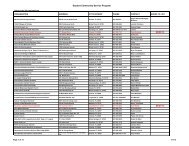

<strong>District</strong> <strong>School</strong> <strong>Board</strong> of <strong>Seminole</strong> <strong>County</strong>, Florida'sOperating Results and Changes in Net AssetsFor the Fiscal Year Ending June 30, 2008 and June 30, 2009(amounts expressed in thousands)GovernmentalBusiness-TypeTotalActivitiesActivities2008 2009 2008 2009 2008 2009Revenues:Program RevenuesCharge for Services $ 13,189 $ 12,549 $ 4,881 $ 4,561 $ 18,070 $ 17,110Operating Grants and Contributions 88,942 91,463 - - 88,942 91,463Capital Grants and Contributions 16,560 8,369 - - 16,560 8,369General Revenues:Property Taxes 241,237 249,459 - - 241,237 249,459Other Taxes 15,549 9,371 - - 15,549 9,371Florida Education Finance Program 185,801 146,705 - - 185,801 146,705Unrestricted Federal Sources 29,949 29,189 - - 29,949 29,189Unrestricted State Sources 20,115 15,460 - - 20,115 15,460Unrestricted Local Sources 4,025 3,821 - - 4,025 3,821Unrestricted Interest Earnings 8,314 3,878 13 3 8,327 3,881Total Revenues 623,681 570,264 4,894 4,564 628,575 574,828Expenses:Instruction 344,910 337,450 - - 344,910 337,450Pupil Personnel Services 23,111 23,994 - - 23,111 23,994Instructional Media Services 8,338 7,876 - - 8,338 7,876Instr. and Curriculum Dev. Services 7,899 7,165 - - 7,899 7,165Instructional Staff Training Services 6,808 7,352 - - 6,808 7,352Instruction Related Technology 3,884 3,935 - - 3,884 3,935<strong>School</strong> <strong>Board</strong> 1,822 1,266 - - 1,822 1,266General Administration 2,592 2,803 - - 2,592 2,803<strong>School</strong> Administration 33,169 31,540 - - 33,169 31,540Facility Services - Non Capitalized 10,258 15,302 - - 10,258 15,302Fiscal Services 2,157 2,146 - - 2,157 2,146Food Services 26,688 26,158 - - 26,688 26,158Central Services 4,821 4,988 - - 4,821 4,988Pupil Transportation 27,585 26,032 - - 27,585 26,032Operation of Plant 42,639 42,177 - - 42,639 42,177Maintenance of Plant 11,436 10,970 - - 11,436 10,970Administrative Technology Services 4,557 4,716 - - 4,557 4,716Community Services 1,992 2,152 - - 1,992 2,152Interest on Long-Term Debt 13,105 11,595 - - 13,105 11,595Extended Day Program - - 3,082 2,889 3,082 2,889Total Expenses 577,771 569,617 3,082 2,889 580,853 572,506Change in Net AssetsBefore Transfers 45,910 647 1,812 1,675 47,722 2,322Transfers 1,905 1,641 (1,905) (1,641) - -Change in Net Assets 47,815 2,288 (93) 34 47,722 2,322Net Assets, Beginning 556,237 604,052 589 496 556,826 604,548Net Assets, Ending $ 604,052 $ 606,340 $ 496 $ 530 $ 604,548 $ 606,870Page 26

The government-wide net assets increased by $2,321,881 during the current fiscal year.This increase is explained further under governmental and business activities below.Governmental Activities. Governmental activities increased the <strong>District</strong>’s net assets by$2,287,914, thereby accounting for 98.5 percent of the total growth in the net assets ofthe <strong>District</strong>. Key elements of the increase are as follows:‣ A decrease of $4,775,311 in unrestricted net assets was due partially:o to actions taken to mitigate the effects of $9,866,788 million in revenuereductions imposed by the State of Florida due to revenues shortfall atthe State level. A budget adjustment plan was implemented thatessentially covered the full deficit amount. Unanticipated savings over theamount needed to cover the deficit were primarily provided through: (1) ahiring freeze; (2) interest earnings over budget estimates; (3) property taxrevenue over estimates; (4) diesel fuel expenditures under budget; and(5) utility expenditures under budget.o and, to offset a net increase in long-term liabilities that affects unrestrictednet assets involving an increase of $916,485 in Compensated Absences,a decrease of $757,928 in Estimated Insurance Claims Payable, and anincrease in Other Postemployment Benefits Payable of $6,325,202.‣ The capital projects (construction) revenues received during the current fiscalyear are disbursed on construction projects and other capital assets that will becapitalized and expensed in future years through depreciation. If these funds arenot disbursed at year-end, they are reported as current assets and restricted netassets. Investments in Capital Assets, Net of Related Debt, increased by$26,274,912 and Restricted Net Assets for Capital Projects decreased by$21,612,729 from the previous year.‣ Restricted Net Assets for State Categorical Programs increased by $2,409,243.This increase was in anticipation of future State budget reductions in theseprograms.Business-Type Activities. Business-type activities increased the <strong>District</strong>’s net assetsby $33,967, thereby accounting for the remaining 1.5 percent of the growth in thegovernment’s total net assets. Key elements of this increase are as follows.‣ Charges for services for business-type activities and other income decreased by6.7 percent, while expenses and transfers out decreased by 9.2 percent.Page 27

