Government & Corporate Bond Funds

Government & Corporate Bond Funds

Government & Corporate Bond Funds

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Nations <strong>Funds</strong><br />

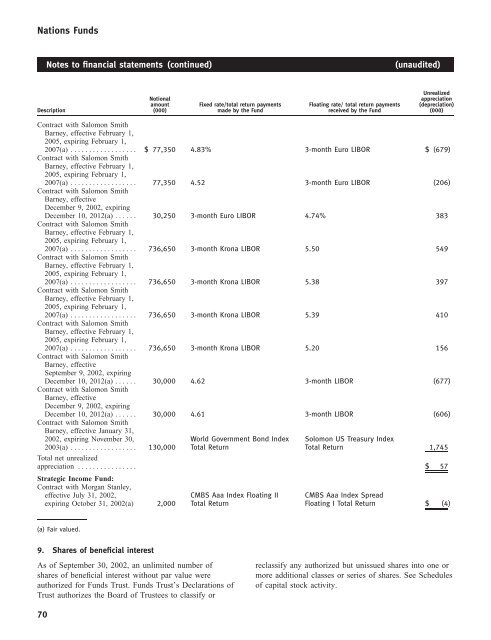

Notes to financial statements (continued) (unaudited)<br />

Unrealized<br />

Notional appreciation<br />

amount Fixed rate/total return payments Floating rate/ total return payments (depreciation)<br />

Description (000) made by the Fund received by the Fund (000)<br />

Contract with Salomon Smith<br />

Barney, effective February 1,<br />

2005, expiring February 1,<br />

2007(a) ******************<br />

Contract with Salomon Smith<br />

Barney, effective February 1,<br />

2005, expiring February 1,<br />

$ 77,350 4.83% 3-month Euro LIBOR $ (679)<br />

2007(a) ******************<br />

Contract with Salomon Smith<br />

Barney, effective<br />

December 9, 2002, expiring<br />

77,350 4.52 3-month Euro LIBOR (206)<br />

December 10, 2012(a) ******<br />

Contract with Salomon Smith<br />

Barney, effective February 1,<br />

2005, expiring February 1,<br />

30,250 3-month Euro LIBOR 4.74% 383<br />

2007(a) ******************<br />

Contract with Salomon Smith<br />

Barney, effective February 1,<br />

2005, expiring February 1,<br />

736,650 3-month Krona LIBOR 5.50 549<br />

2007(a) ******************<br />

Contract with Salomon Smith<br />

Barney, effective February 1,<br />

2005, expiring February 1,<br />

736,650 3-month Krona LIBOR 5.38 397<br />

2007(a) ******************<br />

Contract with Salomon Smith<br />

Barney, effective February 1,<br />

2005, expiring February 1,<br />

736,650 3-month Krona LIBOR 5.39 410<br />

2007(a) ******************<br />

Contract with Salomon Smith<br />

Barney, effective<br />

September 9, 2002, expiring<br />

736,650 3-month Krona LIBOR 5.20 156<br />

December 10, 2012(a) ******<br />

Contract with Salomon Smith<br />

Barney, effective<br />

December 9, 2002, expiring<br />

30,000 4.62 3-month LIBOR (677)<br />

December 10, 2012(a) ******<br />

Contract with Salomon Smith<br />

Barney, effective January 31,<br />

30,000 4.61 3-month LIBOR (606)<br />

2002, expiring November 30, World <strong>Government</strong> <strong>Bond</strong> Index Solomon US Treasury Index<br />

2003(a) ******************<br />

Total net unrealized<br />

130,000 Total Return Total Return 1,745<br />

appreciation ****************<br />

Strategic Income Fund:<br />

Contract with Morgan Stanley,<br />

$ 57<br />

effective July 31, 2002, CMBS Aaa Index Floating II CMBS Aaa Index Spread<br />

expiring October 31, 2002(a) 2,000 Total Return Floating I Total Return $ (4)<br />

(a) Fair valued.<br />

9. Shares of beneficial interest<br />

As of September 30, 2002, an unlimited number of reclassify any authorized but unissued shares into one or<br />

shares of beneficial interest without par value were more additional classes or series of shares. See Schedules<br />

authorized for <strong>Funds</strong> Trust. <strong>Funds</strong> Trust’s Declarations of<br />

Trust authorizes the Board of Trustees to classify or<br />

of capital stock activity.<br />

70