STYLE/TYPEBALANCEDBALANCEDASSETALLOCA-TIONGLOBALBONDHIGHYIELDBONDINVESTMENT OBJECTIVES/POLICIESAST DeAM Global Allocation: seeks a high level of total return by investing primarily in adiversified portfolio of mutual funds. The Portfolio seeks to achieve its investment objective byinvesting in several other AST Portfolios ("Underlying Portfolios"). The Portfolio intends itsstrategy of investing in combinations of Underlying Portfolios to result in investmentdiversification that an investor could otherwise achieve only by holding numerous investments.The Portfolio is expected to be invested in at least six such Underlying Portfolios at any time.It is expected that the investment objectives of such AST Portfolios will be diversified.AST American Century Strategic Balanced: seeks capital growth and current income. TheSub-advisor intends to maintain approximately 60% of the Portfolio’s assets in equity securitiesand the remainder in bonds and other fixed income securities. Both the Portfolio’s equity andfixed income investments will fluctuate in value. The equity securities will fluctuate dependingon the performance of the companies that issued them, general market and economicconditions, and investor confidence. The fixed income investments will be affected primarilyby rising or falling interest rates and the credit quality of the issuers.AST T. Rowe Price Asset Allocation: seeks a high level of total return by investing primarilyin a diversified portfolio of fixed income and equity securities. The Portfolio normally investsapproximately 60% of its total assets in equity securities and 40% in fixed income securities.The Sub-advisor concentrates common stock investments in larger, more establishedcompanies, but the Portfolio may include small and medium-sized companies with good growthprospects. The fixed income portion of the Portfolio will be allocated among investment gradesecurities, high yield or "junk" bonds, foreign high quality debt securities and cash reserves.AST T. Rowe Price Global Bond: seeks to provide high current income and capital growth byinvesting in high-quality foreign and U.S. dollar-denominated bonds. The Portfolio will investat least 80% of its total assets in all types of high quality bonds including those issued orguaranteed by U.S. or foreign governments or their agencies and by foreign authorities,provinces and municipalities as well as investment grade corporate bonds and mortgage andasset-backed securities of U.S. and foreign issuers. The Portfolio generally invests in countrieswhere the combination of fixed-income returns and currency exchange rates appears attractive,or, if the currency trend is unfavorable, where the Sub-advisor believes that the currency riskcan be minimized through hedging. The Portfolio may also invest up to 20% of its assets in theaggregate in below investment-grade, high-risk bonds ("junk bonds"). In addition, the Portfoliomay invest up to 30% of its assets in mortgage-backed (including derivatives, such ascollateralized mortgage obligations and stripped mortgage securities) and asset-backedsecurities.AST Federated High Yield: seeks high current income by investing primarily in a diversifiedportfolio of fixed income securities. The Portfolio will invest at least 80% of its assets in fixedincome securities rated BBB and below. These fixed income securities may include preferredstocks, convertible securities, bonds, debentures, notes, equipment lease certificates andequipment trust certificates. A fund that invests primarily in lower-rated fixed incomesecurities will be subject to greater risk and share price fluctuation than a typical fixed incomefund, and may be subject to an amount of risk that is comparable to or greater than many equityfunds.PORTFOLIOADVISOR/SUB-ADVISORDeutsche AssetManagement, Inc.American CenturyInvestmentManagement, Inc.T. Rowe PriceAssociates, Inc.T. Rowe PriceInternational, Inc.Federated InvestmentCounselingContract described herein is no longer available for sale.19

