106 and 107:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 108 and 109:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 110 and 111:

Year Ended December 31,Sub-account

- Page 112 and 113:

Year Ended December 31,Sub-account

- Page 114 and 115:

Year Ended December 31,Sub-account

- Page 116 and 117:

Year Ended December 31,Sub-account

- Page 118 and 119:

Year Ended December 31,Sub-account

- Page 120 and 121:

Year Ended December 31,Sub-account

- Page 122 and 123:

Year Ended December 31,Sub-account

- Page 124 and 125:

17. Effective May 3, 1999, American

- Page 126 and 127:

Examples of Guaranteed Minimum Deat

- Page 128 and 129:

coverage under the Rider, we will r

- Page 130 and 131:

PLEASE SEND ME A STATEMENT OF ADDIT

- Page 132 and 133:

Variable Annuity Issued by:Variable

- Page 134 and 135:

NOTESContract described herein is n

- Page 136 and 137:

American Skandia's Privacy PolicyAt