Annual Report 2010 - Savatech

Annual Report 2010 - Savatech

Annual Report 2010 - Savatech

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

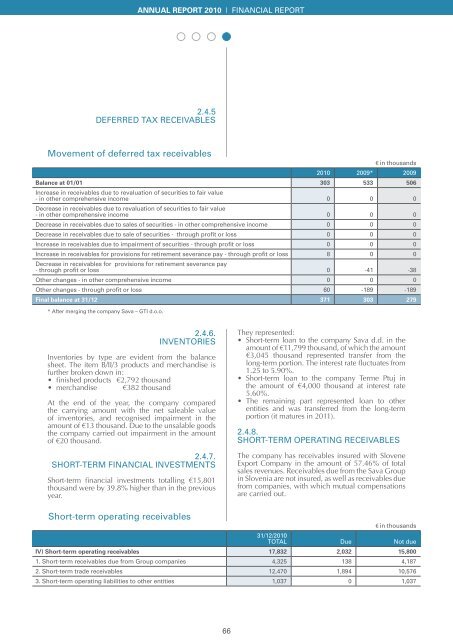

ANNUAL REPORT <strong>2010</strong> ∂ FINANCIAL REPORT2.4.5DEFERRED TAX RECEIVABLESMovement of deferred tax receivables€ in thousands<strong>2010</strong> 2009* 2009Balance at 01/01 303 533 506Increase in receivables due to revaluation of securities to fair value- in other comprehensive income 0 0 0Decrease in receivables due to revaluation of securities to fair value- in other comprehensive income 0 0 0Decrease in receivables due to sales of securities - in other comprehensive income 0 0 0Decrease in receivables due to sale of securities - through profit or loss 0 0 0Increase in receivables due to impairment of securities - through profit or loss 0 0 0Increase in receivables for provisions for retirement severance pay - through profit or loss 8 0 0Decrease in receivables for provisions for retirement severance pay- through profit or loss 0 -41 -38Other changes - in other comprehensive income 0 0 0Other changes - through profit or loss 60 -189 -189Final balance at 31/12 371 303 279* After merging the company Sava – GTI d.o.o.2.4.6.INVENTORIESInventories by type are evident from the balancesheet. The item B/II/3 products and merchandise isfurther broken down in:• finished products €2,792 thousand• merchandise €382 thousandAt the end of the year, the company comparedthe carrying amount with the net saleable valueof inventories, and recognised impairment in theamount of €13 thousand. Due to the unsalable goodsthe company carried out impairment in the amountof €20 thousand.2.4.7.SHORT-TERM FINANCIAL INVESTMENTSShort-term financial investments totalling €15,801thousand were by 39.8% higher than in the previousyear.They represented:• Short-term loan to the company Sava d.d. in theamount of €11,799 thousand, of which the amount€3,045 thousand represented transfer from thelong-term portion. The interest rate fluctuates from1.25 to 5.90%.• Short-term loan to the company Terme Ptuj inthe amount of €4,000 thousand at interest rate5.60%.• The remaining part represented loan to otherentities and was transferred from the long-termportion (it matures in 2011).2.4.8.SHORT-TERM OPERATING RECEIVABLESThe company has receivables insured with SloveneExport Company in the amount of 57.46% of totalsales revenues. Receivables due from the Sava Groupin Slovenia are not insured, as well as receivables duefrom companies, with which mutual compensationsare carried out.Short-term operating receivables€ in thousands31/12/<strong>2010</strong>TOTAL Due Not dueIV) Short-term operating receivables 17,832 2,032 15,8001. Short-term receivables due from Group companies 4,325 138 4,1872. Short-term trade receivables 12,470 1,894 10,5763. Short-term operating liabilities to other entities 1,037 0 1,03766