STYLE/TYPELARGE CAPGROWTHLARGE CAPGROWTHLARGE CAPGROWTHLARGE CAPVALUELARGE CAPBLENDLARGE CAPVALUEINVESTMENT OBJECTIVES/POLICIESAST Marsico Capital Growth: seeks capital growth. Income realization is not an investmentobjective and any income realized on the Portfolio’s investments, therefore, will be incidental tothe Portfolio’s objective. The Portfolio will pursue its objective by investing primarily incommon stocks of larger, more established companies. In selecting investments for thePortfolio, the Sub-advisor uses an approach that combines "top down" economic analysis with"bottom up" stock selection. The "top down" approach identifies sectors, industries andcompanies that should benefit from the trends the Sub-advisor has observed. The Sub-advisorthen looks for individual companies with earnings growth potential that may not be recognizedby the market at large, a "bottom up" stock selection.AST Goldman Sachs Concentrated Growth (f/k/a AST JanCap Growth): seeks growth ofcapital in a manner consistent with the preservation of capital. Realization of income is not asignificant investment consideration and any income realized on the Portfolio’s investments,therefore, will be incidental to the Portfolio’s objective. The Portfolio will pursue its objectiveby investing primarily in equity securities of companies that the Sub-advisor believes havepotential to achieve capital appreciation over the long-term. The Portfolio seeks to achieve itsinvestment objective by investing, under normal circumstances, in approximately 30 – 45companies that are considered by the Sub-advisor to be positioned for long-term growth.AST DeAM Large-Cap Growth: seeks maximum growth of capital by investing primarily inthe growth stocks of larger companies. The Portfolio pursues its objective, under normalmarket conditions, by primarily investing at least 80% of its total assets in the equity securitiesof large-sized companies included in the Russell 1000 ® Growth Index. The Sub-advisoremploys an investment strategy designed to maintain a portfolio of equity securities whichapproximates the market risk of those stocks included in the Russell 1000 ® Growth Index, butwhich attempts to outperform the Russell 1000 ® Growth Index through active stock selection.AST DeAM Large-Cap Value (f/k/a AST Janus Strategic Value): seeks maximum growth ofcapital by investing primarily in the value stocks of larger companies. The Portfolio pursues itsobjective, under normal market conditions, by primarily investing at least 80% of the value ofits assets in the equity securities of large-sized companies included in the Russell 1000 ® ValueIndex. The Sub-advisor employs an investment strategy designed to maintain a portfolio ofequity securities which approximates the market risk of those stocks included in the Russell1000 ® Value Index, but which attempts to outperform the Russell 1000 ® Value Index throughactive stock selection.AST Alliance/Bernstein Growth + Value: seeks capital growth by investing approximately50% of its assets in growth stocks of large companies and approximately 50% of its assets invalue stocks of large companies. The Portfolio will invest primarily in commons tocks of largeU.S. companies included in the Russell 1000 ® Index (the "Russell 1000 ® "). The Russell 1000 ®is a market capitalization-weighted index that measures the performance of the 1,000 largestU.S. companies. Normally, about 60-85 companies will be represented in the Portfolio, with25-35 companies primarily from the Russell 1000 ® Growth Index constituting approximately50% of the Portfolio's net assets and 35-50 companies primarily from the Russell 1000 ® ValueIndex constituting the remainder of the Portfolio's net assets. There will be a periodicrebalancing of each segment's assets to take account of market fluctuations in order to maintainthe approximately equal allocation.AST Sanford Bernstein Core Value: seeks long-term capital growth by investing primarily incommon stocks. The Sub-advisor expects that the majority of the Portfolio's assets will beinvested in the common stocks of large companies that appear to be undervalued. Among otherthings, the Portfolio seeks to identify compelling buying opportunities created when companiesare undervalued on the basis of investor reactions to near-term problems or circumstances eventhough their long-term prospects remain sound. The Sub-advisor seeks to identify individualcompanies with earnings growth potential that may not be recognized by the market at large.PORTFOLIOADVISOR/SUB-ADVISORMarsico CapitalManagement, LLCGoldman Sachs AssetManagementDeutsche AssetManagement, Inc.Deutsche AssetManagement, Inc.Alliance CapitalManagement, L.P.Contract described herein is no longer available for sale.Sanford C. Bernstein& Co., LLC17