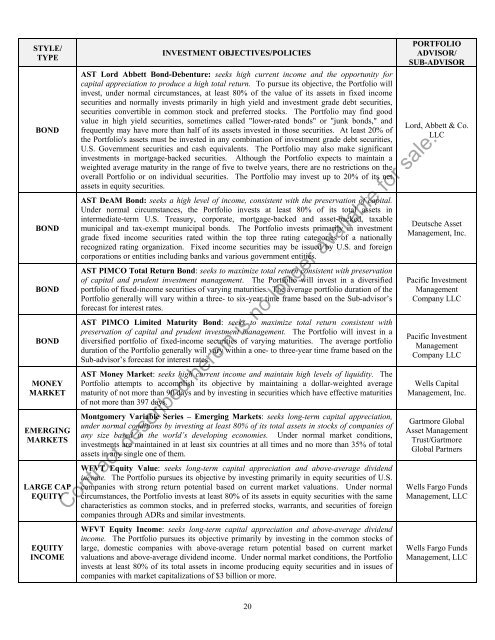

STYLE/TYPEBONDBONDBONDBONDMONEYMARKETEMERGINGMARKETSLARGE CAPEQUITYEQUITYINCOMEINVESTMENT OBJECTIVES/POLICIESAST Lord Abbett Bond-Debenture: seeks high current income and the opportunity forcapital appreciation to produce a high total return. To pursue its objective, the Portfolio willinvest, under normal circumstances, at least 80% of the value of its assets in fixed incomesecurities and normally invests primarily in high yield and investment grade debt securities,securities convertible in common stock and preferred stocks. The Portfolio may find goodvalue in high yield securities, sometimes called "lower-rated bonds" or "junk bonds," andfrequently may have more than half of its assets invested in those securities. At least 20% ofthe Portfolio's assets must be invested in any combination of investment grade debt securities,U.S. Government securities and cash equivalents. The Portfolio may also make significantinvestments in mortgage-backed securities. Although the Portfolio expects to maintain aweighted average maturity in the range of five to twelve years, there are no restrictions on theoverall Portfolio or on individual securities. The Portfolio may invest up to 20% of its netassets in equity securities.AST DeAM Bond: seeks a high level of income, consistent with the preservation of capital.Under normal circumstances, the Portfolio invests at least 80% of its total assets inintermediate-term U.S. Treasury, corporate, mortgage-backed and asset-backed, taxablemunicipal and tax-exempt municipal bonds. The Portfolio invests primarily in investmentgrade fixed income securities rated within the top three rating categories of a nationallyrecognized rating organization. Fixed income securities may be issued by U.S. and foreigncorporations or entities including banks and various government entities.AST PIMCO Total Return Bond: seeks to maximize total return consistent with preservationof capital and prudent investment management. The Portfolio will invest in a diversifiedportfolio of fixed-income securities of varying maturities. The average portfolio duration of thePortfolio generally will vary within a three- to six-year time frame based on the Sub-advisor’sforecast for interest rates.AST PIMCO Limited Maturity Bond: seeks to maximize total return consistent withpreservation of capital and prudent investment management. The Portfolio will invest in adiversified portfolio of fixed-income securities of varying maturities. The average portfolioduration of the Portfolio generally will vary within a one- to three-year time frame based on theSub-advisor’s forecast for interest rates.AST Money Market: seeks high current income and maintain high levels of liquidity. ThePortfolio attempts to accomplish its objective by maintaining a dollar-weighted averagematurity of not more than 90 days and by investing in securities which have effective maturitiesof not more than 397 days.Montgomery Variable Series – Emerging Markets: seeks long-term capital appreciation,under normal conditions by investing at least 80% of its total assets in stocks of companies ofany size based in the world’s developing economies. Under normal market conditions,investments are maintained in at least six countries at all times and no more than 35% of totalassets in any single one of them.WFVT Equity Value: seeks long-term capital appreciation and above-average dividendincome. The Portfolio pursues its objective by investing primarily in equity securities of U.S.companies with strong return potential based on current market valuations. Under normalcircumstances, the Portfolio invests at least 80% of its assets in equity securities with the samecharacteristics as common stocks, and in preferred stocks, warrants, and securities of foreigncompanies through ADRs and similar investments.PORTFOLIOADVISOR/SUB-ADVISORLord, Abbett & Co.LLCDeutsche AssetManagement, Inc.Pacific InvestmentManagementCompany LLCPacific InvestmentManagementCompany LLCWells CapitalManagement, Inc.Gartmore GlobalAsset ManagementTrust/GartmoreGlobal PartnersWells Fargo FundsManagement, LLCContract described herein is no longer available for sale.WFVT Equity Income: seeks long-term capital appreciation and above-average dividendincome. The Portfolio pursues its objective primarily by investing in the common stocks oflarge, domestic companies with above-average return potential based on current marketvaluations and above-average dividend income. Under normal market conditions, the Portfolioinvests at least 80% of its total assets in income producing equity securities and in issues ofcompanies with market capitalizations of $3 billion or more.Wells Fargo FundsManagement, LLC20