- Page 2 and 3: This page was intentionally left bl

- Page 4 and 5: This page was intentionally left bl

- Page 6 and 7: Basic Financial Statements: (contin

- Page 8 and 9: Statistical SectionFinancial Trend

- Page 10 and 11: This page was intentionally left bl

- Page 12 and 13: This page was intentionally left bl

- Page 14 and 15: fairly presented in conformity with

- Page 16 and 17: Major InitiativesClass Size Reducti

- Page 18 and 19: Cash Management and Investments. Th

- Page 20 and 21: District School Board of Seminole C

- Page 22: District School Board of Seminole C

- Page 25 and 26: FINANCIAL SECTIONPage 15

- Page 27 and 28: Ernst & Young LLP390 North Orange A

- Page 29 and 30: This page was intentionally left bl

- Page 31 and 32: Management’s Discussion and Analy

- Page 33 and 34: The District maintains 13 individua

- Page 35: The following is a summary of the D

- Page 39 and 40: $20,675,000 in Certificates of Part

- Page 41 and 42: Long-Term Debt. At the end of the c

- Page 43 and 44: BASIC FINANCIALSTATEMENTSPage 33

- Page 45 and 46: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 47 and 48: Net (Expense) Revenue andChanges in

- Page 49 and 50: Capital Projects -Section1011.71(2)

- Page 51 and 52: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 54 and 55: This page was intentionally left bl

- Page 56 and 57: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 58 and 59: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 60 and 61: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 62 and 63: This page was intentionally left bl

- Page 64 and 65: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 66 and 67: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 68 and 69: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 70 and 71: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 72 and 73: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 74 and 75: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 76 and 77: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 78 and 79: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 80 and 81: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 82 and 83: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 84 and 85: DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 86 and 87:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 88 and 89:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 90 and 91:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 93 and 94:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 95 and 96:

COMBINING AND INDIVIDUALFUND STATEM

- Page 97 and 98:

Nonmajor Governmental FundsSpecial

- Page 99 and 100:

This page was intentionally left bl

- Page 101 and 102:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 103 and 104:

Excess (Deficiency) of RevenuesOver

- Page 105 and 106:

Capital Projects FundsTotal Nonmajo

- Page 107 and 108:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 109 and 110:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 111 and 112:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 113 and 114:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 115 and 116:

Special Revenue FundsThe Special Re

- Page 117 and 118:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 119 and 120:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 121 and 122:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 123 and 124:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 125 and 126:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 127 and 128:

Debt Service FundsThe Debt Service

- Page 129 and 130:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 131 and 132:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 133 and 134:

Capital Projects FundsThe Capital P

- Page 135 and 136:

Capital Projects FundsGovernmental

- Page 137 and 138:

Capital Projects FundsGovernmental

- Page 139 and 140:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 141 and 142:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 143 and 144:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 145 and 146:

Enterprise FundThe Extended Day Pro

- Page 147 and 148:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 149 and 150:

Internal Service FundsInternal Serv

- Page 151 and 152:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 153 and 154:

Agency FundsAgency Funds are Fiduci

- Page 155 and 156:

Discretely Presented Component Unit

- Page 157 and 158:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 159 and 160:

STATISTICAL SECTIONPage 149

- Page 161 and 162:

STATISTICAL SECTIONThis part of the

- Page 163 and 164:

June 30, 2004 June 30, 2005 June 30

- Page 165 and 166:

Total Primary Government Net (Expen

- Page 167 and 168:

June 30, 2004 June 30, 2005 June 30

- Page 169 and 170:

Excess of Revenues over (under) Exp

- Page 171 and 172:

Fiscal Year EndingJune 30, 2004 Jun

- Page 173 and 174:

Fiscal Year EndingJune 30, 2004 Jun

- Page 175 and 176:

Fiscal Year EndingJune 30, 2004 Jun

- Page 177 and 178:

Fiscal Year EndingJune 30, 2004 Jun

- Page 179 and 180:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 181 and 182:

Fiscal Year2003-04 2004-05 2005-06

- Page 183 and 184:

Fiscal Year2006-07 2005-062004-05Pe

- Page 185 and 186:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 187 and 188:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 189 and 190:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 191 and 192:

For the Fiscal Year EndingJune 30,

- Page 193 and 194:

Government-wideEducation Level (c)G

- Page 195 and 196:

Fiscal Year2006-07 2005-062004-05Pe

- Page 197 and 198:

Full-Time Equivalent Enrollment Dat

- Page 199 and 200:

Full-Time Equivalent Enrollment Dat

- Page 201 and 202:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 203 and 204:

Fiscal Year EndingJune 30, 2004 Jun

- Page 205 and 206:

Fiscal Year EndingJune 30, 2004 Jun

- Page 207 and 208:

SINGLE AUDITPage 197

- Page 209 and 210:

This page was intentionally left bl

- Page 211 and 212:

DISTRICT SCHOOL BOARD OF SEMINOLE C

- Page 213 and 214:

A control deficiency in an entity

- Page 215 and 216:

District School Board of Seminole C

- Page 217 and 218:

District School Board of Seminole C

- Page 219 and 220:

OTHER REPORTSPage 209

- Page 221 and 222:

Ernst & Young LLP390 North Orange A

- Page 223 and 224:

Ernst & Young LLP390 North Orange A

- Page 225 and 226:

Other disclosuresThe Rules of the A

- Page 227:

This page was intentionally left bl