STYLE/TYPEINVESTMENT OBJECTIVES/POLICIES29PORTFOLIOADVISOR/SUB-ADVISOREach portfolio of the First Defined Portfolio Fund LLC invests in the securities of a relatively few number of issuers or in aparticular sector of the economy. Since the assets of each portfolio are invested in a limited number of issuers or a limited sectorof the economy, the net asset value of the portfolio may be more susceptible to a single adverse economic, political or regulatoryoccurrence. Certain of the portfolios may also be subject to additional market risk due to their policy of investing based on aninvestment strategy and generally not buying or selling securities in response to market fluctuations. Each portfolio’s relative lackof diversity and limited ongoing management may subject Owners to greater market risk than other portfolios.The stock selection date for each of the strategy Portfolios of the First Defined Portfolio Fund LLC is on or about December 31 st ofeach year. The holdings for each strategy Portfolio will be adjusted annually on or about December 31 st in accordance with thePortfolio’s investment strategy. At that time, the percentage relationship among the shares of each issuer held by the Portfolio isestablished. Through the next one-year period that percentage will be maintained as closely as practicable when the Portfoliomakes subsequent purchases and sales of the securities.First Trust ® 10 Uncommon Values: seeks to provide above-average capital appreciation.The Portfolio seeks to achieve its objective by investing primarily in the ten common stocksLARGE CAPBLENDINTER-NATIONALEQUITYselected by the Investment Policy Committee of Lehman Brothers Inc. ("Lehman Brothers")with the assistance of the Research Department of Lehman Brothers which, in their opinionhave the greatest potential for capital appreciation during the next year. The stocks included inthe Portfolio are adjusted annually on or about July 1 st in accordance with the selections ofLehman Brothers.The <strong>Prudential</strong> Series Fund, Inc. - SP Jennison International Growth: seeks to providelong-term growth of capital. The Portfolio pursues its objective by investing in equity-relatedsecurities of foreign issuers that the Sub-advisor believes will increase in value over a period ofyears. The Portfolio invests primarily in the common stock of large and medium-sized foreigncompanies. Under normal circumstances, the Portfolio invests at least 65% of its total assets incommon stock of foreign companies operating or based in at least five different countries. ThePortfolio looks primarily for stocks of companies whose earnings are growing at a faster ratethan other companies and that have above-average growth in earnings and cash flow, improvingprofitability, strong balance sheets, management strength and strong market share for itsproducts. The Portfolio also tries to buy such stocks at attractive prices in relation to theirgrowth prospects.First TrustAdvisors L.P.<strong>Prudential</strong>Investments LLC/JennisonAssociates LLC"Standard & Poor’s ® ," "S&P ® ," "S&P 500 ® ," "Standard & Poor’s 500," and "500" are trademarks of the McGraw-Hill Companies, Inc. and have been licensed for useby American Skandia Investment Services, Incorporated. The Portfolio is not sponsored, endorsed, sold or promoted by Standard & Poor’s and Standard & Poor’smakes no representation regarding the advisability of investing in the Portfolio.The First Trust ® 10 Uncommon Values portfolio is not sponsored or created by Lehman Brothers, Inc. ("Lehman Brothers"). Lehman Brothers' only relationship toFirst Trust is the licensing of certain trademarks and trade names of Lehman Brothers and of the "10 Uncommon Values" which is determined, composed and calculatedby Lehman Brothers without regard to First Trust or the First Trust ® 10 Uncommon Values portfolio.Dow Jones has no relationship to the ProFunds VP, other than the licensing of the Dow Jones sector indices and its service marks for use in connection with theProFunds VP. The ProFunds VP are not sponsored, endorsed, sold, or promoted by Standard & Poor's or NASDAQ, and neither Standard & Poor's nor NASDAQmakes any representations regarding the advisability of investing in the ProFunds VP.WHAT ARE THE FIXED INVESTMENT OPTIONS?We offer fixed investment options of different durations during the accumulation period. These "Fixed Allocations" earn a guaranteedfixed rate of interest for a specified period of time, called the "Guarantee Period." In most states, we offer Fixed Allocations withGuarantee Periods from 1 to 10 years. We may also offer special purpose Fixed Allocations for use with certain optional investmentprograms. We guarantee the fixed rate for the entire Guarantee Period. However, if you withdraw or transfer Account Value beforethe end of the Guarantee Period, we will adjust the value of your withdrawal or transfer based on a formula, called a "Market ValueAdjustment." The Market Value Adjustment can either be positive or negative, depending on the rates that are currently beingcredited on Fixed Allocations. Please refer to the section entitled "How does the Market Value Adjustment Work?" for a descriptionof the formula along with examples of how it is calculated. You may allocate Account Value to more than one Fixed Allocation at atime.Contract described herein is no longer available for sale.Fixed Allocations may not be available in all states. Availability of Fixed Allocations is subject to change and may differ by state andby the annuity product you purchase. Please call American Skandia at 1-800-766-4530 to determine availability of Fixed Allocationsin your state and for your annuity product.

