Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMPANY PERFORMANCE<br />

Your company has recorded yet another year <strong>of</strong> good performance<br />

during the year under review. The total revenue at Rs.1184.48<br />

million for the year ended March 2006 as against Rs.783.75 million<br />

for the same period during the previous year higher by 51% and pr<strong>of</strong>it<br />

at Rs.350.62 million as <strong>of</strong> March 2006 as against Rs.190.43 million<br />

for the same period during the previous year million represents as<br />

increase <strong>of</strong> 84% over the previous year.<br />

DIVIDEND<br />

Considering the performance <strong>of</strong> the Company, your <strong>Directors</strong>' are<br />

pleased to recommend an Dividend at the rate <strong>of</strong> 40% for the year<br />

ended 31st March 2006 on the equity share capital, which amounts<br />

Rs.4.00 per share.<br />

MANAGEMENT DISCUSSION AND ANALYSIS<br />

Executive Summary<br />

Your Company is engaged in the Design, Development,<br />

Manufacturing, Marketing and Distribution <strong>of</strong> Medical Electronic<br />

Devices and Medical monitoring products employing Sensing and<br />

Detection techniques. In the past fourteen years the company has<br />

established itself as a leading supplier <strong>of</strong> noninvasive OEM Optical<br />

sensors in the field <strong>of</strong> Patient monitoring systems.<br />

The company has received US FDA approval for its SpO2 products. It<br />

has also added two new products to its patient monitoring range.<br />

32<br />

DIRECTORS REPORT<br />

st<br />

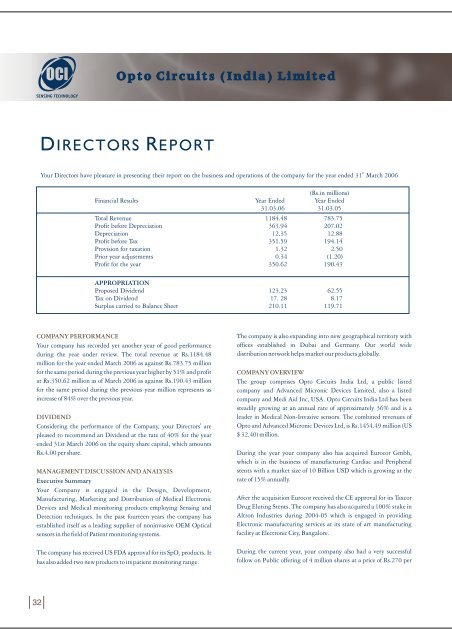

Your <strong>Directors</strong> have pleasure in presenting their report on the business and operations <strong>of</strong> the company for the year ended 31 March 2006<br />

Financial Results Year Ended<br />

(Rs.in millions)<br />

Year Ended<br />

31.03.06 31.03.05<br />

Total Revenue 1184.48 783.75<br />

Pr<strong>of</strong>it before Depreciation 363.94 207.02<br />

Depreciation 12.35 12.88<br />

Pr<strong>of</strong>it before Tax 351.59 194.14<br />

Provision for taxation 1.32 2.50<br />

Prior year adjustments 0.34 (1.20)<br />

Pr<strong>of</strong>it for the year 350.62 190.43<br />

APPROPRIATION<br />

Proposed Dividend 123.23 62.55<br />

Tax on Dividend 17. 28 8.17<br />

Surplus carried to Balance Sheet 210.11 119.71<br />

The company is also expanding into new geographical territory with<br />

<strong>of</strong>fices established in Dubai and Germany. Our world wide<br />

distribution network helps market our products globally.<br />

COMPANY OVERVIEW<br />

The group comprises <strong>Opto</strong> <strong>Circuits</strong> India Ltd, a public listed<br />

company and Advanced Micronic Devices Limited, also a listed<br />

company and Medi Aid Inc, USA. <strong>Opto</strong> <strong>Circuits</strong> India Ltd has been<br />

steadily growing at an annual rate <strong>of</strong> approximately 36% and is a<br />

leader in Medical Non-Invasive sensors. The combined revenues <strong>of</strong><br />

<strong>Opto</strong> and Advanced Micronic Devices Ltd, is Rs.1454.49 million (US<br />

$ 32.40) million.<br />

During the year your company also has acquired Eurocor Gmbh,<br />

which is in the business <strong>of</strong> manufacturing Cardiac and Peripheral<br />

stents with a market size <strong>of</strong> 10 Billion USD which is growing at the<br />

rate <strong>of</strong> 15% annually.<br />

After the acquisition Eurocor received the CE approval for its Taxcor<br />

Drug Eluting Stents. The company has also acquired a 100% stake in<br />

Altron Industries during 2004-05 which is engaged in providing<br />

Electronic manufacturing services at its state <strong>of</strong> art manufacturing<br />

facility at Electronic City, Bangalore.<br />

During the current year, your company also had a very successful<br />

follow on Public <strong>of</strong>fering <strong>of</strong> 4 million shares at a price <strong>of</strong> Rs.270 per