Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

30<br />

WEALTH CREATION<br />

Total shareholder return is a measure <strong>of</strong> the gain delivered to the shareholders <strong>of</strong><br />

the company. Returns are calculated not only in terms <strong>of</strong> the dividend per share,<br />

but also in terms <strong>of</strong> capital appreciation in the underlying investment.<br />

The management <strong>of</strong> <strong>Opto</strong> <strong>Circuits</strong> believes in rewarding shareholders<br />

handsomely, and this is reflected in the undermentioned list <strong>of</strong><br />

dividend and bonus shares announced by the company over the years:<br />

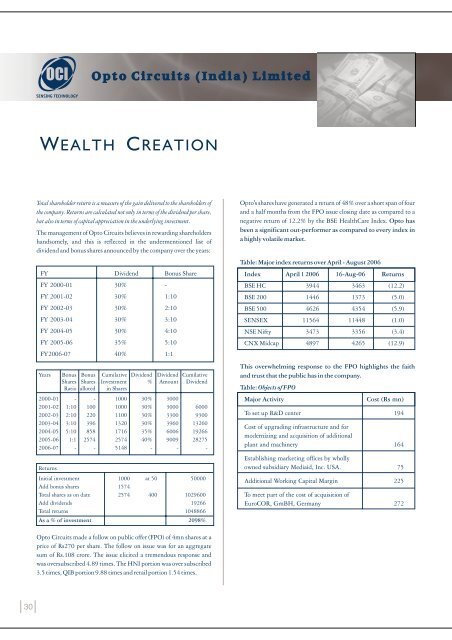

FY Dividend Bonus Share<br />

FY 2000-01 30% -<br />

FY 2001-02 30% 1:10<br />

FY 2002-03 30% 2:10<br />

FY 2003-04 30% 3:10<br />

FY 2004-05 30% 4:10<br />

FY 2005-06 35% 5:10<br />

FY2006-07 40% 1:1<br />

Years Bonus Bonus Cumilative Dividend Dividend Cumilative<br />

Shares Shares Investment % Amount Dividend<br />

Ratio alloted in Shares<br />

2000-01 - - 1000 30% 3000<br />

2001-02 1:10 100 1000 30% 3000 6000<br />

2002-03 2:10 220 1100 30% 3300 9300<br />

2003-04 3:10 396 1320 30% 3960 13260<br />

2004-05 5:10 858 1716 35% 6006 19266<br />

2005-06 1:1 2574 2574 40% 9009 28275<br />

2006-07 - - 5148 - - -<br />

Returns<br />

Initial investment 1000 at 50 50000<br />

Add bonus shares 1574<br />

Total shares as on date 2574 400 1029600<br />

Add dividends 19266<br />

Total returns 1048866<br />

Asa%<strong>of</strong>investment 2098%<br />

<strong>Opto</strong> <strong>Circuits</strong> made a follow on public <strong>of</strong>fer (FPO) <strong>of</strong> 4mn shares at a<br />

price <strong>of</strong> Rs270 per share. The follow on issue was for an aggregate<br />

sum <strong>of</strong> Rs.108 crore. The issue elicited a tremendous response and<br />

was oversubscribed 4.89 times. The HNI portion was over subscribed<br />

3.5 times, QIB portion 9.88 times and retail portion 1.54 times.<br />

<strong>Opto</strong>'s shares have generated a return <strong>of</strong> 48% over a short span <strong>of</strong> four<br />

and a half months from the FPO issue closing date as compared to a<br />

negative return <strong>of</strong> 12.2% by the BSE HealthCare Index. <strong>Opto</strong> has<br />

been a significant out-performer as compared to every index in<br />

a highly volatile market.<br />

Table: Major index returns over April - August 2006<br />

Index April 1 2006 16-Aug-06 Returns<br />

BSE HC 3944 3463 (12.2)<br />

BSE 200 1446 1373 (5.0)<br />

BSE 500 4626 4354 (5.9)<br />

SENSEX 11564 11448 (1.0)<br />

NSE Nifty 3473 3356 (3.4)<br />

CNX Midcap 4897 4265 (12.9)<br />

This overwhelming response to the FPO highlights the faith<br />

and trust that the public has in the company.<br />

Table: Objects <strong>of</strong> FPO<br />

Major Activity Cost (Rs mn)<br />

To set up R&D center 194<br />

Cost <strong>of</strong> upgrading infrastructure and for<br />

modernizing and acquisition <strong>of</strong> additional<br />

plant and machinery 164<br />

Establishing marketing <strong>of</strong>fices by wholly<br />

owned subsidiary Mediaid, Inc. USA. 75<br />

Additional Working Capital Margin 225<br />

To meet part <strong>of</strong> the cost <strong>of</strong> acquisition <strong>of</strong><br />

EuroCOR, GmBH, Germany 272