Annual Report 2010 - Magnitogorsk Iron & Steel Works

Annual Report 2010 - Magnitogorsk Iron & Steel Works

Annual Report 2010 - Magnitogorsk Iron & Steel Works

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

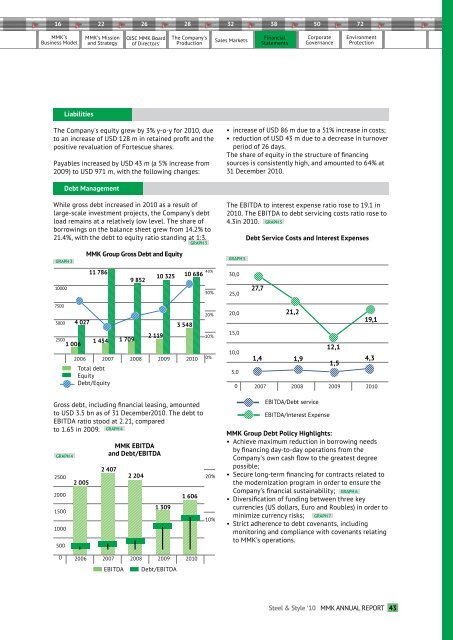

16 22 26 28 32 38 50 72MMK , sBusiness ModelMMK’s Missionand StrategyOJSC MMK Boardof Directors'The Company'sProductionSales MarketsFinancialStatementsCorporateGovernanceEnvironmentProtectionLiabilitiesThe Company's equity grew by 3% y-o-y for <strong>2010</strong>, dueto an increase of USD 128 m in retained profit and thepositive revaluation of Fortescue shares.Payables increased by USD 43 m (a 5% increase from2009) to USD 971 m, with the following changes:• increase of USD 86 m due to a 51% increase in costs;• reduction of USD 43 m due to a decrease in turnoverperiod of 26 days.The share of equity in the structure of financingsources is consistently high, and amounted to 64% at31 December <strong>2010</strong>.Debt ManagementWhile gross debt increased in <strong>2010</strong> as a result oflarge-scale investment projects, the Company’s debtload remains at a relatively low level. The share ofborrowings on the balance sheet grew from 14.2% to21.4%, with the debt to equity ratio standing at 1:3.GRAPH 310000MMK Group Gross Debt and Equity11 7869 852GRAPH 310 325 10 68640%30%The EBITDA to interest expense ratio rose to 19.1 in<strong>2010</strong>. The EBITDA to debt servicing costs ratio rose to4.3in <strong>2010</strong>. GRAPH 5GRAPH 530,025,0Debt Service Costs and Interest Expenses27,7750050004 02725001 0061 4541 7092 1193 54820%10%2006 2007 2008 2009 <strong>2010</strong> 0%Total debtEquityDebt/Equity20,015,010,05,001,4200721,21,9200812,11,5200919,14,3<strong>2010</strong>Gross debt, including financial leasing, amountedto USD 3.5 bn as of 31 December<strong>2010</strong>. The debt toEBITDA ratio stood at 2.21, comparedto 1.65 in 2009. GRAPH 4GRAPH 425002000150010005002 005MMK EBITDAand Debt/EBITDA2 4072 2041 3091 60620%10%EBITDA/Debt serviceEBITDA/Interest ExpenseMMK Group Debt Policy Highlights:• Achieve maximum reduction in borrowing needsby financing day-to-day operations from theCompany's own cash flow to the greatest degreepossible;• Secure long-term financing for contracts related tothe modernization program in order to ensure theCompany’s financial sustainability; GRAPH 6• Diversification of funding between three keycurrencies (US dollars, Euro and Roubles) in order tominimize currency risks; GRAPH 7• Strict adherence to debt covenants, includingmonitoring and compliance with covenants relatingto MMK’s operations.02006200720082009 <strong>2010</strong>EBITDADebt/EBITDA<strong>Steel</strong> & Style , 10 MMK ANNUAL REPORT 43