Government & Corporate Bond Funds

Government & Corporate Bond Funds

Government & Corporate Bond Funds

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

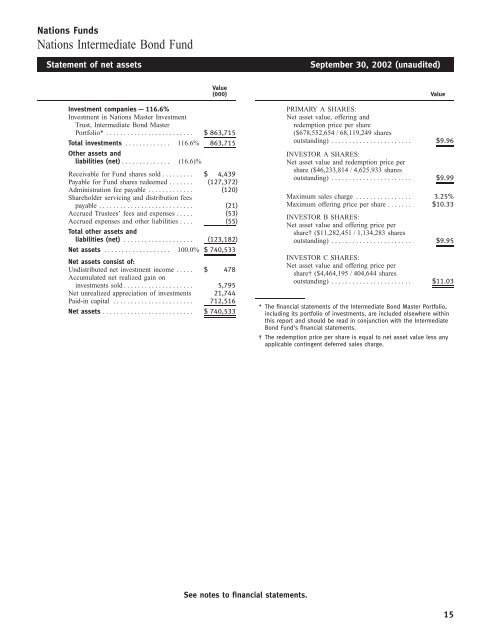

Nations <strong>Funds</strong><br />

Nations Intermediate <strong>Bond</strong> Fund<br />

Statement of net assets September 30, 2002 (unaudited)<br />

Value<br />

(000) Value<br />

Investment companies — 116.6% PRIMARY A SHARES:<br />

Investment in Nations Master Investment Net asset value, offering and<br />

Trust, Intermediate <strong>Bond</strong> Master redemption price per share<br />

Portfolio* ************************* $ 863,715 ($678,552,654 / 68,119,249 shares<br />

Total investments ************* 116.6% 863,715<br />

outstanding) *********************** $9.96<br />

Other assets and INVESTOR A SHARES:<br />

liabilities (net) ************** (16.6)% Net asset value and redemption price per<br />

Receivable for Fund shares sold *********<br />

Payable for Fund shares redeemed *******<br />

$ 4,439<br />

(127,372)<br />

share ($46,233,814 / 4,625,933 shares<br />

outstanding) *********************** $9.99<br />

Administration fee payable *************<br />

Shareholder servicing and distribution fees<br />

payable ***************************<br />

(120)<br />

(21)<br />

Maximum sales charge ****************<br />

Maximum offering price per share *******<br />

3.25%<br />

$10.33<br />

Accrued Trustees’ fees and expenses ***** (53)<br />

Accrued expenses and other liabilities **** (55)<br />

INVESTOR B SHARES:<br />

Net asset value and offering price per<br />

Total other assets and<br />

liabilities (net) ******************** (123,182)<br />

share† ($11,282,451 / 1,134,283 shares<br />

outstanding) *********************** $9.95<br />

Net assets ******************* 100.0% $ 740,533<br />

Net assets consist of:<br />

Undistributed net investment income ***** $ 478<br />

INVESTOR C SHARES:<br />

Net asset value and offering price per<br />

share† ($4,464,195 / 404,644 shares<br />

Accumulated net realized gain on<br />

outstanding) *********************** $11.03<br />

investments sold******************** 5,795<br />

Net unrealized appreciation of investments 21,744<br />

Paid-in capital ***********************<br />

Net assets **************************<br />

712,516<br />

$ 740,533<br />

* The financial statements of the Intermediate <strong>Bond</strong> Master Portfolio,<br />

including its portfolio of investments, are included elsewhere within<br />

this report and should be read in conjunction with the Intermediate<br />

<strong>Bond</strong> Fund’s financial statements.<br />

† The redemption price per share is equal to net asset value less any<br />

applicable contingent deferred sales charge.<br />

See notes to financial statements.<br />

15