STYLE/TYPEINVESTMENT OBJECTIVES/POLICIESPORTFOLIOADVISOR/SUB-ADVISORThe NASDAQ-100 Index ® is a market capitalization weighted index that includes 100 of the largest domestic and internationalnon-financial companies listed on The NASDAQ Stock Market.NASDAQ 100NASDAQ 100NASDAQ 100ProFund VP OTC: seeks daily investment results, before fees and expenses, that correspondto the daily performance of the NASDAQ-100 Index ® . "OTC" in the name of ProFund VP OTCreflers to securities that do not trade on a U.S. securities exchange, as registered under theSecurities Exchange Act of 1934.ProFund VP Short OTC: seeks daily investment results, before fees and expenses, thatcorrespond to the inverse (opposite) of the daily performance of the NASDAQ-100 Index ® . IfProFund VP Short OTC is successful in meeting its objective, its net asset value should gainapproximately the same, on a percentage basis, as any decrease in the NASDAQ-100 Index ®when the Index declines on a given day. Conversely, its net asset value should loseapproximately the same, on a percentage basis, as any increase in the Index when the Indexrises on a given day. "OTC" in the name of ProFund VP Short OTC refers to securities that donot trade on a U.S. securities exchange, as registered under the Securities Exchange Act of1934.ProFund VP UltraOTC: seeks daily investment results, before fees and expenses, thatcorrespond to twice (200%) the daily performance of the NASDAQ-100 Index ® . If ProFund VPUltraOTC is successful in meeting its objective, its net asset value should gain approximatelytwice as much, on a percentage basis, as the NASDAQ-100 Index ® when the Index rises on agiven day. Conversely, its net asset value should lose approximately twice as much, on apercentage basis, as the Index when the Index declines on a given day. "OTC" in the name ofProFund VP UltraOTC refers to securities that do not trade on a U.S. securities exchange, asregistered under the Securities Exchange Act of 1934.ProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCThe S&P MidCap 400 Index ® is a widely used measure of mid-sized company U.S. stock market performance. Companies areselected for inclusion in the Index by Standard & Poor's ® for being U.S. companies with adequate liquidity, appropriate marketcapitalization, financial viability and public float.S&PMIDCAP 400S&PMIDCAP 400S&PMIDCAP 400ProFund VP Mid-Cap Value: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the S&P MidCap 400/Barra Value Index ® . The S&PMidCap400/Barra Value Index ® is designed to differentiate between fast growing companiesand slower growing or undervalued companies. Standard & Poor's and Barra cooperate toemploy a price-to-book value calculation whereby the market capitalization of the S&P MidCap400 Index ® is divided equally between growth and value. The Index is rebalanced twice peryear.ProFund VP Mid-Cap Growth: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the S&P MidCap 400/Barra Growth Index ® . The S&PMidCap 400/Barra Growth Index ® is designed to differentiate between fast growing companiesand slower growing or undervalued companies. Standard & Poor's and Barra cooperate toemploy a price-to-book value calculation whereby the market capitalization of the S&P MidCap400 Index ® is divided equally between growth and value. The Index is rebalanced twice peryear..ProFund VP UltraMid-Cap: seeks daily investment results, before fees and expenses, thatcorrespond to twice (200%) the daily performance of the S&P MidCap 400 Index ® . If ProFundVP UltraMid-Cap is successful in meeting its objective, its net asset value should gainapproximately twice as much, on a percentage basis, as the S&P MidCap 400 Index ® when theIndex rises on a given day. Conversely, its net asset value should lose approximately twice asmuch, on a percentage basis, as the Index when the Index declines on a given day.ProFund AdvisorsLLCProFund AdvisorsLLCContract described herein is no longer available for sale.ProFund AdvisorsLLC27