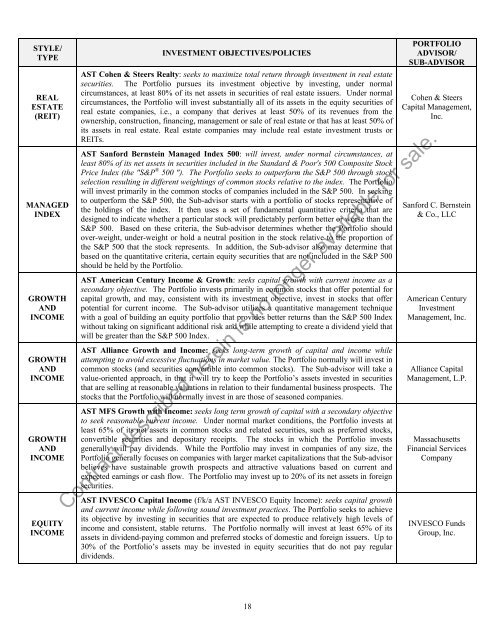

STYLE/TYPEREALESTATE(REIT)MANAGEDINDEXGROWTHANDINCOMEGROWTHANDINCOMEGROWTHANDINCOMEEQUITYINCOMEINVESTMENT OBJECTIVES/POLICIESAST Cohen & Steers Realty: seeks to maximize total return through investment in real estatesecurities. The Portfolio pursues its investment objective by investing, under normalcircumstances, at least 80% of its net assets in securities of real estate issuers. Under normalcircumstances, the Portfolio will invest substantially all of its assets in the equity securities ofreal estate companies, i.e., a company that derives at least 50% of its revenues from theownership, construction, financing, management or sale of real estate or that has at least 50% ofits assets in real estate. Real estate companies may include real estate investment trusts orREITs.AST Sanford Bernstein Managed Index 500: will invest, under normal circumstances, atleast 80% of its net assets in securities included in the Standard & Poor's 500 Composite StockPrice Index (the "S&P ® 500 "). The Portfolio seeks to outperform the S&P 500 through stockselection resulting in different weightings of common stocks relative to the index. The Portfoliowill invest primarily in the common stocks of companies included in the S&P 500. In seekingto outperform the S&P 500, the Sub-advisor starts with a portfolio of stocks representative ofthe holdings of the index. It then uses a set of fundamental quantitative criteria that aredesigned to indicate whether a particular stock will predictably perform better or worse than theS&P 500. Based on these criteria, the Sub-advisor determines whether the Portfolio shouldover-weight, under-weight or hold a neutral position in the stock relative to the proportion ofthe S&P 500 that the stock represents. In addition, the Sub-advisor also may determine thatbased on the quantitative criteria, certain equity securities that are not included in the S&P 500should be held by the Portfolio.AST American Century Income & Growth: seeks capital growth with current income as asecondary objective. The Portfolio invests primarily in common stocks that offer potential forcapital growth, and may, consistent with its investment objective, invest in stocks that offerpotential for current income. The Sub-advisor utilizes a quantitative management techniquewith a goal of building an equity portfolio that provides better returns than the S&P 500 Indexwithout taking on significant additional risk and while attempting to create a dividend yield thatwill be greater than the S&P 500 Index.AST Alliance Growth and Income: seeks long-term growth of capital and income whileattempting to avoid excessive fluctuations in market value. The Portfolio normally will invest incommon stocks (and securities convertible into common stocks). The Sub-advisor will take avalue-oriented approach, in that it will try to keep the Portfolio’s assets invested in securitiesthat are selling at reasonable valuations in relation to their fundamental business prospects. Thestocks that the Portfolio will normally invest in are those of seasoned companies.AST MFS Growth with Income: seeks long term growth of capital with a secondary objectiveto seek reasonable current income. Under normal market conditions, the Portfolio invests atleast 65% of its net assets in common stocks and related securities, such as preferred stocks,convertible securities and depositary receipts. The stocks in which the Portfolio investsgenerally will pay dividends. While the Portfolio may invest in companies of any size, thePortfolio generally focuses on companies with larger market capitalizations that the Sub-advisorbelieves have sustainable growth prospects and attractive valuations based on current andexpected earnings or cash flow. The Portfolio may invest up to 20% of its net assets in foreignsecurities.AST INVESCO Capital Income (f/k/a AST INVESCO Equity Income): seeks capital growthand current income while following sound investment practices. The Portfolio seeks to achieveits objective by investing in securities that are expected to produce relatively high levels ofincome and consistent, stable returns. The Portfolio normally will invest at least 65% of itsassets in dividend-paying common and preferred stocks of domestic and foreign issuers. Up to30% of the Portfolio’s assets may be invested in equity securities that do not pay regulardividends.PORTFOLIOADVISOR/SUB-ADVISORCohen & SteersCapital Management,Inc.Sanford C. Bernstein& Co., LLCAmerican CenturyInvestmentManagement, Inc.Alliance CapitalManagement, L.P.MassachusettsFinancial ServicesCompanyContract described herein is no longer available for sale.INVESCO FundsGroup, Inc.18