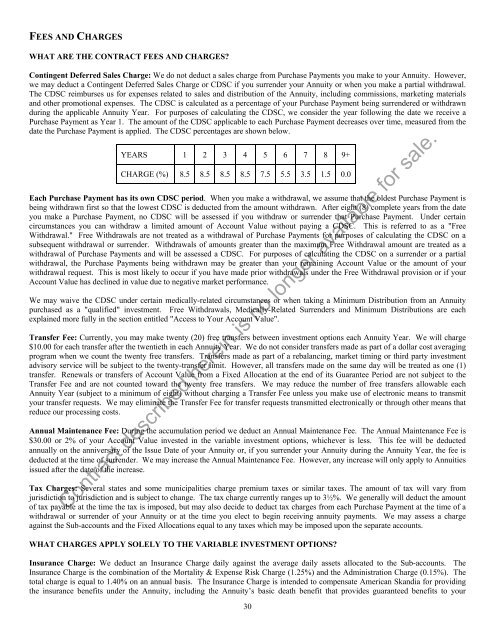

FEES AND CHARGESWHAT ARE THE CONTRACT FEES AND CHARGES?Contingent Deferred Sales Charge: We do not deduct a sales charge from Purchase Payments you make to your Annuity. However,we may deduct a Contingent Deferred Sales Charge or CDSC if you surrender your Annuity or when you make a partial withdrawal.The CDSC reimburses us for expenses related to sales and distribution of the Annuity, including commissions, marketing materialsand other promotional expenses. The CDSC is calculated as a percentage of your Purchase Payment being surrendered or withdrawnduring the applicable Annuity Year. For purposes of calculating the CDSC, we consider the year following the date we receive aPurchase Payment as Year 1. The amount of the CDSC applicable to each Purchase Payment decreases over time, measured from thedate the Purchase Payment is applied. The CDSC percentages are shown below.YEARS 1 2 3 4 5 6 7 8 9+CHARGE (%) 8.5 8.5 8.5 8.5 7.5 5.5 3.5 1.5 0.0Each Purchase Payment has its own CDSC period. When you make a withdrawal, we assume that the oldest Purchase Payment isbeing withdrawn first so that the lowest CDSC is deducted from the amount withdrawn. After eight (8) complete years from the dateyou make a Purchase Payment, no CDSC will be assessed if you withdraw or surrender that Purchase Payment. Under certaincircumstances you can withdraw a limited amount of Account Value without paying a CDSC. This is referred to as a "FreeWithdrawal." Free Withdrawals are not treated as a withdrawal of Purchase Payments for purposes of calculating the CDSC on asubsequent withdrawal or surrender. Withdrawals of amounts greater than the maximum Free Withdrawal amount are treated as awithdrawal of Purchase Payments and will be assessed a CDSC. For purposes of calculating the CDSC on a surrender or a partialwithdrawal, the Purchase Payments being withdrawn may be greater than your remaining Account Value or the amount of yourwithdrawal request. This is most likely to occur if you have made prior withdrawals under the Free Withdrawal provision or if yourAccount Value has declined in value due to negative market performance.We may waive the CDSC under certain medically-related circumstances or when taking a Minimum Distribution from an Annuitypurchased as a "qualified" investment. Free Withdrawals, Medically-Related Surrenders and Minimum Distributions are eachexplained more fully in the section entitled "Access to Your Account Value".Transfer Fee: Currently, you may make twenty (20) free transfers between investment options each Annuity Year. We will charge$10.00 for each transfer after the twentieth in each Annuity Year. We do not consider transfers made as part of a dollar cost averagingprogram when we count the twenty free transfers. Transfers made as part of a rebalancing, market timing or third party investmentadvisory service will be subject to the twenty-transfer limit. However, all transfers made on the same day will be treated as one (1)transfer. Renewals or transfers of Account Value from a Fixed Allocation at the end of its Guarantee Period are not subject to theTransfer Fee and are not counted toward the twenty free transfers. We may reduce the number of free transfers allowable eachAnnuity Year (subject to a minimum of eight) without charging a Transfer Fee unless you make use of electronic means to transmityour transfer requests. We may eliminate the Transfer Fee for transfer requests transmitted electronically or through other means thatreduce our processing costs.Annual Maintenance Fee: During the accumulation period we deduct an Annual Maintenance Fee. The Annual Maintenance Fee is$30.00 or 2% of your Account Value invested in the variable investment options, whichever is less. This fee will be deductedannually on the anniversary of the Issue Date of your Annuity or, if you surrender your Annuity during the Annuity Year, the fee isdeducted at the time of surrender. We may increase the Annual Maintenance Fee. However, any increase will only apply to <strong>Annuities</strong>issued after the date of the increase.Tax Charges: Several states and some municipalities charge premium taxes or similar taxes. The amount of tax will vary fromjurisdiction to jurisdiction and is subject to change. The tax charge currently ranges up to 3½%. We generally will deduct the amountof tax payable at the time the tax is imposed, but may also decide to deduct tax charges from each Purchase Payment at the time of awithdrawal or surrender of your Annuity or at the time you elect to begin receiving annuity payments. We may assess a chargeagainst the Sub-accounts and the Fixed Allocations equal to any taxes which may be imposed upon the separate accounts.Contract described herein is no longer available for sale.WHAT CHARGES APPLY SOLELY TO THE VARIABLE INVESTMENT OPTIONS?Insurance Charge: We deduct an Insurance Charge daily against the average daily assets allocated to the Sub-accounts. TheInsurance Charge is the combination of the Mortality & Expense Risk Charge (1.25%) and the Administration Charge (0.15%). Thetotal charge is equal to 1.40% on an annual basis. The Insurance Charge is intended to compensate American Skandia for providingthe insurance benefits under the Annuity, including the Annuity’s basic death benefit that provides guaranteed benefits to your30