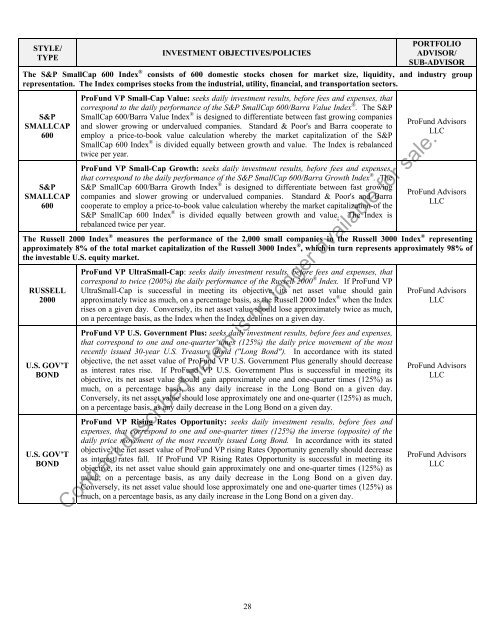

STYLE/TYPEINVESTMENT OBJECTIVES/POLICIESPORTFOLIOADVISOR/SUB-ADVISORThe S&P SmallCap 600 Index ® consists of 600 domestic stocks chosen for market size, liquidity, and industry grouprepresentation. The Index comprises stocks from the industrial, utility, financial, and transportation sectors.S&PSMALLCAP600S&PSMALLCAP600ProFund VP Small-Cap Value: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the S&P SmallCap 600/Barra Value Index ® . The S&PSmallCap 600/Barra Value Index ® is designed to differentiate between fast growing companiesand slower growing or undervalued companies. Standard & Poor's and Barra cooperate toemploy a price-to-book value calculation whereby the market capitalization of the S&PSmallCap 600 Index ® is divided equally between growth and value. The Index is rebalancedtwice per year.ProFund VP Small-Cap Growth: seeks daily investment results, before fees and expenses,that correspond to the daily performance of the S&P SmallCap 600/Barra Growth Index ® . TheS&P SmallCap 600/Barra Growth Index ® is designed to differentiate between fast growingcompanies and slower growing or undervalued companies. Standard & Poor's and Barracooperate to employ a price-to-book value calculation whereby the market capitalization-of theS&P SmallCap 600 Index ® is divided equally between growth and value. The Index isrebalanced twice per year.ProFund AdvisorsLLCProFund AdvisorsLLCThe Russell 2000 Index ® measures the performance of the 2,000 small companies in the Russell 3000 Index ® representingapproximately 8% of the total market capitalization of the Russell 3000 Index ® , which in turn represents approximately 98% ofthe investable U.S. equity market.RUSSELL2000U.S. GOV’TBONDU.S. GOV’TBONDProFund VP UltraSmall-Cap: seeks daily investment results, before fees and expenses, thatcorrespond to twice (200%) the daily performance of the Russell 2000 ® Index. If ProFund VPUltraSmall-Cap is successful in meeting its objective, its net asset value should gainapproximately twice as much, on a percentage basis, as the Russell 2000 Index ® when the Indexrises on a given day. Conversely, its net asset value should lose approximately twice as much,on a percentage basis, as the Index when the Index declines on a given day.ProFund VP U.S. Government Plus: seeks daily investment results, before fees and expenses,that correspond to one and one-quarter times (125%) the daily price movement of the mostrecently issued 30-year U.S. Treasury Bond ("Long Bond"). In accordance with its statedobjective, the net asset value of ProFund VP U.S. Government Plus generally should decreaseas interest rates rise. If ProFund VP U.S. Government Plus is successful in meeting itsobjective, its net asset value should gain approximately one and one-quarter times (125%) asmuch, on a percentage basis, as any daily increase in the Long Bond on a given day.Conversely, its net asset value should lose approximately one and one-quarter (125%) as much,on a percentage basis, as any daily decrease in the Long Bond on a given day.ProFund VP Rising Rates Opportunity: seeks daily investment results, before fees andexpenses, that correspond to one and one-quarter times (125%) the inverse (opposite) of thedaily price movement of the most recently issued Long Bond. In accordance with its statedobjective, the net asset value of ProFund VP rising Rates Opportunity generally should decreaseas interest rates fall. If ProFund VP Rising Rates Opportunity is successful in meeting itsobjective, its net asset value should gain approximately one and one-quarter times (125%) asmuch, on a percentage basis, as any daily decrease in the Long Bond on a given day.Conversely, its net asset value should lose approximately one and one-quarter times (125%) asmuch, on a percentage basis, as any daily increase in the Long Bond on a given day.ProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCContract described herein is no longer available for sale.28