- Page 1 and 2: Effective January 1, 2008, American

- Page 4 and 5: HOW DO I PURCHASE THIS ANNUITY?We s

- Page 6 and 7: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 8 and 9: SUMMARY OF CONTRACT FEES AND CHARGE

- Page 10 and 11: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 12 and 13: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 14 and 15: Effective close of business June 28

- Page 16 and 17: STYLE/TYPESMALL CAPGROWTHSMALL CAPV

- Page 20 and 21: STYLE/TYPEBALANCEDBALANCEDASSETALLO

- Page 22 and 23: STYLE/TYPESTRATEGICORTACTICALALLOCA

- Page 24 and 25: STYLE/TYPELARGE CAPEQUITYLARGE CAPE

- Page 26 and 27: STYLE/TYPESECTORSECTORSECTORSECTORS

- Page 28 and 29: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 30 and 31: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 32 and 33: eneficiaries even if the market dec

- Page 34 and 35: • Annuitant: The Annuitant is the

- Page 36 and 37: Credits Applied to Purchase Payment

- Page 38 and 39: ARE THERE RESTRICTIONS OR CHARGES O

- Page 40 and 41: Allocations during prolonged market

- Page 42 and 43: To the extent permitted by law, we

- Page 44 and 45: Certain provisions of this benefit

- Page 46 and 47: When we determine if a CDSC applies

- Page 48 and 49: You may also annuitize your contrac

- Page 50 and 51: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 52 and 53: Beneficiary to pay taxes on your An

- Page 54 and 55: AMERICAN SKANDIA’S ANNUITY REWARD

- Page 56 and 57: When do you determine the Death Ben

- Page 58 and 59: WHAT HAPPENS TO MY UNITS WHEN THERE

- Page 60 and 61: • Then, from any "income on the c

- Page 62 and 63: The IRS has released Treasury regul

- Page 64 and 65: Prudential Financial is a New Jerse

- Page 66 and 67: Service Fees Payable to American Sk

- Page 68 and 69:

INCORPORATION OF CERTAIN DOCUMENTS

- Page 70 and 71:

APPENDIX A - FINANCIAL INFORMATION

- Page 72 and 73:

MANAGEMENT’S DISCUSSION AND ANALY

- Page 74 and 75:

The Company’s income tax (benefit

- Page 76 and 77:

31, 2001. The estimated present val

- Page 78 and 79:

interest rate risk from contracts t

- Page 80 and 81:

AUDITED CONSOLIDATED FINANCIAL STAT

- Page 82 and 83:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 84 and 85:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 86 and 87:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 88 and 89:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 90 and 91:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 92 and 93:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 94 and 95:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 96 and 97:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 98 and 99:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 100 and 101:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 102 and 103:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 104 and 105:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 106 and 107:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 108 and 109:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 110 and 111:

Year Ended December 31,Sub-account

- Page 112 and 113:

Year Ended December 31,Sub-account

- Page 114 and 115:

Year Ended December 31,Sub-account

- Page 116 and 117:

Year Ended December 31,Sub-account

- Page 118 and 119:

Year Ended December 31,Sub-account

- Page 120 and 121:

Year Ended December 31,Sub-account

- Page 122 and 123:

Year Ended December 31,Sub-account

- Page 124 and 125:

17. Effective May 3, 1999, American

- Page 126 and 127:

Examples of Guaranteed Minimum Deat

- Page 128 and 129:

coverage under the Rider, we will r

- Page 130 and 131:

PLEASE SEND ME A STATEMENT OF ADDIT

- Page 132 and 133:

Variable Annuity Issued by:Variable

- Page 134 and 135:

NOTESContract described herein is n

- Page 136 and 137:

American Skandia's Privacy PolicyAt