- Page 1 and 2: Effective January 1, 2008, American

- Page 4 and 5: HOW DO I PURCHASE THIS ANNUITY?We s

- Page 6 and 7: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 8 and 9: SUMMARY OF CONTRACT FEES AND CHARGE

- Page 10 and 11: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 12 and 13: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 14 and 15: Effective close of business June 28

- Page 16 and 17: STYLE/TYPESMALL CAPGROWTHSMALL CAPV

- Page 18 and 19: STYLE/TYPELARGE CAPGROWTHLARGE CAPG

- Page 22 and 23: STYLE/TYPESTRATEGICORTACTICALALLOCA

- Page 24 and 25: STYLE/TYPELARGE CAPEQUITYLARGE CAPE

- Page 26 and 27: STYLE/TYPESECTORSECTORSECTORSECTORS

- Page 28 and 29: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 30 and 31: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 32 and 33: eneficiaries even if the market dec

- Page 34 and 35: • Annuitant: The Annuitant is the

- Page 36 and 37: Credits Applied to Purchase Payment

- Page 38 and 39: ARE THERE RESTRICTIONS OR CHARGES O

- Page 40 and 41: Allocations during prolonged market

- Page 42 and 43: To the extent permitted by law, we

- Page 44 and 45: Certain provisions of this benefit

- Page 46 and 47: When we determine if a CDSC applies

- Page 48 and 49: You may also annuitize your contrac

- Page 50 and 51: HOW ARE ANNUITY PAYMENTS CALCULATED

- Page 52 and 53: Beneficiary to pay taxes on your An

- Page 54 and 55: AMERICAN SKANDIA’S ANNUITY REWARD

- Page 56 and 57: When do you determine the Death Ben

- Page 58 and 59: WHAT HAPPENS TO MY UNITS WHEN THERE

- Page 60 and 61: • Then, from any "income on the c

- Page 62 and 63: The IRS has released Treasury regul

- Page 64 and 65: Prudential Financial is a New Jerse

- Page 66 and 67: Service Fees Payable to American Sk

- Page 68 and 69: INCORPORATION OF CERTAIN DOCUMENTS

- Page 70 and 71:

APPENDIX A - FINANCIAL INFORMATION

- Page 72 and 73:

MANAGEMENT’S DISCUSSION AND ANALY

- Page 74 and 75:

The Company’s income tax (benefit

- Page 76 and 77:

31, 2001. The estimated present val

- Page 78 and 79:

interest rate risk from contracts t

- Page 80 and 81:

AUDITED CONSOLIDATED FINANCIAL STAT

- Page 82 and 83:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 84 and 85:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 86 and 87:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 88 and 89:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 90 and 91:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 92 and 93:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 94 and 95:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 96 and 97:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 98 and 99:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 100 and 101:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 102 and 103:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 104 and 105:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 106 and 107:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 108 and 109:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 110 and 111:

Year Ended December 31,Sub-account

- Page 112 and 113:

Year Ended December 31,Sub-account

- Page 114 and 115:

Year Ended December 31,Sub-account

- Page 116 and 117:

Year Ended December 31,Sub-account

- Page 118 and 119:

Year Ended December 31,Sub-account

- Page 120 and 121:

Year Ended December 31,Sub-account

- Page 122 and 123:

Year Ended December 31,Sub-account

- Page 124 and 125:

17. Effective May 3, 1999, American

- Page 126 and 127:

Examples of Guaranteed Minimum Deat

- Page 128 and 129:

coverage under the Rider, we will r

- Page 130 and 131:

PLEASE SEND ME A STATEMENT OF ADDIT

- Page 132 and 133:

Variable Annuity Issued by:Variable

- Page 134 and 135:

NOTESContract described herein is n

- Page 136 and 137:

American Skandia's Privacy PolicyAt