Annual Report 2010 - Savatech

Annual Report 2010 - Savatech

Annual Report 2010 - Savatech

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

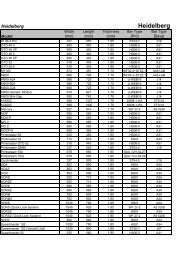

ANNUAL REPORT <strong>2010</strong> ∂ FINANCIAL REPORTas at 31/12/<strong>2010</strong> and 31/12/2009 (for the past data31/12/2009 and 31/12/2008), and other requireddata.2.3.Financial risk management2.3.1.CREDIT RISKThis involves the risk that a customer engaged in anagreement on a financial instrument will not meetits obligations, thus causing the company to make afinancial loss.Credit risk is directly connected with commercialrisk and presents a danger that trade receivables orreceivables due from other business partners will besettled with a delay or not at all. For this purpose,we devote special attention to customer solvency. Todecrease exposure to this risk we make use of thecustomer rating system, ongoing compensations andsupervision over bad payers. Trade receivables areinsured with SID – Prva Kreditna Zavarovalnica d.d.in Ljubljana.2.3.2SOLVENCY RISKThis involves the risk that a company may encounterdifficulties in raising financial assets to meet its financialobligations. In the Sava Group, a standard financialpolicy and centralised management with financialassets have been established; cash flows are dailybalanced within the Sava Group to avoid unnecessarycontracting of debts out of the Group. The companycontracts short- and long-term loans with banks. To beable to balance the daily requirements for liquid assets,it has a revolving credit line opened with a bank.2.3.3INTEREST RATE RISKThis involves the risk that the value of a financialinstrument will fluctuate due to changes in marketinterest rates. At the level of the Sava Group we havedefined a standard approach for all companies withbanks and a standard interest rate policy within theGroup. In the Group, interest rate swaps offered bybanks are used. The company does not use derivativefinancial instruments. Interest rate risk is indirectlyreduced through continual improvements in managingcurrent assets, thus reducing indebtedness.2.3.4FOREIGN CURRENCY RISKThis involves the risk that the value of financialinstruments will fluctuate due to changes in foreigncurrency exchange rates. Due to its geographicallydiversified operations the company is exposed tofluctuations in foreign exchange rates, particularly offoreign currency pairs such as EUR/USD, EUR/GBPand EUR/PLN. In <strong>2010</strong>, we had the longest net positionin American dollars. The exposure to the Americandollar is decreased through internal protectionmethods, i.e. balancing sales and purchasing.2.4.Breakdown and notesto the financial statements2.4.1INTANGIBLE FIXED ASSETSAND LONG-TERM DEFERRED COSTSAND ACCRUED REVENUESIntangible fixed assets totalling €6 thousand werepurchased licences for computer programmes.Movement of intangible fixed assetsCost value€ in thousandsIndustrial property rightsInvestments in acquired industrial propertyrights and other rightsBalance at 01/01/<strong>2010</strong> 9Increases, purchases 4Balance at 31/12/<strong>2010</strong> 13VALUE ADJUSTMENTBalance at 01/01/<strong>2010</strong> -7Balance at 31/12/<strong>2010</strong> -7CARRYING AMOUNTBalance at 01/01/<strong>2010</strong> 2Balance at 31/12/<strong>2010</strong> 662