- Page 1 and 2: Effective January 1, 2008, American

- Page 4 and 5: HOW DO I PURCHASE THIS ANNUITY?We s

- Page 6 and 7: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 8 and 9: SUMMARY OF CONTRACT FEES AND CHARGE

- Page 10 and 11: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 12 and 13: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 14 and 15: Effective close of business June 28

- Page 16 and 17: STYLE/TYPESMALL CAPGROWTHSMALL CAPV

- Page 18 and 19: STYLE/TYPELARGE CAPGROWTHLARGE CAPG

- Page 20 and 21: STYLE/TYPEBALANCEDBALANCEDASSETALLO

- Page 22 and 23: STYLE/TYPESTRATEGICORTACTICALALLOCA

- Page 24 and 25: STYLE/TYPELARGE CAPEQUITYLARGE CAPE

- Page 26 and 27: STYLE/TYPESECTORSECTORSECTORSECTORS

- Page 28 and 29: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 32 and 33: eneficiaries even if the market dec

- Page 34 and 35: • Annuitant: The Annuitant is the

- Page 36 and 37: Credits Applied to Purchase Payment

- Page 38 and 39: ARE THERE RESTRICTIONS OR CHARGES O

- Page 40 and 41: Allocations during prolonged market

- Page 42 and 43: To the extent permitted by law, we

- Page 44 and 45: Certain provisions of this benefit

- Page 46 and 47: When we determine if a CDSC applies

- Page 48 and 49: You may also annuitize your contrac

- Page 50 and 51: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 52 and 53: Beneficiary to pay taxes on your An

- Page 54 and 55: AMERICAN SKANDIA’S ANNUITY REWARD

- Page 56 and 57: When do you determine the Death Ben

- Page 58 and 59: WHAT HAPPENS TO MY UNITS WHEN THERE

- Page 60 and 61: • Then, from any "income on the c

- Page 62 and 63: The IRS has released Treasury regul

- Page 64 and 65: Prudential Financial is a New Jerse

- Page 66 and 67: Service Fees Payable to American Sk

- Page 68 and 69: INCORPORATION OF CERTAIN DOCUMENTS

- Page 70 and 71: APPENDIX A - FINANCIAL INFORMATION

- Page 72 and 73: MANAGEMENT’S DISCUSSION AND ANALY

- Page 74 and 75: The Company’s income tax (benefit

- Page 76 and 77: 31, 2001. The estimated present val

- Page 78 and 79: interest rate risk from contracts t

- Page 80 and 81:

AUDITED CONSOLIDATED FINANCIAL STAT

- Page 82 and 83:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 84 and 85:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 86 and 87:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 88 and 89:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 90 and 91:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 92 and 93:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 94 and 95:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 96 and 97:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 98 and 99:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 100 and 101:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 102 and 103:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 104 and 105:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 106 and 107:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 108 and 109:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 110 and 111:

Year Ended December 31,Sub-account

- Page 112 and 113:

Year Ended December 31,Sub-account

- Page 114 and 115:

Year Ended December 31,Sub-account

- Page 116 and 117:

Year Ended December 31,Sub-account

- Page 118 and 119:

Year Ended December 31,Sub-account

- Page 120 and 121:

Year Ended December 31,Sub-account

- Page 122 and 123:

Year Ended December 31,Sub-account

- Page 124 and 125:

17. Effective May 3, 1999, American

- Page 126 and 127:

Examples of Guaranteed Minimum Deat

- Page 128 and 129:

coverage under the Rider, we will r

- Page 130 and 131:

PLEASE SEND ME A STATEMENT OF ADDIT

- Page 132 and 133:

Variable Annuity Issued by:Variable

- Page 134 and 135:

NOTESContract described herein is n

- Page 136 and 137:

American Skandia's Privacy PolicyAt