- Page 1 and 2: Effective January 1, 2008, American

- Page 4 and 5: HOW DO I PURCHASE THIS ANNUITY?We s

- Page 6 and 7: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 8 and 9: SUMMARY OF CONTRACT FEES AND CHARGE

- Page 10 and 11: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 12 and 13: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 14 and 15: Effective close of business June 28

- Page 16 and 17: STYLE/TYPESMALL CAPGROWTHSMALL CAPV

- Page 18 and 19: STYLE/TYPELARGE CAPGROWTHLARGE CAPG

- Page 20 and 21: STYLE/TYPEBALANCEDBALANCEDASSETALLO

- Page 22 and 23: STYLE/TYPESTRATEGICORTACTICALALLOCA

- Page 24 and 25: STYLE/TYPELARGE CAPEQUITYLARGE CAPE

- Page 26 and 27: STYLE/TYPESECTORSECTORSECTORSECTORS

- Page 30 and 31: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 32 and 33: eneficiaries even if the market dec

- Page 34 and 35: • Annuitant: The Annuitant is the

- Page 36 and 37: Credits Applied to Purchase Payment

- Page 38 and 39: ARE THERE RESTRICTIONS OR CHARGES O

- Page 40 and 41: Allocations during prolonged market

- Page 42 and 43: To the extent permitted by law, we

- Page 44 and 45: Certain provisions of this benefit

- Page 46 and 47: When we determine if a CDSC applies

- Page 48 and 49: You may also annuitize your contrac

- Page 50 and 51: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 52 and 53: Beneficiary to pay taxes on your An

- Page 54 and 55: AMERICAN SKANDIA’S ANNUITY REWARD

- Page 56 and 57: When do you determine the Death Ben

- Page 58 and 59: WHAT HAPPENS TO MY UNITS WHEN THERE

- Page 60 and 61: • Then, from any "income on the c

- Page 62 and 63: The IRS has released Treasury regul

- Page 64 and 65: Prudential Financial is a New Jerse

- Page 66 and 67: Service Fees Payable to American Sk

- Page 68 and 69: INCORPORATION OF CERTAIN DOCUMENTS

- Page 70 and 71: APPENDIX A - FINANCIAL INFORMATION

- Page 72 and 73: MANAGEMENT’S DISCUSSION AND ANALY

- Page 74 and 75: The Company’s income tax (benefit

- Page 76 and 77: 31, 2001. The estimated present val

- Page 78 and 79:

interest rate risk from contracts t

- Page 80 and 81:

AUDITED CONSOLIDATED FINANCIAL STAT

- Page 82 and 83:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 84 and 85:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 86 and 87:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 88 and 89:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 90 and 91:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 92 and 93:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 94 and 95:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 96 and 97:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 98 and 99:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 100 and 101:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 102 and 103:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 104 and 105:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 106 and 107:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 108 and 109:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 110 and 111:

Year Ended December 31,Sub-account

- Page 112 and 113:

Year Ended December 31,Sub-account

- Page 114 and 115:

Year Ended December 31,Sub-account

- Page 116 and 117:

Year Ended December 31,Sub-account

- Page 118 and 119:

Year Ended December 31,Sub-account

- Page 120 and 121:

Year Ended December 31,Sub-account

- Page 122 and 123:

Year Ended December 31,Sub-account

- Page 124 and 125:

17. Effective May 3, 1999, American

- Page 126 and 127:

Examples of Guaranteed Minimum Deat

- Page 128 and 129:

coverage under the Rider, we will r

- Page 130 and 131:

PLEASE SEND ME A STATEMENT OF ADDIT

- Page 132 and 133:

Variable Annuity Issued by:Variable

- Page 134 and 135:

NOTESContract described herein is n

- Page 136 and 137:

American Skandia's Privacy PolicyAt